It’s been a really interesting week for traders, but perhaps the most surprising event has been the rally in Nvidia (NVDA) and Advanced Micro Devices (AMD).

Going into the weekend, traders faced a spiking CBOE Volatility Index, or VIX, as SVB Financial (SIVB) failed. Then over the weekend, Signature Bank (SBNY) failed as well.

The week has been littered with rumors, worries and plenty of volatility. Through it all, though, there’s been a rush into safe-haven assets like Treasury securities and gold, and in some cases, individual stocks like Apple (AAPL) and Microsoft (MSFT).

Don't Miss: Buy FedEx Stock on Earnings Rally? Check the Chart for Clues.

But we've also seen a rush into semiconductor stocks, like Nvidia and AMD.

At one point on Friday, Nvidia stock was 3.4% higher. At that highs, the shares were up about 15% for the week. And if Nvidia can finish higher on Friday, the stock will have closed higher each day this week — an impressive feat given the macro backdrop.

At last glance, AMD stock was 0.5% up on the day after rising 2.2% at the high. Despite the fade, the shares are still up 17% so far this week.

Now, though, it’s running into a big resistance level.

Can AMD Stock Break Out?

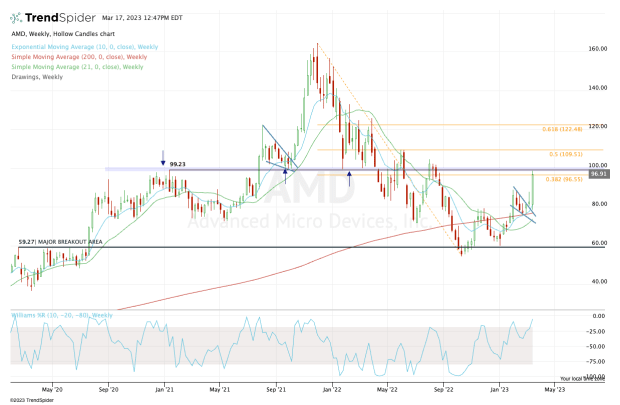

Chart courtesy of TrendSpider.com

I am thoroughly impressed with the price action in Nvidia and AMD. Regarding the latter, it’s now working on its third straight weekly gain and is up fully 61% from the year-to-date low.

That’s quite impressive, particularly given the recent backdrop and the S&P 500's four declines in the past five weeks.

After rocketing off the $80 area — and thus, the 10-week and 200-week moving averages — AMD stock is running right into the $100 area.

The $100 zone was notable resistance until an enormous breakout in mid-2021, which then cemented this area as support over the next 12 months. Eventually the bear market caught up with AMD and sent the shares below this key level and it again became resistance.

Don't Miss: Credit Suisse, Europe Banks Drag Down S&P 500. Here's the SPY Trade.

It’s been several quarters since we’ve seen this area again, but it’s now back in focus. If AMD cannot break out over this key area, we could be looking at a dip back into the high-$80s.

There, it would find prior resistance that will hopefully act as support, along with the rising 10-day moving average.

In the event of a breakout, we could be looking at a move to the $110 zone next, followed by $120 to $123.

Keep an eye on these relative strength leaders. Even if you're not trading them, they can act as key stocks to gauge investor sentiment.

.jpg?w=600)