/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)

IonQ (IONQ) has once again stepped into the spotlight, and this time the buzz carries weight. At the New York Stock Exchange, during its 2025 Analyst Day, the company drew close attention from Wall Street. Needham analyst Quinn Bolton walked away with stronger conviction, lifting his price target on IONQ stock while holding firm on a “Buy” rating.

To Bolton, IonQ is not only well-positioned but on course to emerge as a frontrunner in quantum computing. The analyst highlighted three pillars supporting this view — a clear technology path, a leadership team with proven execution, and a balance sheet that holds steady against the tide.

IonQ has not shied away from ambition. It kept its goal intact of building a system with 2 million physical qubits and 80,000 logical qubits by 2030. Beyond hardware, IonQ is also broadening into quantum networking and QKD security.

The UK Investment Security Unit recently approved the company’s acquisition of Oxford Ionics, adding more fuel to IonQ's fire. Following the announcement on Sept. 12, the stock soared 18% intraday, with another 6% gain the following day. These developments reflect that IonQ is carving out a strong position in the tech landscape.

About IonQ Stock

Headquartered in College Park, Maryland, IonQ stands at the intersection of quantum computing and networking. Its business spans the sale of specialized quantum hardware, related support services, and access to quantum computers of varying qubit capacities.

With a market capitalization of roughly $19.4 billion, the company is steadily investing in research and development to push the frontier of computational power. Investors have already taken notice. Over the past year, IONQ shares have climbed 753%. In the last six months alone, they have surged 194%. Even on a shorter horizon, the stock has shown vitality with a 66% rise in just the past month.

The current valuation reflects lofty expectations. IONQ trades at 429 times sales, towering well above industry averages.

A Closer Look at IonQ’s Q2 Earnings

On Aug. 6, IonQ reported its second-quarter 2025 results. Revenue came in at $20.7 million, surpassing the top end of the management guidance and sailing past analyst estimates of $17.03 million. The performance marked an 82% year-over-year (YOY) improvement.

That said, the road to innovation comes at a cost. Total operating costs and expenses reached $181.3 million, reflecting a 200% YOY increase, although the figure remained within management’s planned spending range.

Research and development dominated the rise, with costs climbing 231% to $103.4 million from the prior-year quarter. The company has consistently signaled that such spending is deliberate, aimed at enlarging its R&D headcount and fulfilling road map commitments.

The bottom line reflected these heavy investments. Adjusted EBITDA loss stood at $36.5 million, widening 54% from the same quarter last year. Net loss deepened 372% to $177.5 million, and loss per share expanded 289% to $0.70, missing the consensus estimate of $0.29.

Despite that, IonQ’s liquidity remains robust. As of June 30, cash, cash equivalents, and investments totaled $656.8 million. Adding to this cushion, back in July, the company raised $1 billion through an equity offering priced at a 25% premium to the prior trading session’s close. Management described it as the largest single investment in quantum computing and networking to date.

Turning to guidance, the outlook strikes a more encouraging note. Management raised its full-year 2025 revenue forecast to a range of $82 million to $100 million, signaling confidence in the pace of customer adoption. For the third quarter alone, revenue is expected to fall between $25 million and $29 million.

On the earnings front, analysts project Q3 2025 loss per share of $0.24. Looking further ahead, full fiscal year 2025 loss per share is estimated to narrow by 38% from the prior year, reaching a loss of $0.97.

What Do Analysts Expect for IonQ Stock?

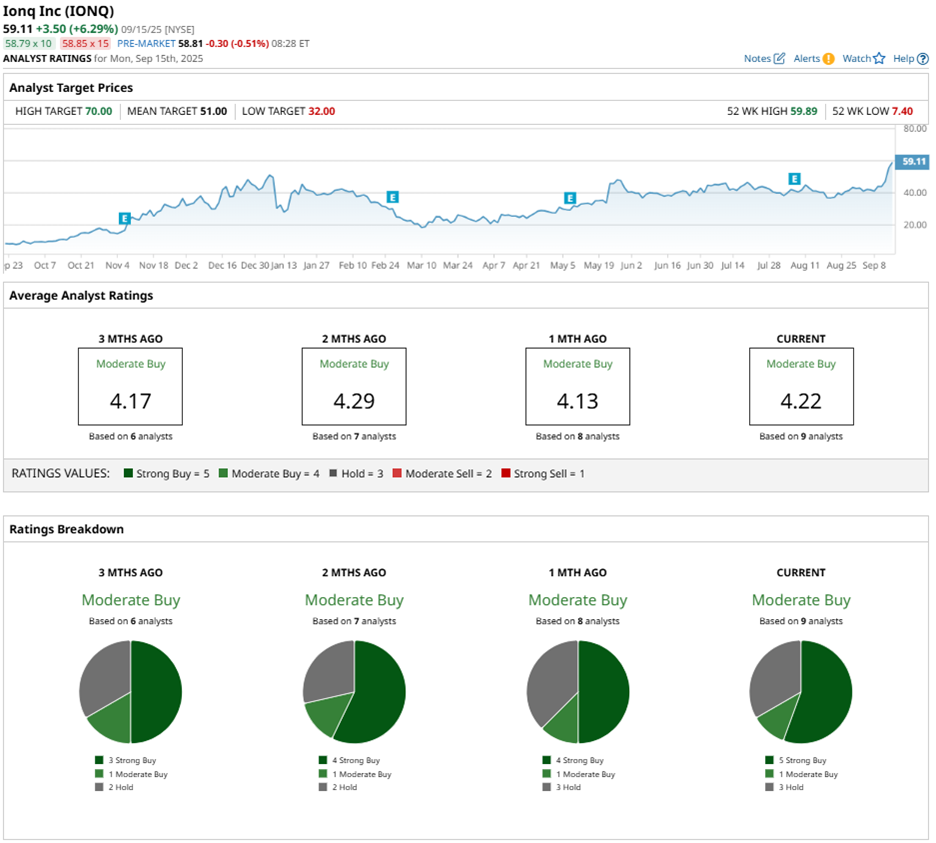

The analyst community has responded with an air of confidence when it comes to IonQ. Cantor Fitzgerald lifted its price target on IONQ stock from $45 to $60, reiterating an “Overweight” rating. Similarly, B. Riley Securities analyst Craig Ellis initiated coverage with a “Buy” rating and a $61 price target.

The broader analyst community has shown confidence, assigning IonQ a consensus rating of “Moderate Buy.” Out of the nine analysts covering the stock, five recommend it as a “Strong Buy,” one leans toward a “Moderate Buy,” and three advise a “Hold” rating.

IONQ stock is already trading above its average price target of $59, yet there is room for more. Needham's Street-high price target of $80 implies 20% potential upside from current levels.