/Uber%20and%20Lyft%20by%20Thought%20catalog%20via%20Unsplash.jpg)

Lyft (LYFT) shares have been on a tear, recently climbing above $22 after the company unveiled a groundbreaking partnership with Waymo to bring fully autonomous ride-hailing services to Nashville by 2026. The stock jumped 25% on the announcement, while rival Uber (UBER) slipped, signaling investor enthusiasm for Lyft’s positioning in the autonomous mobility race. The deal leverages Lyft’s Flexdrive unit for fleet management, combining Waymo’s driverless technology with Lyft’s operational expertise.

About Lyft Stock

Lyft is the U.S. ridesharing and mobility leader. San Francisco-headquartered Lyft, with a market capitalization of roughly $8.7 billion, grew its services through fleet management affiliate Flexdrive and other key partnerships. Lyft competes head-to-head with Uber but differentiates itself through rider-focused experiences, corporate travel integration, and now, a heightened commitment to autonomous ride-hailing.

LYFT stock has done quite well this year, increasing by 121% over the past 52 weeks, much higher than the S&P 500 Index ($SPX) increase of 25% during the same period. The stock recently closed at $22.58, quite close to its 52-week price high of $23.50 and much higher than the low of $9.66, reflecting growing bullishness among investors regarding its recovery and turnaround strategy.

Valuation remains rich with an 81.6x price-earnings (P/E) multiple and next-year P/E multiple of 66.4x. Lyft is priced at 1.6x sales and 87x cash flow, significantly higher than most other conventional transport industry peers, reflecting positive sentiments regarding future growth. Profitability challenges are, however, indicated by the minimal net margin of 0.39% and price-to-book (P/B) multiple of 12.8. Lyft is a growth play with no dividend payout.

Lyft Beats on Earnings

In Q2 2025, Lyft achieved historic financial performance. Gross Bookings reached a record $4.5 billion, up 12% year-over-year (YoY), while revenue climbed 11% to $1.6 billion. Net income rose sharply to $40.3 million, compared to just $5.0 million in the prior year, reflecting a meaningful expansion in margins despite competitive pricing pressures. Net income as a percentage of Gross Bookings rose to 0.9% from 0.1% in Q2 2024.

Adjusted EBITDA also hit a record $129.4 million, growing 26% YoY. The margin improved to 2.9% of Gross Bookings versus 2.6% a year earlier, reinforcing Lyft’s ability to scale efficiently. Free cash flow surged to $329.4 million, up from $256.4 million, with trailing twelve-month free cash flow now just shy of $1 billion. Importantly, operating cash flow exceeded $343 million, allowing Lyft to repurchase 12.8 million shares for $200 million under its buyback program.

Looking ahead, management guided for Q3 2025 Gross Bookings of $4.65 billion to $4.80 billion, representing 13% to 17% YoY growth. Adjusted EBITDA is expected to range between $125 million and $145 million, with margins steady at 2.7% to 3.0%. These forecasts exclude potential upside from the newly closed Freenow acquisition, which will be integrated for two months of the quarter and could further strengthen European exposure.

What Are the Analyst Predictions for LYFT Stock?

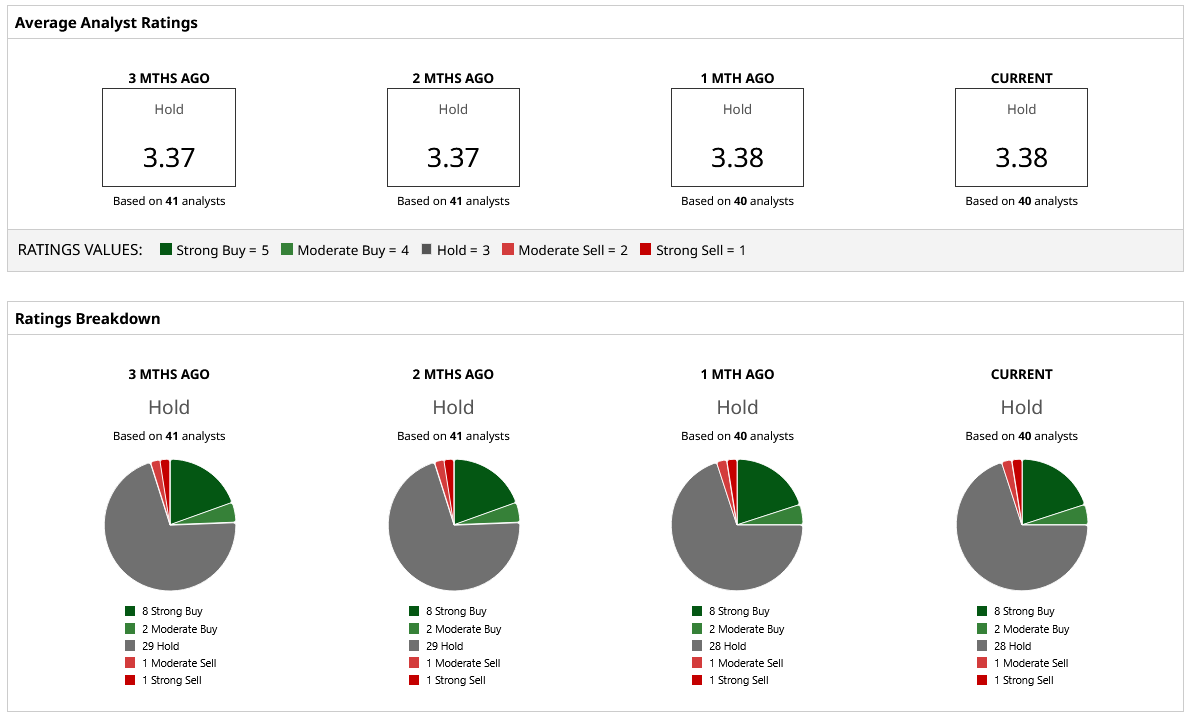

Analyst sentiment about Lyft continues to be divided, with analysts assigning a “Hold” rating consensus. There are a few surveyed analysts who recommend caution based on the firm’s rich valuation and competition.

The mean price target is $17.72, lower than what it is currently trading at, $22.58. There is thus downside potential of roughly 21.5% if the stock returns to the mean consensus. The highest target is $28, providing potential upside of 24%, while the lowest is $10, reflecting large discrepancies in Wall Street estimates regarding the fair value of LYFT stock.