/Caesars%20Entertainment%20Inc%20tower%20by-%20JHVEPhoto%20via%20iStock.jpg)

Valued at $5.6 billion by market cap, Caesars Entertainment, Inc. (CZR) manages casinos and resorts under the Caesars, Harrah's, Horseshoe, and Eldorado brands. The Reno, Nevada-based company operates through Las Vegas, Regional, Caesars Digital, Managed and Branded, and Corporate and Other segments.

Companies worth between $2 billion and $10 billion are generally described as "mid-cap stocks." CZR fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the resorts & casinos industry.

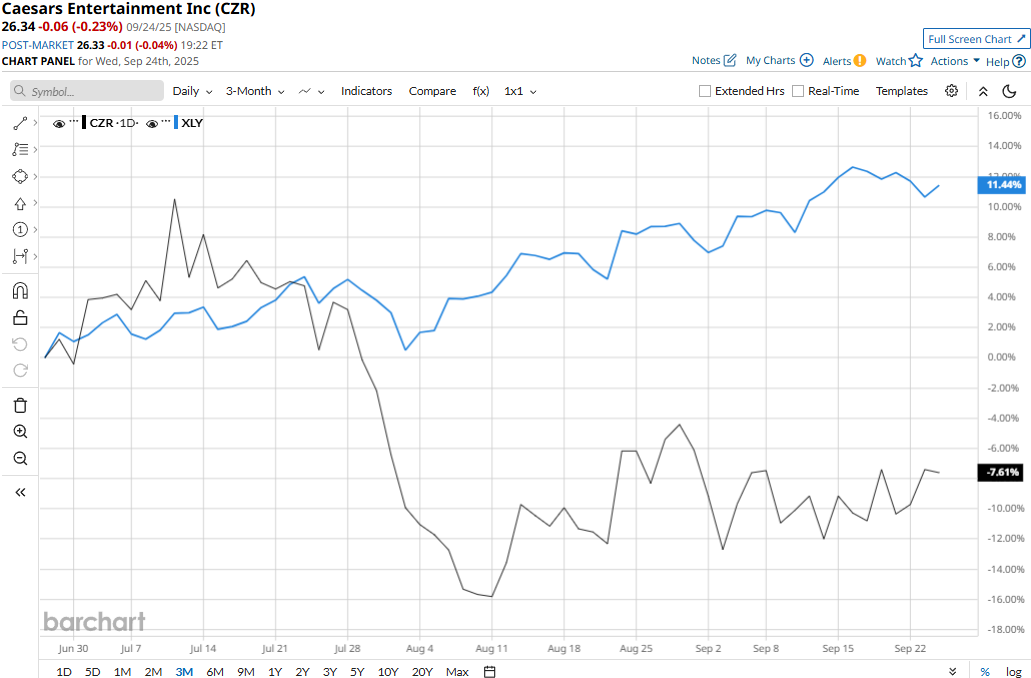

Despite its notable strengths, CZR stock has plummeted 42.7% from its 52-week high of $45.93 touched on Oct. 15, 2024. Meanwhile, the stock has plunged 11% over the past three months, notably underperforming the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 11.1% surge during the same time frame.

Caesars’ performance has remained grim over the longer term as well. CZR stock is down 21.1% in 2025 and 35.5% over the past 52 weeks, compared to XLY’s 6.8% gains on a YTD basis and 19.6% returns over the past year.

Further, the stock has traded below its 200-day moving average since early November 2024 and mostly below its 50-day moving average since late October 2024, highlighting its bearish trend.

Caesars’ stock prices declined 2% in the trading session following the release of its mixed Q2 results on Jul. 29 and maintained a downward trajectory for the next eight trading sessions. The quarter was marked by the strongest ever performance recorded in the Caesars Digital segment, along with robust performance in gaming in Las Vegas and notable growth in the Regional segment, driven by Caesars Virginia and New Orleans. Overall, the company’s net sales reached $2.9 billion, up 2.7% year-over-year and 1.1% ahead of Street’s expectations.

However, due to low operating margins and high interest expense, the company’s bottom line has remained under constant pressure. The company reported a loss of $0.39 per share, missing the Street’s expectations of $0.07 positive EPS by a huge margin, making investors jittery.

When compared to its peer, Caesars has also underperformed Vail Resorts, Inc.’s (MTN) 20.6% decline in 2025 and 20.9% drop over the past 52 weeks.

Nonetheless, analysts remain bullish on the company’s longer-term prospects. Among the 17 analysts covering the CZR stock, the consensus rating is a “Strong Buy.” Its mean price target of $39.94 suggests a 51.6% upside potential.