/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Alphabet (GOOGL) recently received a significant regulatory boost after Judge Amit Mehta issued a ruling that, while affirming Google’s monopolistic control over general Search and related advertising, stopped short of ordering the structural breakup of critical assets like Chrome and Android.

Instead, the court barred exclusive contracts for Google Search, Chrome, Google Assistant, and the Gemini app and mandated that Google share portions of its search index and user-interaction data with qualified competitors, while permitting the continuation of lucrative placement payments. This outcome for Alphabet prompted analysts to raise price targets, with Evercore ISI lifting its forecast to a Street-high of $300 amid strengthened fundamentals across Search, artificial intelligence (AI), YouTube, Cloud, and reduced regulatory overhang.

Is GOOGL stock on track to achieve this mark?

About Alphabet Stock

Based in Mountain View, California, Alphabet has reshaped the technology landscape through its diverse operations, which include Google Services, Google Cloud, and innovative ventures such as Waymo and Verily. The company’s focused investments in AI and cloud computing are key drivers of its growth, strengthening its competitive edge in the industry. With a market capitalization of $2.9 trillion, Alphabet stands as a dominant global tech leader and a core member of the elite Magnificent Seven.

On a year-to-date (YTD) basis, shares have gained around 26%. GOOGL stock has also delivered a 61% return over the trailing 52 weeks. The stock has seen renewed interest following the recent favorable Chrome decision on Sept. 2, with shares surging 9.1% intraday on Sept. 3. GOOGL hit a 52-week high of $241.66 on Sept. 10.

GOOGL stock currently trades at a premium compared to the sector median but a discount compared to its own historical average at 23.4 times forward earnings.

Alphabet’s Q2 Results Surpassed Projections

Alphabet unveiled its second-quarter 2025 results on July 23, reporting a standout quarter that reinforced its resilience across core operations and AI-driven innovation. The company posted $96.4 billion in revenue, marking a 14% year-over-year (YOY) increase, signaling widespread strength across Google Search, YouTube ads, subscriptions, devices, and Google Cloud.

Net income surged 19% YOY to $28.2 billion, while EPS climbed 22% to $2.31, surpassing analysts’ estimates and reflecting robust profitability growth.

The Google Services segment — which includes Search, YouTube, subscriptions, and devices — delivered $82.5 billion in revenue, growing 12% YOY, boosted by strong performance across all sub-segments. Meanwhile, Google Cloud particularly stood out with 32% growth to $13.6 billion in revenue, achieving an annual revenue run-rate exceeding $50 billion, underscoring its expanding scale and strategic importance.

CEO Sundar Pichai emphasized the transformative role of artificial intelligence, noting that innovations like AI Overviews and AI Mode are showing strength. These AI features are now deeply integrated into everyday products and are beginning to drive monetization at levels comparable to traditional Search.

In response to soaring demand for AI infrastructure and cloud services, Alphabet raised its capital expenditure guidance for 2025 to approximately $85 billion. This reflects accelerated investment in servers, data center construction, and AI platform capacity.

Analysts remain optimistic as they predict EPS to be around $9.99 for fiscal 2025, up 24% YOY, before surging by another 6% annually to $10.59 in fiscal 2026.

What Do Analysts Expect for Alphabet Stock?

Recently, Evercore ISI lifted its price target on Alphabet from $240 to $300 while reiterating an “Outperform” rating. The firm’s survey results show Google’s continued dominance in commercial-intent Search, with generative AI improvements making its platform more effective for users and advertisers. Evercore pointed to several growth drivers such as accelerating YouTube revenue, steady momentum in Google Cloud, and the ongoing expansion of Waymo’s robotaxi business.

Tigress Financial Partners also raised its price target on Alphabet to $280 while reaffirming a “Strong Buy” rating. The firm highlighted Alphabet’s AI-driven leadership across major tech trends, noting robust revenue and profitability, as well as relief from the favorable Chrome ruling that eased regulatory risks. Tigress pointed to Q2’s double-digit growth led by Cloud and Search, ongoing AI integration across Google’s ecosystem, and the company's strong balance sheet.

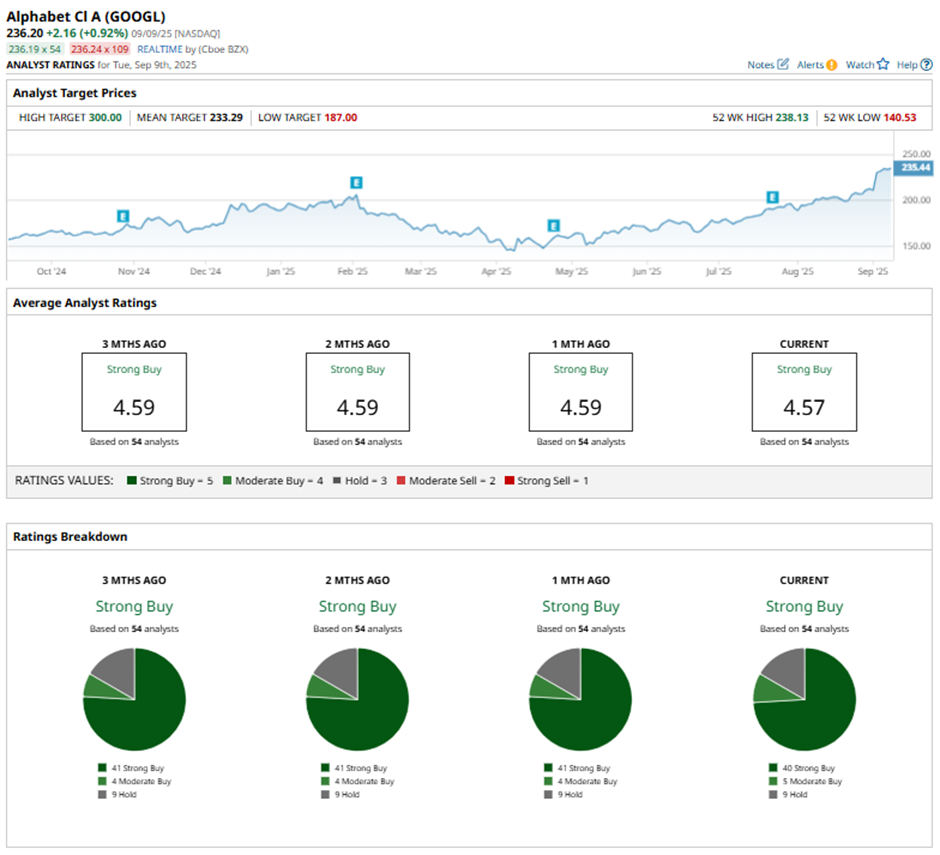

Wall Street is majorly bullish on GOOGL stock. Overall, GOOGL has a consensus “Strong Buy" rating. Of the 54 analysts covering the stock, 40 advise a “Strong Buy,” five suggest a “Moderate Buy,” and the remaining nine analysts are on the sidelines with a “Hold” rating.

GOOGL stock has already surged past the average analyst price target of $234.76. Meanwhile, Evercore’s Street-high target of $300 suggests that shares could rally as much as 25% from here.