/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

Shares of Advanced Micro Devices (AMD) have rallied over 85% year-to-date. AMD stock got a significant boost from its recently announced strategic partnership with OpenAI. The deal, valued in the billions, is likely to reshape AMD’s technology roadmap, accelerate its revenue trajectory, and boost its earnings potential.

Under this agreement, AMD will supply OpenAI with up to six gigawatts of Instinct GPUs, starting in the second half of 2026. The deployment of these next-generation MI450 accelerators will make OpenAI one of AMD’s largest data center customers. It validates AMD’s competitiveness in the high-performance GPU market, positioning it alongside Nvidia (NVDA) in the global AI compute race.

Per the structure of the deal, AMD issued OpenAI a warrant for up to 160 million shares, which vests as specific GPU deployment milestones are achieved. Each tranche of shares is also tied to stock price targets, with the final tranche vesting only if AMD’s share price hits $600. This alignment of incentives reflects AMD’s confidence in both execution and valuation upside. It also limits dilution risk, since OpenAI only earns those shares if AMD reaches extraordinary performance milestones.

From a financial perspective, the partnership is transformative for AMD. The chip maker expects revenue from this deal to begin flowing in the second half of 2026, ramping into double-digit billions of annual incremental data center AI revenue by 2027. Management projects the structure will be immediately accretive to adjusted earnings once shipments begin and believes the agreement could generate well over $100 billion in cumulative revenue over several years. That’s an enormous figure, offering visibility into future growth.

AMD Is Expanding Its AI and CPU Ecosystem

Beyond OpenAI, AMD’s broader AI data center strategy positions it well for solid growth. The company is already engaged in multiple large-scale deployments of its MI450 and Helios GPUs with other major customers. This shows that AMD is evolving as one of the few viable challengers to Nvidia with meaningful scale and competitive hardware. As more hyperscalers diversify their AI supply chains, AMD stands to gain market share.

AMD’s growth isn’t limited to GPUs. Its CPU business remains a powerful growth engine, led by the EPYC and Ryzen processors. In its most recent quarter, AMD reported $7.7 billion in revenue, a 32% year-over-year increase, driven by strong demand for EPYC chips across cloud, enterprise, and AI-related workloads. Importantly, CPUs are becoming increasingly critical in AI workflows, creating new demand for high-performance processors.

AMD is also expanding its CPU lineup to capture smaller-scale deployments through its EPYC 4005 series, tailored for SMBs and hosted IT providers. Meanwhile, Ryzen processors are achieving record sales in the consumer and embedded markets.

AMD’s Valuation and Outlook

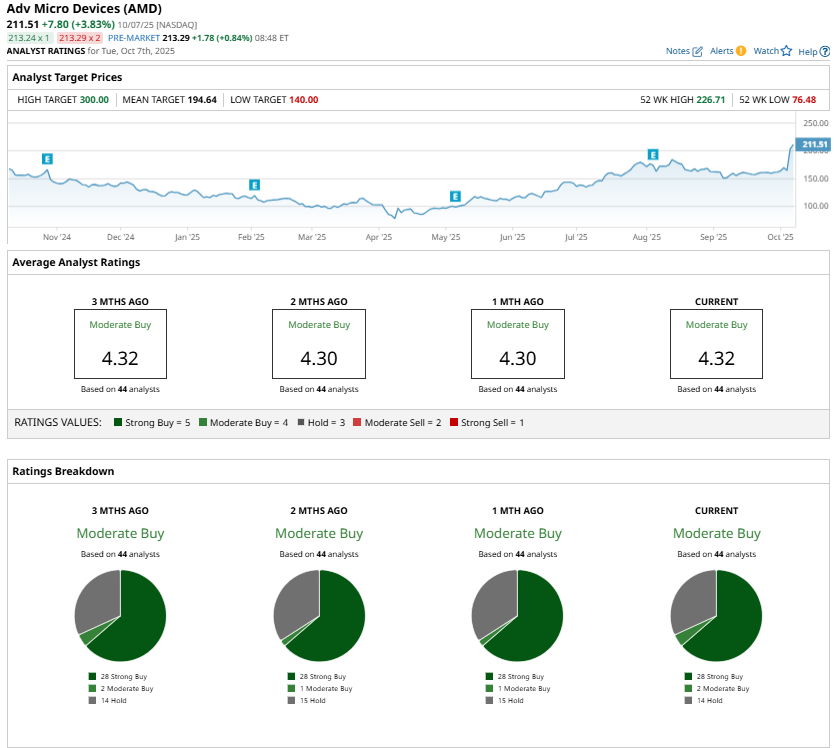

Overall, AMD’s long-term catalysts are compelling. However, after an 85% rally, AMD isn’t cheap by valuation metrics, which is why analysts are cautiously optimistic about its prospects and maintain a “Moderate Buy” consensus rating.

AMD stock trades at a forward price-earnings (P/E) multiple of 64.75x. Analyst forecasts suggest that AMD’s earnings could grow 63.4% in 2026, which justifies today’s premium valuation. If the OpenAI deal unfolds as planned and AMD continues expanding its AI footprint, its share price could have room to climb further. The warrant structure also gives both companies a shared incentive to make the partnership a success.

The Bottom Line

AMD’s recent surge, driven by its landmark partnership with OpenAI, validates its technological advancements and strengthens its competitiveness in the high-performance compute market. It bolsters revenue streams and offers multi-year AI-led growth.

While AMD’s valuation appears rich, its AI-driven momentum could propel shares higher. With earnings projected to climb 63.4% in 2026 and getting a boost from the OpenAI deal in 2027 and beyond, the stock’s high multiple seems warranted.