/Amazon_com%20Inc_%20%20logo%20on%20building%20by-%20HJBC%20via%20iStock.jpg)

Amazon (AMZN) will report its fourth quarter 2025 financial results on Thursday, Feb. 5. Despite being the leader in cloud and e-commerce and seeing growing spending on AI infrastructure, Amazon’s stock performance has remained muted over the past year.

Over the last 12 months, Amazon's shares are almost flat. By comparison, the S&P 500 ($SPX) has climbed more than 15% during the same period. This gap highlights that, despite its market leadership, Amazon has faced challenges that have weighed on investor sentiment.

One key factor limiting Amazon’s upside has been the intensifying competition in the cloud computing space. Rivals such as Alphabet’s (GOOG) (GOOGL) Google Cloud and Microsoft (MSFT) Azure continue to aggressively expand, putting pressure on Amazon Web Services (AWS), which is also AMZN’s strongest growth engine. At the same time, Amazon’s rising spending on AI infrastructure has raised concerns about near-term profitability, even as it positions the company for future opportunities.

With AMZN stock trailing the market over the past year, will the upcoming Q4 earnings report be an important catalyst?

Will Amazon Deliver Strong Growth in Q4?

While Amazon's stock has underperformed the broader market, the company’s core businesses continue to deliver steady growth. The momentum in its e-commerce, cloud, and digital advertising segments will likely sustain in Q4, helping the company to deliver double-digit top-line growth.

Management expects net sales between $206 billion and $213 billion, representing year-over-year (YoY) growth of 10% to 13% compared with the fourth quarter of 2024.

Amazon’s retail business should remain a key driver, supported by Amazon’s competitive pricing and fast delivery. Seasonal demand from holiday shopping will provide an additional lift, while Amazon’s logistics improvements should help reduce delivery times and fulfillment costs. These efficiencies, combined with steady Prime engagement and resilient consumer spending, should allow Amazon to maintain healthy retail sales and expand margins.

Still, the segment that will be under scrutiny is AWS. In the third quarter, AWS generated $33 billion in revenue, up 20.2% YoY. Growth accelerated meaningfully from the prior quarter, driven by rising demand for both AI-related services and core cloud offerings. Amazon has also been bringing more capacity online, allowing AWS to capitalize on demand. Revenue increased by $2.1 billion quarter-over-quarter, pushing AWS to an annualized run rate of $132 billion.

Advertising is another area that will be on investors’ radar. The company posted $17.7 billion in advertising revenue in Q3, with growth accelerating for the third straight quarter. Amazon’s ability to connect brands directly with shoppers is proving increasingly attractive, allowing the advertising business to expand rapidly even on a large revenue base.

While Amazon is likely to sustain double-digit revenue growth, investors should expect some pressure on near-term profitability as the company ramps up investments in AI and cloud infrastructure.

Wall Street currently expects Amazon to deliver fourth-quarter earnings per share of $1.98, up 6.5% YoY. Further, investors should note that Amazon has been beating analysts’ expectations, surpassing consensus EPS estimates in each of the last four quarters, including a notable 23.4% beat in Q3.

Wall Street expects Amazon to post fourth-quarter earnings per share (EPS) of $1.98, up 6.5% from the prior year. The company has exceeded EPS expectations in each of the past four quarters, including a substantial 23.4% beat in Q3.

The Bottom Line on AMZN Stock

Amazon is well-positioned heading into the fourth quarter, supported by accelerating growth in its cloud division, rising advertising revenue, and a continued emphasis on operational efficiency. Together, these drivers strengthen the company’s outlook for solid Q4 financial performance.

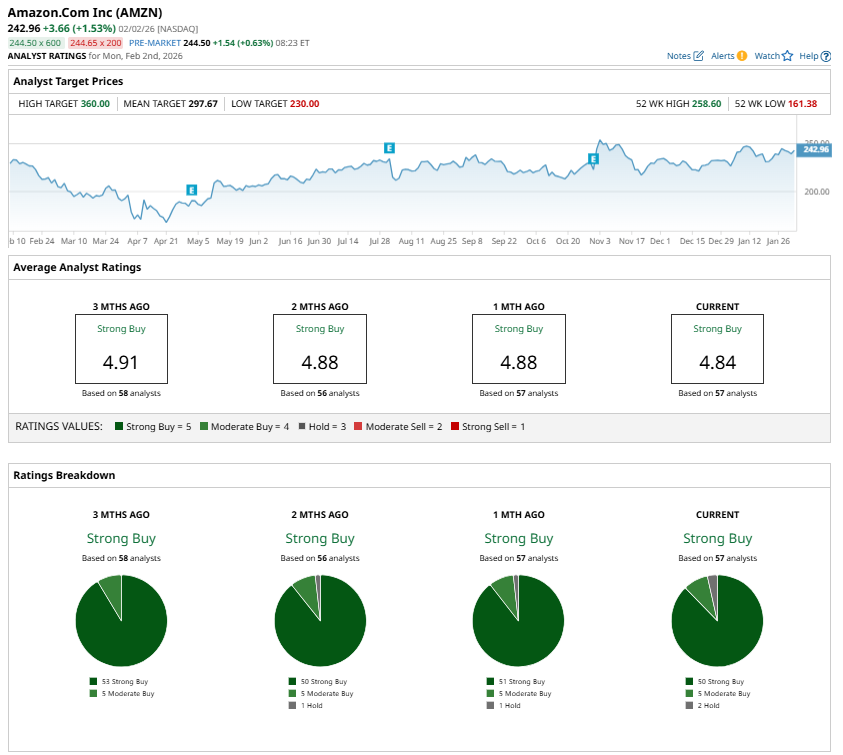

Wall Street remains optimistic, with analysts broadly maintaining a “Strong Buy” consensus rating on AMZN stock ahead of earnings.

However, AWS's performance will likely play the most important role in shaping the market’s reaction once results are released. Investors will be watching whether AWS can sustain its momentum, especially as the company faces capacity constraints and intensifying competitive pressure from Microsoft and Google.