/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Semiconductors have become the beating heart of modern innovation, powering everything from self-driving cars to the artificial intelligence (AI) models reshaping industries. Within this ecosystem, Advanced Micro Devices (AMD) wasn’t always a Wall Street favorite. Once the scrappy underdog to industry giants Intel (INTC) and Nvidia (NVDA), AMD mainly fought on price. The Ryzen era changed that for the firm, and its push into AI, cloud, and high-performance computing (HPC) has repositioned it as a serious contender.

In 2025, stellar quarterly earnings reports so far, the launch of Instinct MI350 GPUs in June, and AI-focused acquisitions have reignited investor confidence in AMD.

The spotlight grew even brighter when AMD unveiled a landmark partnership with OpenAI, agreeing to supply a staggering six gigawatts (GWs) of GPUs for the company’s expanding AI infrastructure. Along with promising billions in potential revenue, the deal includes a rare strategic twist — OpenAI can take an up to 10% stake in AMD through warrants.

AMD stock staged a 24% breakout on Oct. 6, turning heads across trading floors. Barclays swiftly recalibrated in response, lifitng its price target to $300 from $200, eyeing solid top- and bottom-line quarterly growth if things unfold correctly.

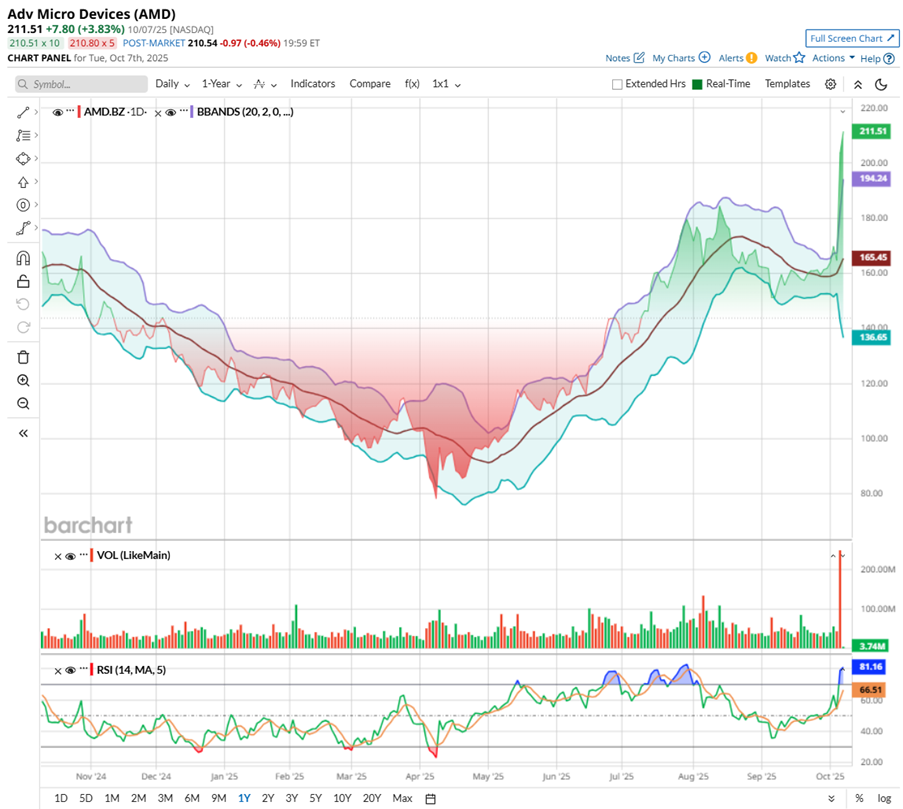

Still, with AMD trading hot above its Bollinger Band and momentum running full throttle, can the chipmaker sustain its charge toward $300 in 2025? Or is a pullback imminent?

About Advanced Micro Devices Stock

For more than five decades, AMD has been at the forefront of HPC, graphics, and AI innovation. Its Instinct MI350 GPUs deliver efficient, powerful performance at an accessible price, fueling everything from gaming setups to hyperscale data centers. With a market capitalization of around $349 billion, AMD has cemented itself as a major player in the semiconductor world.

Looking ahead, the Helios system — built on the next-gen MI400 Series — is generating buzz for AI workloads at scale. Supported by partnerships with OpenAI, Meta (META), and Microsoft (MSFT), AMD is shaping the future of AI hardware with speed, value, and innovation at its core.

AMD has flipped the script in 2025, with the AI chip stock up 79% on a year-to-date (YTD) basis, far outpacing the Semiconductor iShares ETF’s (SOXX) 32% surge. The real surge has unfolded over the past six months, with shares climbing 131%, fueled by AI-chip hype, strong analyst upgrades, and renewed investor conviction.

AMD stock’s trajectory has hit key technical milestones along the way, and recently roared to a 52-week high of $240.10 on Oct. 9, before a minor pullback. Trading volumes peaked at nearly 249 million shares on Oct. 6, underscoring the intensity of buying interest.

Yet, technical indicators hint at caution. Trading well above its upper Bollinger Band, AMD faces potential pullbacks despite its unstoppable momentum.

AMD stock has surged impressively, zooming past expectations. Valuation-wise, its 74.30 times forward adjusted earnings multiple and price-to-sales (P/S) ratio of 14.66 times are high compared to the historical median. But peeking at its P/S ratio, AMD trades at a discount to peers like Broadcom (AVGO) and Nvidia, making it a pricey-yet-intriguing story in the chip race.

Advanced Micro Devices’ Q2 Earnings Snapshot

AMD released its second-quarter earnings report on Aug. 5, and it was a mixed bag, showing stellar numbers on paper but a reality check in the markets. The firm delivered $7.7 billion in revenue, up 32% year-over-year (YOY) and topping expectations, while adjusted EPS declined 30% annually to $0.48, matching Wall Street analysts' projections. But the market’s reaction told a different story. AMD stock slipped more than 6% the next day, weighed down by disappointment in one crucial pocket: Data center AI revenue.

At first glance, it seemed puzzling. AMD’s core businesses were firing on all cylinders. The Client segment posted record revenue of $2.5 billion, up 67% YOY, fueled by booming Ryzen desktop CPU demand and a premium product mix. The Gaming division soared 73% to $1.1 billion, riding strong GPU launches and replenished console shipments. Even Data Center revenue climbed 14% annually to $3.2 billion, powered by continued adoption of EPYC CPUs among cloud and enterprise players. Yet, the softness in AI accelerators casted a shadow.

The culprit was U.S. export restrictions that curbed sales of AMD’s MI308 series to China, coupled with a brief sales lull as customers awaited the launch of AMD’s next-gen MI350 accelerators. This temporary pause was enough to make investors nervous about near-term AI momentum — the hottest narrative on Wall Street right now.

Still, management didn’t blink. CEO Lisa Su reaffirmed confidence in the company’s long-term AI roadmap. AMD's MI350 series promises greater performance and efficiency, while the MI400 series — already in development — is attracting strong early interest. AMD also advanced its MI300 and MI325 accelerators during the quarter, winning new deals with major cloud providers.

Looking ahead, AMD expects sequential revenue growth in Q3 led by the AI and client segments. The firm guided for roughly $8.7 billion in sales (plus or minus $300 million). The broader outlook also remains bullish. Management expects the AI data center business to scale to “tens of billions of dollars in annual revenue” over time as deployment accelerates across hyperscalers and sovereign AI projects.

Meanwhile, AMD continues to expand its AI ecosystem through acquisitions of teams from ZT Systems, Brium, and Lamini, bolstering both hardware design and software stack capabilities. With over 40 sovereign AI engagements worldwide, AMD is emerging as a serious contender in the global AI buildout.

Analysts tracking the chipmaker project its fiscal 2025 earnings to climb 20% YOY to $3.14 per share, then surge another 64% to $5.16 in fiscal 2026.

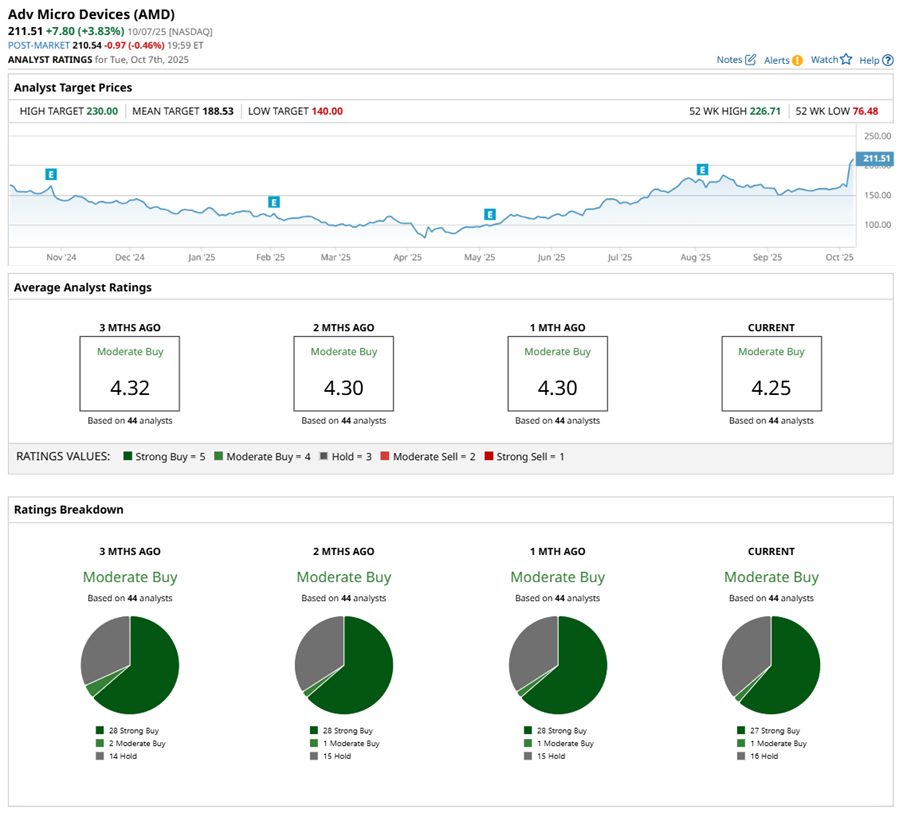

What Do Analysts Expect for AMD Stock?

AMD stock's recent surge gained extra fuel as analysts piled back in with bullish targets, reigniting optimism across Wall Street following the blockbuster OpenAI partnership. For instance, Barclays analyst Tom O'Malley raised his price target to $300 from $200 while keeping an "Overweight" rating. Barclays calls the multi-year OpenAI deal mutually beneficial — a partnership built not just on supply, but strategy.

Analysts believe the agreement could add roughly $4.5 billion in quarterly revenue by late 2026. They estimate a potential EPS boost of about $1.30 per quarter, fueled by the rollout of six GWs of GPU capacity through 2030. The deal’s structure, with warrants issued at each GW milestone, even has a final tranche tied to AMD hitting $600 per share. That's a bold signal of long-term confidence in AMD's trajectory.

Jefferies also jumped on the bullish bandwagon, upgrading to a “Buy” from a “Hold” and hiking its target to $300 from $170. Analyst Blayne Curtis dubbed the OpenAI partnership a “multi-generational opportunity,” even sketching a wild upside scenario if AI server demand explodes.

AMD stock has a “Moderate Buy” rating overall, reflecting solid confidence from the analyst community. Among the 44 analysts tracking the stock, 29 issue a “Strong Buy” rating, two back a “Moderate Buy,” and 13 advise to “Hold.”

The average analyst price target of $236.44 implies 9% potential upside from current levels. Meanwhile, the Street-high target of $300 suggests that AMD stock could rally as much as 39% from here.