The fast-food industry entered 2025 under heavy clouds. Inflation had eroded margins, consumer tastes had shifted in unpredictable ways, and operating costs had climbed steadily. Many operators found themselves in choppy waters, with traffic dwindling and profitability weakening.

In that testing environment, McDonald's (MCD) managed to keep its house in order. Its value-driven promotions and marketing discipline helped sustain demand while its ability to absorb pressure at the store level drew a clear line between its fortunes and those of its peers.

Citigroup has sharpened that distinction further. Analyst Jon Tower recently reaffirmed a “Buy” rating on MCD stock and raised the price target to $381, setting the highest benchmark on Wall Street among those with coverage. Tower tied the company's strength to a blend of aggressive value offers, an increase in marketing spend, and favorable comparisons to earlier weaker quarters.

Another cornerstone of resilience came from McDonald’s choice to maintain nationally advertised price points by subsidizing net profit losses in higher-cost markets, a move that preserved affordability and loyalty.

Looking ahead, Citi sees momentum building through 2026 as new growth initiatives roll out. Expanded beverage offerings, particularly in the energy drink space, alongside remodel cycles and faster unit expansion, position the company to seize market share while competitors struggle with declining traffic.

About McDonald's Stock

Headquartered in Chicago, McDonald's operates as a global foodservice retailer. Holding a market capitalization of roughly $216 billion, most of its restaurants are franchised, reflecting a business model built on consistency, convenience, and affordability. The McDonald's menu spans iconic burgers, chicken sandwiches, nuggets, fries, desserts, coffee, and beverages, while adjusting local offerings to regional tastes.

Over the past 52 weeks, MCD stock has advanced 1.3%, with a nearly 5% gain year-to-date (YTD). This performance stands out when placed against broader sector trends. The Invesco Dynamic Food & Beverage ETF (PBJ) has slipped 5% over the same 52 weeks and has dropped nearly 2% YTD. The contrast highlights McDonald’s ability to hold its ground in a market where peers and sector-focused funds have struggled to deliver meaningful returns.

Valuation reflects MCD’s premium standing. The stock trades at 24.37 times forward adjusted earnings and 8.32 times sales — levels comfortably above industry averages — signaling investor confidence in durability and earnings quality.

As a Dividend Aristocrat, McDonald’s has increased its dividend for 49 consecutive years. The company pays an annual dividend of $7.08, which equates to a yield of 2.35%. Its most recent quarterly dividend of $1.77 was paid on Sept. 16 to shareholders of record on Sept. 2, underscoring MCD's reliability as an income stock.

McDonald's Surpasses Q2 Earnings

On Aug. 6, McDonald’s stock climbed nearly 3% after the company released its financial results for the second quarter of fiscal 2025, which topped both revenue and earnings expectations. Total revenue for the period came in at $6.8 billion, a 5.4% year-over-year (YOY) increase and above the Street forecast of $6.7 billion. The performance stood out against a difficult backdrop for the wider industry.

Operating income expanded 10.7% to $3.2 billion from the prior year, while non-GAAP net income rose 6.5% to $2.3 billion. Adjusted EPS grew 7.4% to $3.19, edging past Wall Street expectations of $3.15. These numbers reinforced the staying power of its value and affordability strategy. The company's app-based offers and nationally promoted pricing drew traction in major IOM markets, while its loyalty program lifted purchase frequency.

For the full year, McDonald’s aims to achieve an adjusted operating margin in the mid-to-high 40% range. Management expects the second half of 2025 to outperform the first. Expansion also remains central, with plans to open 2,200 new restaurants globally this year and a target of 1,000 gross openings annually by 2027.

On the other hand, analysts forecast earnings growth to continue. Q3 EPS is expected to rise 5.3% YOY to $3.40. For the full fiscal year, estimates place EPS at $12.36, a 5.5% improvement from the prior year. Looking further into fiscal 2026, projections show another 8.2% increase to $13.37.

What Do Analysts Expect for McDonald's Stock?

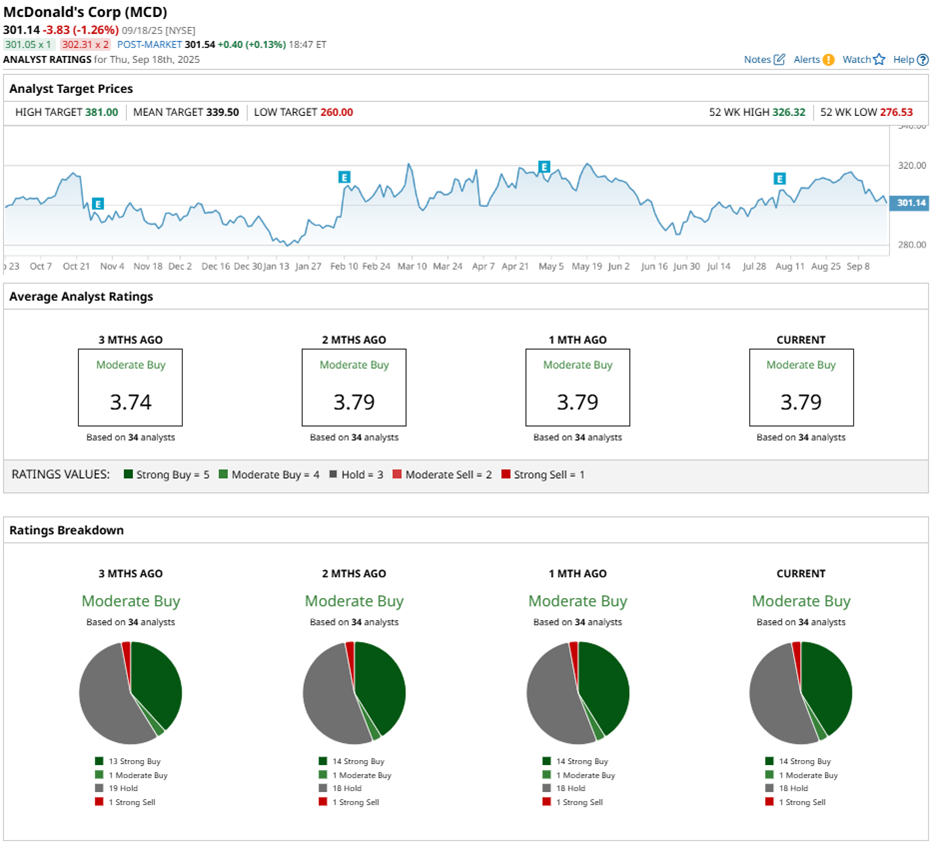

Analysts tracking MCD stock maintain a constructive view, with the stock holding a consensus rating of “Moderate Buy” among 34 analysts. Within that group, 14 recommend a “Strong Buy,” one suggests “Moderate Buy,” 18 call for a “Hold” rating, and one analyst advises “Strong Sell.”

The average price target for MCD stands at $339.50, pointing to potential upside of 12%. Meanwhile, the Street-high target of $381, assigned by Citi analyst Jon Tower, suggests room for a further 26% gain, should the company execute on its expansion and marketing strategies.