Valued at $106.3 billion, Nike (NKE), the global leader in athletic footwear, apparel, equipment, and accessories, is in the midst of a major transformation. After a year of sluggish growth and brand fatigue, Nike is gearing up for a comeback. With its new "Sport Offense" strategy and a renewed emphasis on performance innovation, the sportswear giant hopes to sprint back to glory.

Recently, Nike reported its first quarter of fiscal 2026 earnings, and its efforts appear to be attracting Wall Street's attention. NKE stock has dipped 5.3% year to date (YTD), underperforming the S&P 500 Index ($SPX) gain of 14.6%. Let’s find out if Nike’s strategies are working and if it is a good buy now.

Nike Showed Progress in Q1

After several quarters of slow growth and weak product cycles, the sportswear giant is making a dramatic move to recover its leading position. At the heart of Nike's comeback strategy is the Sport Offense, a reformed, sport-focused operational model that unifies Nike, Jordan, and Converse under a single, sport-specific framework. The goal is to utilize Nike's vast portfolio by giving each brand a unique identity while driving innovation and sales across numerous price points.

In the first quarter of fiscal 2026, revenues rose 1% year-over-year (YoY) on a reported basis. Nike Direct fell 5%, driven by a 12% loss in Nike Digital and a 1% drop in stores, while wholesale increased 5%. Gross margins declined to 42.2% owing to increasing wholesale and factory store discounts, higher product expenses, including new tariffs, and an unfavorable channel mix.

Earnings per share came in at $0.49, down 30% YoY, while inventory decreased 2% versus the prior year, indicating progress toward Nike's aim of a healthier marketplace by the first half of fiscal 2026.

The company reported mixed results in global markets. North America led the way with a 4% revenue increase, while EMEA saw 1% growth. Greater China was the weakest link, with revenue dropping 10%. Reciprocal tariffs present a significant new headwind for the company. Nike now anticipates incremental annualized costs of $1.5 billion, up from the $1 billion forecast just 90 days ago. Management stressed the company's commitment to minimizing the damage but acknowledged that the disruption is substantial.

Despite the challenges, Nike continues to reward its commitment to shareholders by maintaining its status as a reliable dividend payer. By paying and increasing dividends for the last 23 years consecutively, Nike is close to winning the title of a Dividend Aristocrat. The company paid out $591 million in dividends in Q1 and repurchased shares worth $123 million. It offers an attractive dividend yield of 2.2%, higher than the consumer discretionary average of 1.89%.

But, Challenges Remain…

The company is navigating macro headwinds like cautious consumer spending and tariffs, alongside the internal adjustments of the Sport Offense. Looking ahead, for the full-year fiscal 2026, Nike expects wholesale to expand somewhat in fiscal 2026, aided by an improved spring order book. North American markets are projected to continue to lead the recovery, with Greater China taking longer to recover. SG&A is expected to grow at a low single-digit rate for the year.

For fiscal 2026, analysts predict a 1.02% increase in revenue to $46.8 billion, followed by a 23.4% decline in earnings. However, analysts also predict things to turn around for the company in fiscal 2027 with a 5.13% increase in revenue and a 50.1% growth in earnings. Trading at 28 times forward 2027 estimated earnings, Nike is trading at a premium.

What Does Wall Street Say About NKE Stock?

Following the Q1 results, KeyBanc upgraded NKE stock to “Overweight” from “Sector Weight,” assigning a target price of $90, which suggests a potential upside of 25% from current levels. Similarly, DZ Bank also upgraded NKE stock to a “Buy” from “Hold” with a price target of $85. Additionally, Goldman Sachs, Piper Sandler, Truist Financial, RBC Capital, and many other firms reaffirmed their “Buy” rating for the stock.

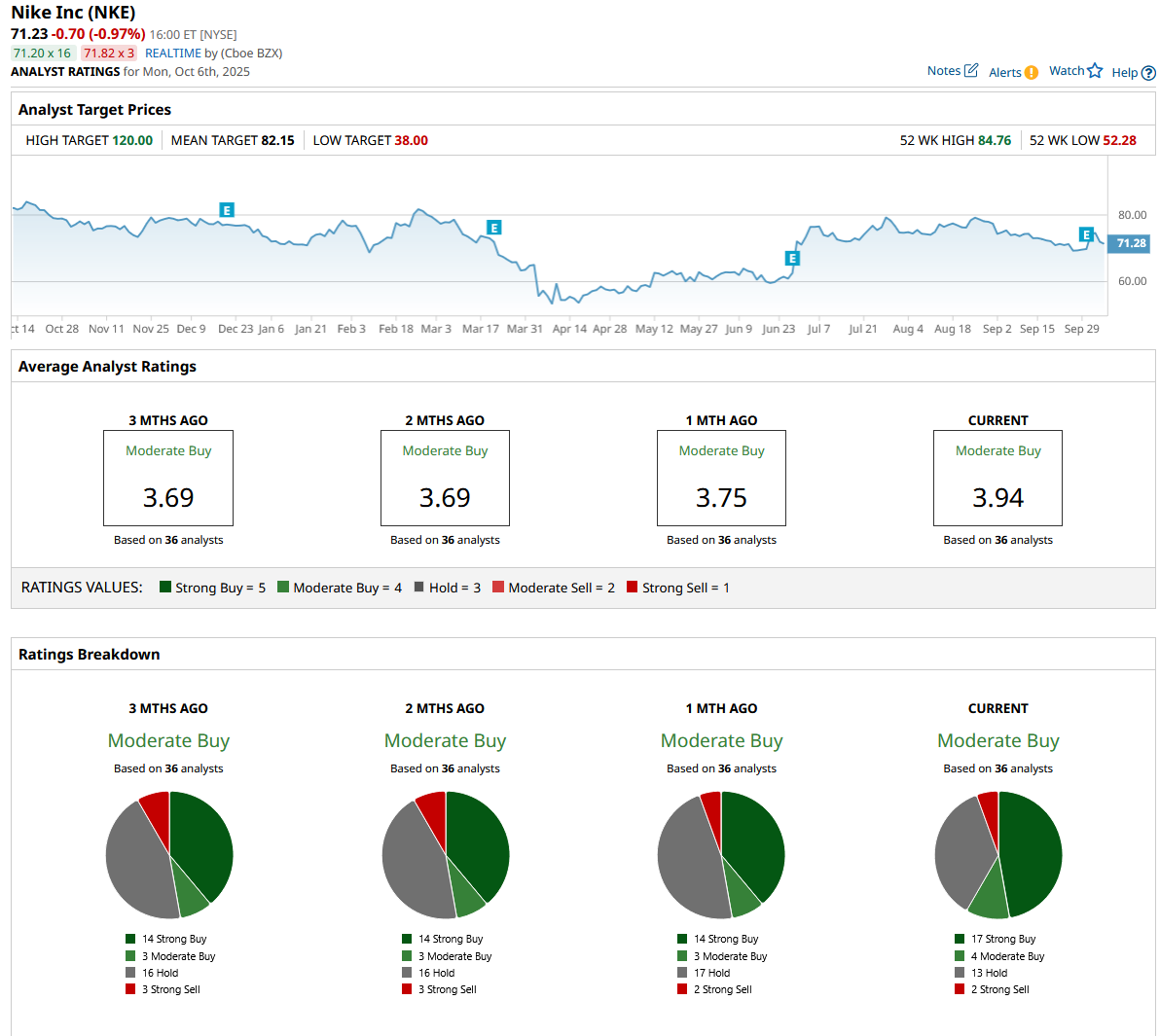

On Wall Street, NKE stock is rated as a “Moderate Buy.” Of the 36 analysts who cover the stock, 17 rate it as a “Strong Buy,” four as a “Moderate Buy,” 13 as a “Hold,” and two as a “Strong Sell.” The average analyst target price of $82.15 for Nike implies a 15% increase over current levels. Furthermore, its Street-high estimate of $120 suggests that the stock could rally by up to 68% over the next year.

Although progress is evident, recovery will take time. Management remains confident that the strategy is the right path forward, which prioritizes athletes, fuels creativity, and leverages Nike, Jordan, and Converse's global portfolio.

In CEO Elliott Hill’s words, “Nike’s journey back to greatness has only just begun.” Investors willing to take the risk that Nike could turn around its story may find this consumer stock a good buy now on the dip.

.jpg?w=600)