I last wrote about the natural gas futures market on Barchart on August 15, when I concluded:

As natural gas heads into its peak season, the odds favor higher prices over the coming months. The U.S. inventory levels suggest a limited downside risk at around the $3 per MMBtu level over the coming months even though the price is lower in mid-August, which could be an opportunity.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Nearby NYMEX natural gas prices were at the $2.835 per MMBtu level on August 14 and were over $3 in late September as the peak season is just around the corner.

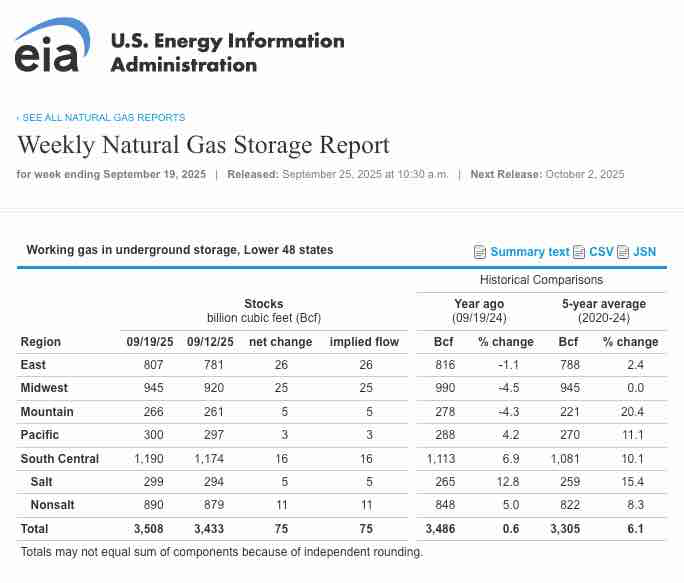

Natural gas stocks are just slightly above last year’s level

Each year, the natural gas injection season from March through November is the time when natural gas inventories across the United States rise in anticipation of the peak heating season during winter.

According to the EIA, U.S. natural gas stockpiles stood at 3.508 trillion cubic feet. As of the week of September 19, inventories were 0.60% above last year’s level and 6.1% above the five-year average. Last year, stocks peaked at 3.972 tcf, 464 billion cubic feet above the September 19, 2025, level.

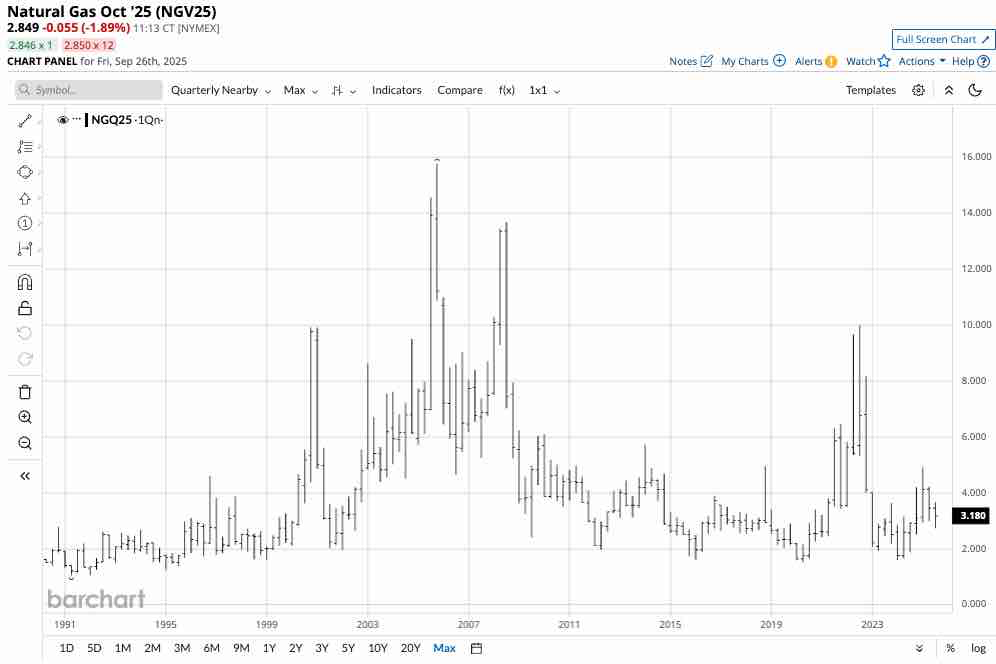

Seasonality is critical for natural gas

The continuous monthly thirty-year chart shows that natural gas futures prices tend to rally during the winter.

As the chart shows, the two factors that tend to push natural gas futures prices higher are the peak heating season and months when storms impact natural gas infrastructure. Natural gas prices traded in a $2.075 to $2.948 per MMBtu range in September 2024. In September 2025, the range was higher, between $2.850 and $3.419 per MMBtu.

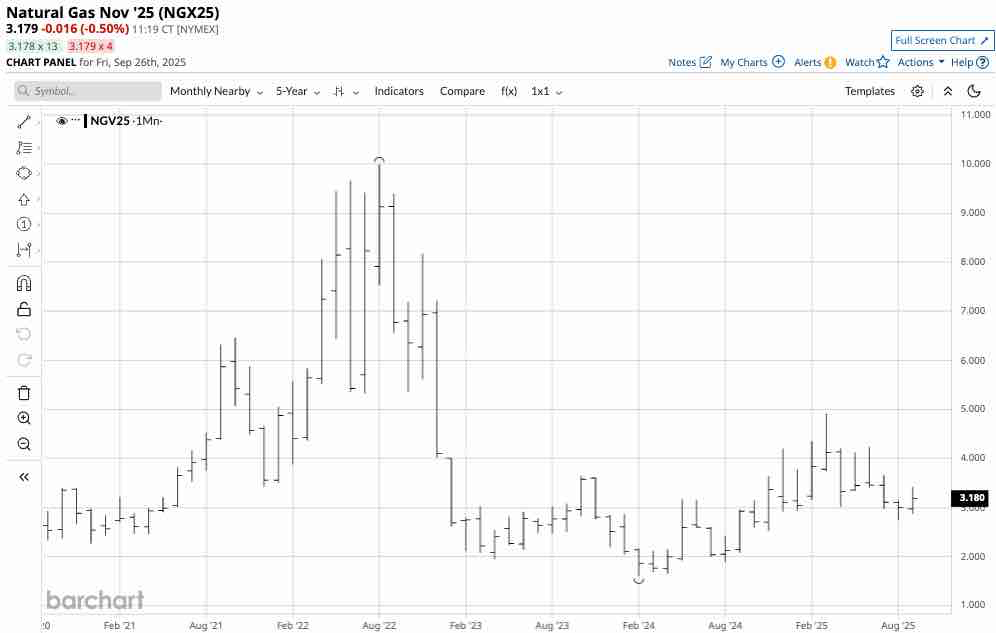

The trend is turning slightly bullish

Since late August, the short-term U.S. NYMEX natural gas futures trend has been bullish.

The chart of NYMEX natural gas futures for November 2025 delivery highlights the slightly bullish pattern of higher lows since late August 2025.

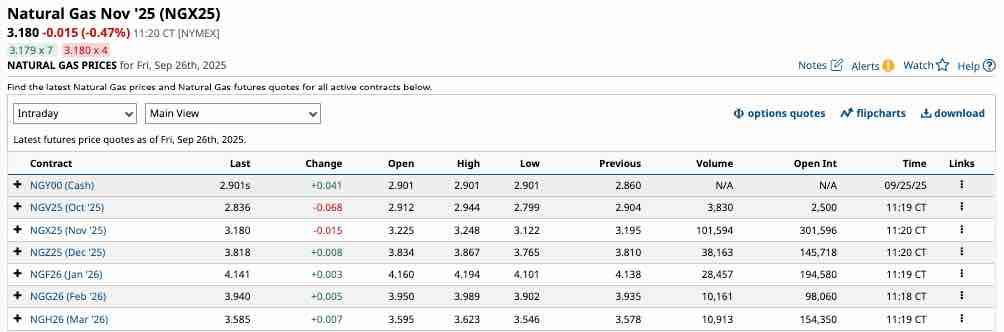

Technical levels to watch over the coming weeks

As the natural gas futures market heads toward the 2025/2026 peak season winter, the odds favor higher prices due to the uncertainty of weather conditions.

The monthly five-year chart illustrates that technical support is at the August 2025 low of $2.738 per MMBtu, with technical resistance at the March 2025 high of $4.908 per MMBtu. At just under $3.18, prices are closer to the low than the high, which could be a buying opportunity.

The NYMEX natural gas futures curve indicates that the market already anticipates significantly higher prices over the upcoming winter. The price for January 202 delivery is already over the $4 per MMBtu level.

LNG and European demand could impact U.S. prices

One crucial factor that could push U.S. natural gas prices higher over the coming months is European demand for U.S. LNG, or liquefied natural gas. For many years, U.S. natural gas was a landlocked energy commodity that could only travel by pipeline. Technological advances created the opportunity to liquefy natural gas for delivery by ocean vessel to regions and countries where prices are far higher. Russia had been supplying Europe with natural gas for years. As the war in Ukraine continues to rage, sanctions and boycotts on Russian exports could significantly increase the demand for U.S. LNG, leading to a decrease in U.S. inventories and putting upward pressure on NYMEX natural gas futures prices.

Natural gas tends to be the most volatile energy commodity. The coming winter could support higher prices. Cold temperatures across the U.S. and increased demand from Europe and Asia could create a perfect bullish storm.