Government-sponsored enterprise (GSE) Federal Home Loan Mortgage Corporation (FMCC) — also known as Freddie Mac — is having a stellar year on Wall Street this year. President Donald Trump announced that he is giving “very serious consideration” to privatizing the GSE, alongside the Federal National Mortgage Association (FNMA), commonly known as Fannie Mae.

The U.S. Treasury owns preferred shares and warrants for the majority of the GSEs’ common stock after a bailout during the 2008 financial crisis. However, despite the optimism, any move to offload stakes may face resistance from Congress, as privatization could lead to higher mortgage rates or destabilize the housing market.

While there appears to be ample time before any move materializes, that didn’t stop Deutsche Bank from initiating coverage on Freddie Mac with a “Buy” rating and a $25 price target. The bank's analysis indicates that the business is now essentially de-risked and generating returns.

About Freddie Mac Stock

Freddie Mac is a GSE based in McLean, Virginia. Founded in 1970, it plays a vital role in the U.S. housing finance system by purchasing home loans from lenders and converting them into mortgage-backed securities (MBS) for sale to investors.

This helps free up capital, allowing lenders to offer more mortgages. Freddie Mac supports both single-family and multi-family housing sectors and collaborates with financial institutions to maintain market liquidity. The firm has a market capitalization of $8.7 billion.

By managing risk and strengthening the secondary mortgage market, the organization helps ensure that Americans have consistent access to home financing, even during periods of economic uncertainty or housing downturns. Its operations are central to maintaining housing market stability.

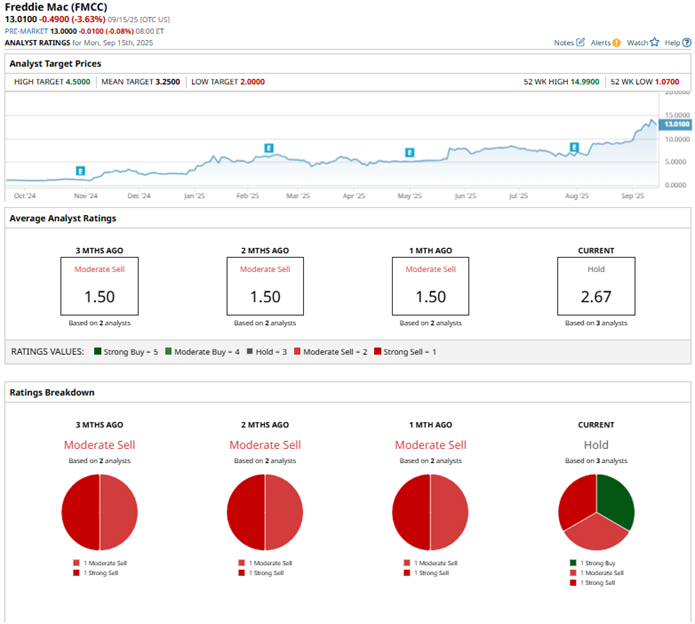

With hopes of a potential privatization, FMCC stock has been skyrocketing for quite some time now. Over the past 52 weeks, the stock has gained 947%. It reached a 52-week high of $14.99 on Sept. 12, but shares are down 13% from this high. So far this year, the stock has increased by 297%.

FMCC stock is relatively undervalued. Its price sits at 0.07 times sales, which is far lower than the industry average.

Freddie Mac’s Q2 Results Were Mixed

On July 31, Freddie Mac reported its second-quarter results for fiscal 2025. Net revenues declined marginally year-over-year (YOY) to $5.92 billion. On the other hand, net interest income increased 8% to $5.3 billion, driven by growth in the company's mortgage portfolio. The marginal decline in the topline was driven by a 42% annual decline in non-interest income to $617 million.

Freddie Mac’s provision for credit losses widened 99% YOY to $783 million due to a credit reserve build in single-family, attributable to lower estimated market values of single-family properties, which was based on the internal house price index and lower forecasted house price growth rates. The company reported that its new business activity increased, primarily driven by an increase in refinance activity.

As of the end of Q2, the GSE’s mortgage portfolio was $3.59 trillion, which was higher than the $3.57 trillion value the mortgage portfolio had at the end of last year. Freddie Mac’s single-family serious delinquency rates declined from 0.59% in Q1 to 0.55% in Q2. However, in Q2 2024, the serious delinquency rate was 0.50%.

Greater provision for credit losses also led Freddie Mac’s bottom line to decline. Net income declined 14% from the year-ago value to $2.39 billion in Q2, while the company reported a net loss per share of $0.01 for the quarter.

For the current year, Wall Street analysts expect EPS to increase by 4.9% from the prior year to $3.45.

What Do Analysts Think About Freddie Mac Stock?

In direct contrast to Deutsche Bank’s bullish stance, analysts at Keefe, Bruyette & Woods (KBW) recently reiterated an “Underperform” rating on FMCC stock, with a price target of $4.50. KBW believes that downside risks persist in the stock if privatization does not succeed.

Wall Street analysts are taking a cautious stance on Freddie Mac, with a consensus “Hold” rating overall. Of the three analysts rating the stock, there is an even split, with one analyst giving a “Strong Buy” rating, one offering a “Moderate Sell,” and one analyst recommending a “Strong Sell.” The consensus price target of $10.50 represents 19% potential downside from current levels.