/Jen-Hsun%20Huan%20NVIDIA)

Nvidia (NVDA) shares opened higher on Wednesday after Frank Lee, an HSBC analyst, upgraded his rating on the artificial intelligence (AI) behemoth to “Buy.”

Lee raised his price target on NVDA stock this morning as well to a Street-high $320, indicating potential upside of more than 75% from current levels.

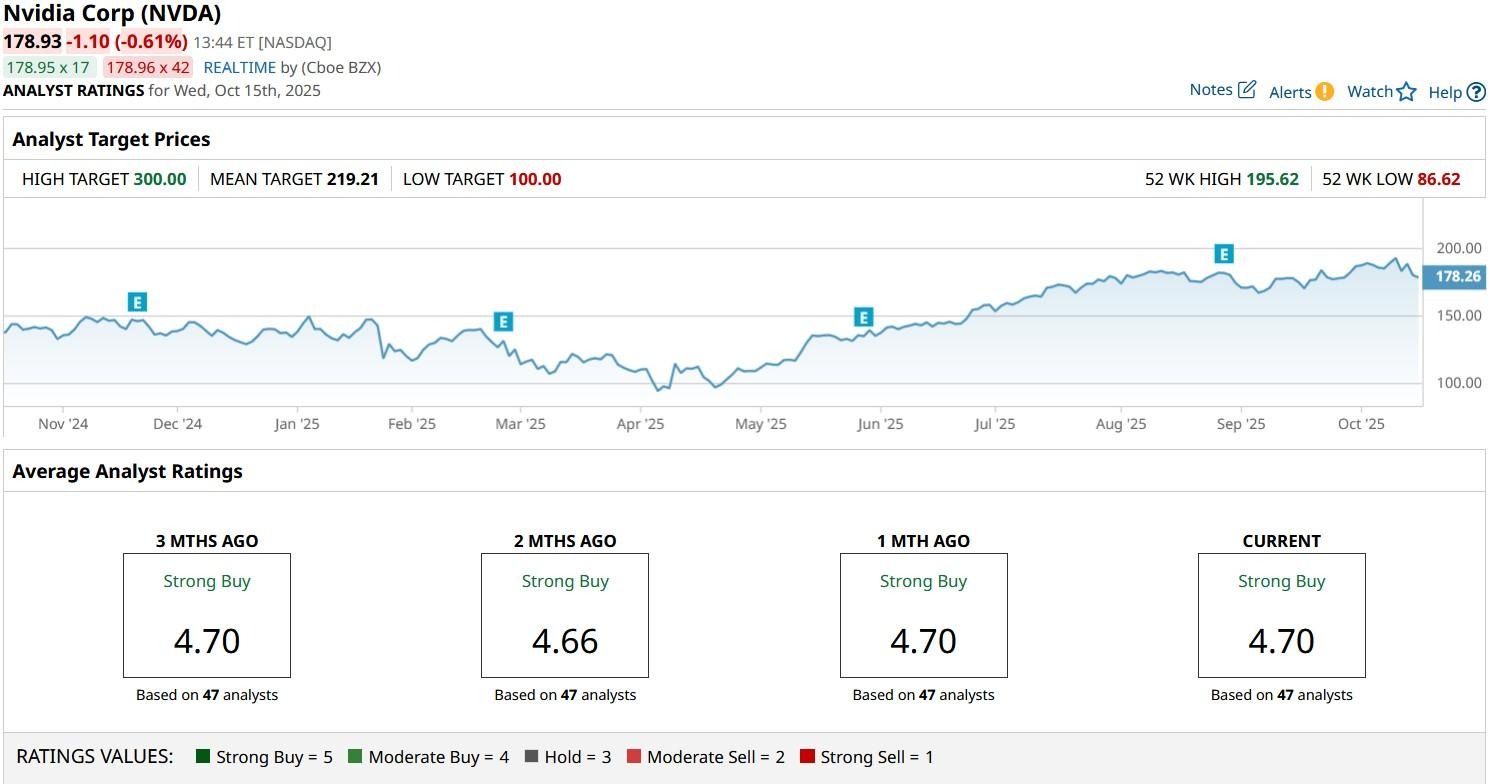

Following HSBC’s research note, only one Wall Street firm (Deutsche Bank) has a “Hold” rating on the AI stock while another (Seaport Global) has a “Sell” rating on it.

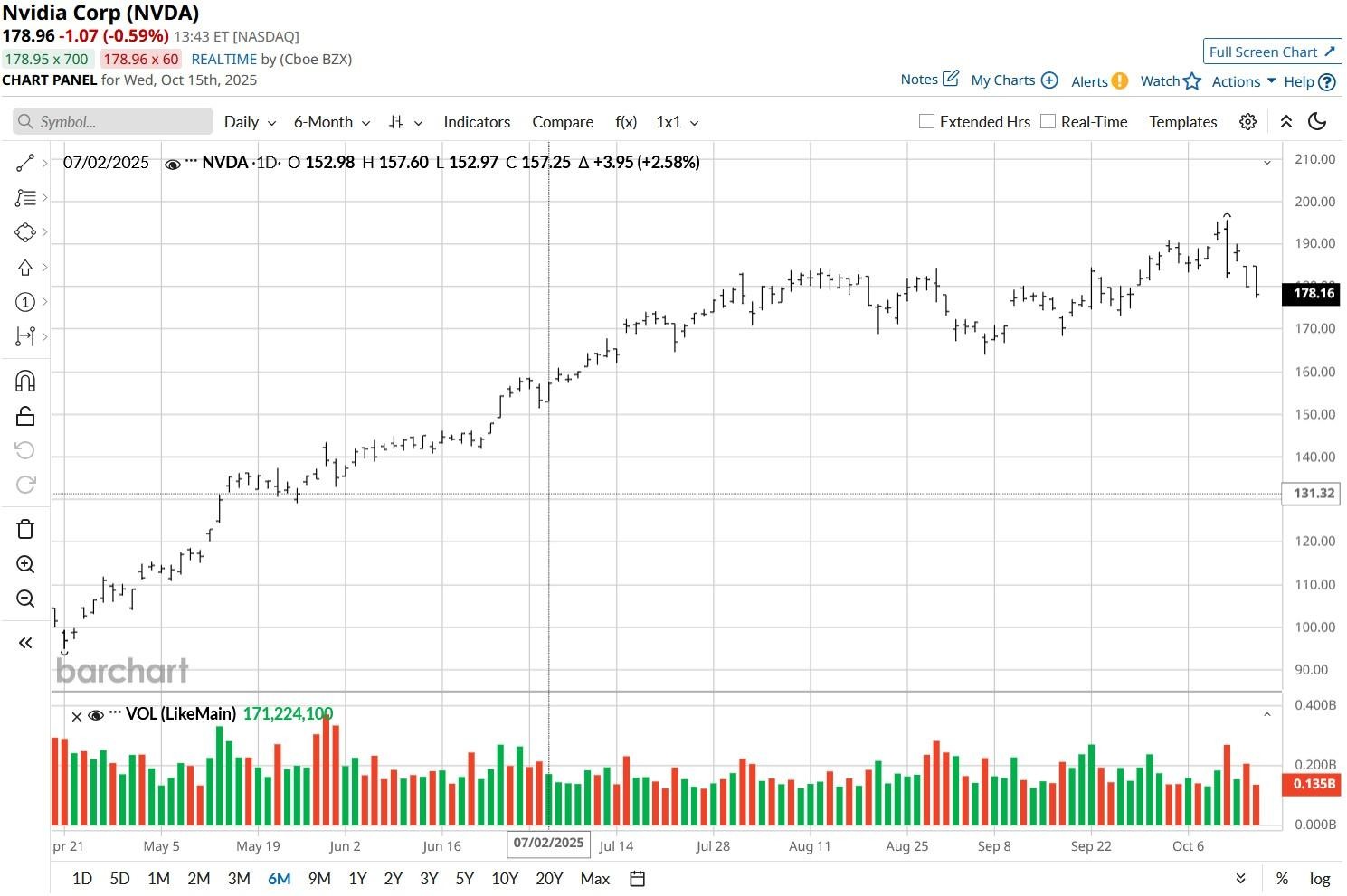

Note that Nvidia stock is currently up nearly 110% versus its year-to-date low in early April.

Why HSBC Turned Uber Bullish on Nvidia Stock

According to Frank Lee, Nvidia’s recent agreement with OpenAI and the Stargate initiative at large significantly expands the GPU total addressable market (TAM) versus initial expectations.

For fiscal 2027, the HSBC analyst now estimates data center revenue at $351 billion, about 36% higher than consensus.

The investment firm’s bullish note on NVDA shares arrives about a month ahead of the company’s third-quarter financial results.

Consensus is for the giant to earn $1.17 on a per-share basis – up 50% versus the same quarter last year. Nvidia’s upcoming earnings release could prove a near-term catalyst for its stock.

China Could Turn Into a Tailwind for NVDA Shares

HSBC views China restrictions as temporary only and expects an eventual recovery in that regional business to prove a major tailwind for Nvidia shares.

“We also see potential easing of China GPU uncertainties following the potential US-China trade deal that could enable NVDA to see a demand recovery in the Chinese market,” Lee argued.

Simply put, the investment firm recommends investing in the semiconductor giant for its dominant position in artificial intelligence infrastructure.

Hyperscalers and enterprise customers are increasingly dependent on its GPUs to power next-gen workloads, which will drive the company’s stock price higher over the next 12 months, the analyst concluded.

Wall Street Continues to Recommend Owning Nvidia

Other Wall Street firms agree with HSBC’s bullish view on Nvidia shares as well.

The consensus rating on NVDA stock currently sits at “Strong Buy” with the mean target of roughly $219 indicating potential upside of another 20% from here.