The U.S. Supreme Court conservative bloc’s skepticism toward President Biden’s use of executive authority to eliminate more than $400 billion in student loan debt is no mere thought exercise in California. The economic future of millions of its residents may depend on it.

Among the estimated 40 million Americans who would benefit from the Biden administration’s plan, California is home to far and away the largest number of beneficiaries of any single state – some 3.5 million, according to the White House’s figures.

The total includes 2.3 million residents who would qualify for the highest level of forgiveness, $20,000. That’s because they received Pell Grant federal loans, which generally go to lower income applicants. Others would be forgiven up to $10,000 in debt. In all cases, forgiveness would be applied only to individuals who earn less than $125,000 or to households under $250,000.

Considering that the debt relief could apply to almost 10% of the state’s population, it’s no wonder Californians generally approve of the idea. According to a statewide survey conducted by the Public Policy Institute of California last fall, 60% of adults favored eliminating college debt, while 68% thought tuition at public two- and four-year colleges should be free.

In truth, though, we’re just barely scratching the surface of the story. Student debt relief has significant economic implications, certainly, but there are other layers of impact there to be examined.

“Debt forgiveness could end up being an equity issue,” said Jacob Jackson, a research fellow at the PPIC’s Higher Education Center. In some ways, it already is.

Support for forgiving student debt varied by race in the PPIC’s survey, with white adults breaking 50-50 and Asian Americans slightly in favor. But among Latino and Black respondents, the support was overwhelming — 76% and 73%, respectively.

There is life experience and real struggle behind those responses. Three-quarters of Black graduates from the California State University system and two-thirds of Black graduates from the UC system carried loan debt with them when they left college, according to the California Student Aid Commission.

About half of Latino college students, meanwhile, receive a Pell Grant, which often doesn’t have to be repaid. But because those grants have fallen so far behind the skyrocketing cost of a college education, many of those students also wind up applying for other financial assistance. Years of compounding interest later, they’re still digging out.

That’s a brief and quite incomplete explanation for how the U.S. came to sit with $1.6 trillion in student debt, an estimate delivered at the end of last year by the Federal Reserve Bank of New York. It is debt that is crippling some people’s attempts to build a life, escape lower income living or simply begin securing a future.

While white students hold 54% of all outstanding student loan debt in the country, Black college graduates on average owe $25,000 more than do white graduates, according to the Education Data Initiative. Four years after graduation, nearly half of Black students owe an average of 6% more than they borrowed.

The Biden plan won’t come close to wiping that out — but it could provide a gateway to a better economic future for those who qualify. One of those people is Ambalika Williams, who spoke to Capital & Main by phone from the steps of the Supreme Court in Washington, D.C., on Tuesday.

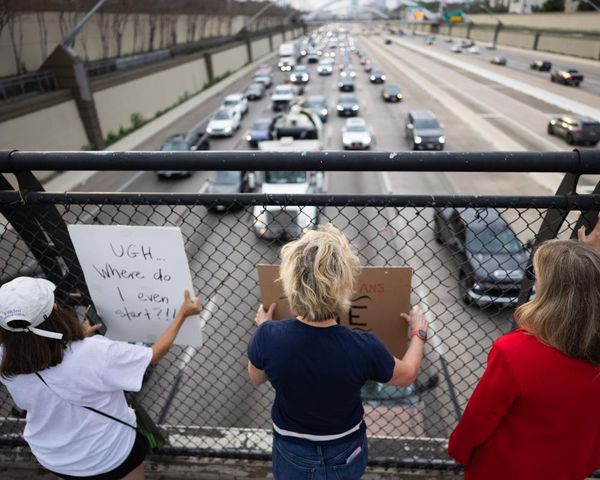

As the justices inside bandied about concepts like separation of powers and cast doubt on Biden’s authority to invoke debt relief, Williams was concluding an overnight vigil. She’d stood in rain and near-freezing temperatures for about 15 hours, waiting to receive a ticket for a seat at the proceedings.

In the end, Williams, an organizer for the student advocacy group Rise, handed her ticket to one of the 50 college students whom she had recruited to be there.

“I just felt like I wanted the students who are in college right now to be the ones to see the actual arguments,” she said.

Williams is 33. More than a decade after leaving the University of Texas with a degree in political science and $40,000 in loan debt, she’s still trying to dig out financially. She was told she needed a college diploma to get ahead in life. Now she is trying to close out the final $10,000 of her loan repayment in order to get that life started.

Maybe a house. Maybe a family.

“The clock is ticking on all that,” Williams said. “My dad is 63 and about to retire. He’s still paying off student loan debt.”

The fate of the Biden administration’s plan is unclear. In Tuesday’s oral arguments, conservative justices loudly questioned whether the plan oversteps the authority granted by the Higher Education Relief Opportunities for Students Act of 2003 (the HEROES Act), which was invoked in the early stages of the pandemic to freeze borrower balances and pause repayments. That freeze, incidentally, came under former President Donald Trump.

“Your view [is] that the president can act unilaterally, that there was no role for Congress to play in this … and … there’s no role for us to play in this either,” Chief Justice John Roberts told lawyers representing the administration, suggesting that perhaps the justices themselves should decide who has to pay what.

Student borrowers are waiting to learn when the pause on their debt will end. According to the U.S. Department of Education, if the Biden relief plan isn’t in place and the case still isn’t resolved by June 30, payments will resume 60 days after that date.

But with or without the blessing of the court, the movement to relieve the crushing debt felt by millions of Californians — and 40 million people across the country — is likely to continue. For last year’s midterm elections, Ambalika Williams said, her organization recruited more than half a million student voters to mobilize on the issue. They paid close attention to Biden’s promise to wipe out student debt, she said, “And we’re not done yet.”