California’s wildfire crisis just hit a new financial flashpoint, and it’s not happening in the forests — it’s happening in the insurance system. The California FAIR Plan, the state’s insurer of last resort, has seen its exposure explode to a staggering $650 billion, more than double what it carried just a few years ago. At the same time, the plan is requesting a 35.8% rate hike, setting off alarm bells for homeowners, regulators, and anyone who cares about housing stability in wildfire-prone areas.

This isn’t just an insurance industry story — it’s a housing story, a climate story, and a cost-of-living story all rolled into one. If you live in California, know someone who does, or care about the future of insurability in high-risk regions, this matters more than you might think.

How the FAIR Plan Went From Safety Net to Financial Giant

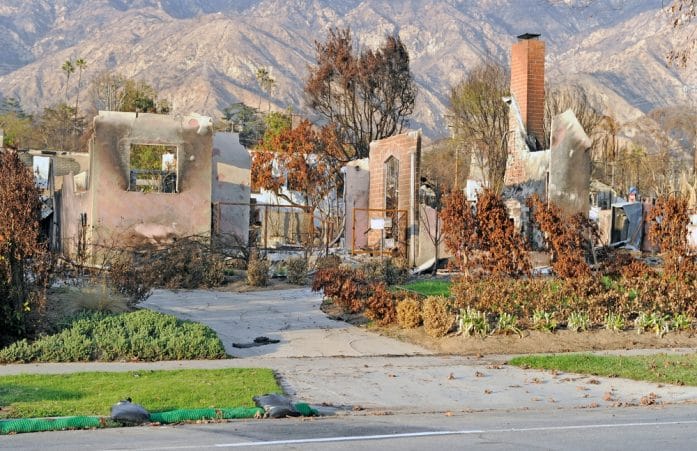

The FAIR Plan was never designed to be a massive insurer. It was meant to be a backup option—a last resort for homeowners who couldn’t get coverage in the private market. But as wildfire risks intensified and major insurers pulled back from high-risk areas, the FAIR Plan became less of a safety net and more of a primary provider for hundreds of thousands of Californians.

That shift is exactly why exposure has ballooned to $650 billion. Exposure doesn’t mean cash in the bank—it means the total value of properties the FAIR Plan is on the hook to cover if disaster strikes. In plain English: if a catastrophic wildfire season hits hard, the financial responsibility would be massive, fast, and incredibly complex to manage.

The 35.8% Rate Hike Request: What It Really Means for Homeowners

A 35.8% rate hike sounds like a headline number, but for real people, it translates into painful monthly reality. That’s not a minor adjustment — that’s a major cost shift for families who already struggle with housing affordability, taxes, utilities, and maintenance costs.

For many homeowners using the FAIR Plan, this isn’t optional insurance. It’s not a “shop around and find a better deal” situation. It’s literally the only option available, which means price sensitivity becomes almost irrelevant. People pay because they have to, not because they want to.

This creates a tough emotional and financial bind. People are already living in areas that carry wildfire risk, and now they’re facing rising premiums that feel less like a service and more like a survival tax.

A System Under Pressure: Why This Isn’t Just an Insurance Problem

What’s happening with the FAIR Plan isn’t isolated. It’s a symptom of a system under stress. Climate risk is colliding with financial risk, regulatory structures, and housing demand in ways that traditional insurance models weren’t built to handle.

Insurance depends on predictability. Wildfires, however, are becoming less predictable, more intense, and more destructive. When risk becomes harder to model, insurers become more cautious. Insurers become more cautious, coverage shrinks. When coverage shrinks, public or semi-public systems like the FAIR Plan absorb the overflow.

What Comes Next for California’s Housing and Insurance Future

The doubling of exposure and the rate hike request signal something deeper than a temporary spike. California is entering an era where insurance availability and affordability will shape where people can realistically live, not just where they want to live.

This doesn’t mean the end of high-risk communities. But it does mean adaptation becomes essential. Fire-resistant construction, smarter land use planning, better evacuation infrastructure, and large-scale mitigation strategies are no longer optional extras — they’re economic necessities.

When Insurance Becomes Infrastructure: The Real Wake-Up Call

The FAIR Plan’s $650 billion exposure isn’t just a number — it’s a warning signal. It tells us that insurance is no longer just a financial product. It’s becoming a form of critical infrastructure in climate-risk regions. When that infrastructure strains, everything connected to it feels the pressure.

What do you think? Should California rethink how insurance, housing, and climate risk are connected, or are we just watching a broken system stretch itself to the breaking point? Drop your thoughts in the comments and join the conversation.

You May Also Like…

The Hidden Cost of Rent Control in California

FireAid Concert Raises a Staggering $100 Million for LA Wildfire Relief—Here’s How It Happened

Regulation Watch: 8 Compliance Changes That May Affect Advisory Fees

The Home Insurance Review Clause That’s Triggering Surprise Policy Cancellations in 2026

14 Costly Disasters That Happen When You Renovate Without a Permit

The post California FAIR Plan Exposure Doubles to $650 Billion — 35.8% Rate Hike Requested appeared first on The Free Financial Advisor.