/Cadence%20Design%20Systems%2C%20Inc_%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Valued at $96.3 billion by market cap, San Jose, California-based Cadence Design Systems, Inc. (CDNS) is a global provider of software services. Its offerings include functional verification services, such as Jasper, a formal verification platform; Xcelium, a parallel logic simulation platform; Palladium, an enterprise emulation platform; and Protium, a prototyping platform for chip verification.

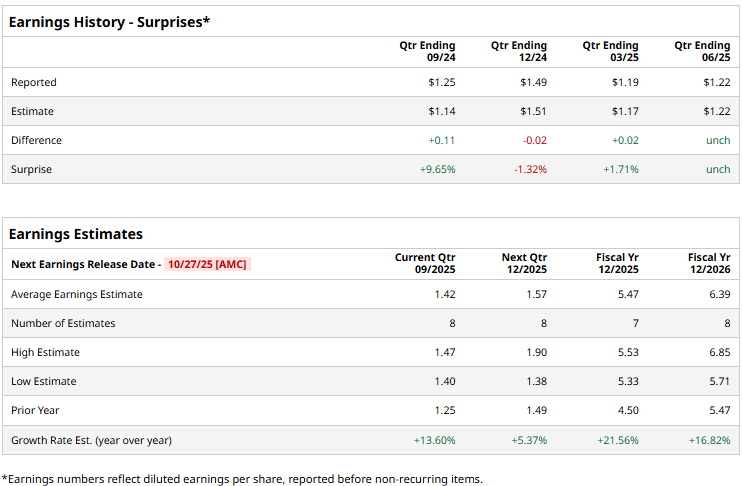

The tech giant is set to release its third-quarter results after the market closes on Monday, Oct. 27. Ahead of the event, analysts expect CDNS to deliver a profit of $1.42 per share, up 13.6% from $1.25 per share reported in the year-ago quarter. While the company missed the Street’s bottom-line estimates once over the past four quarters, it met or surpassed the projections on three other occasions.

For the full fiscal 2025, CDNS is expected to report an EPS of $5.47, up 21.6% from $4.50 in 2024. While in fiscal 2026, its earnings are expected to grow 16.8% year-over-year to $6.39 per share.

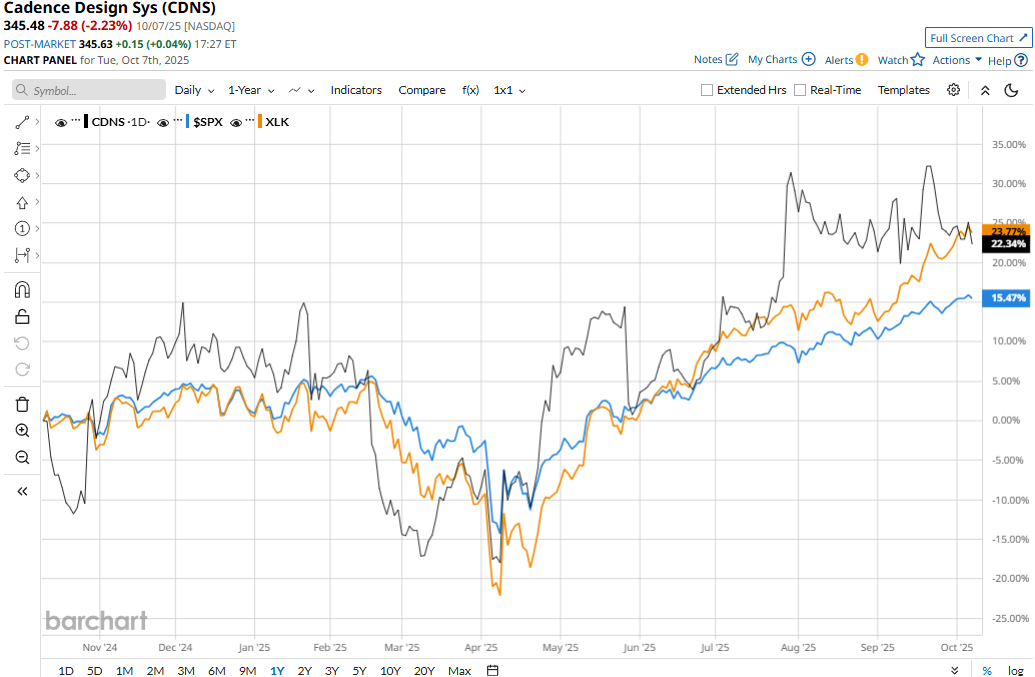

CDNS stock prices have soared 31.4% over the past 52 weeks, notably outperforming the Technology Select Sector SPDR Fund’s (XLK) 27.7% gains and the S&P 500 Index’s ($SPX) 17.9% returns during the same time frame.

Cadence Design Systems’ stock prices shot up 9.7% in a single trading session following the release of its impressive Q2 results on Jul. 28. The strength and breadth of its offerings have enabled Cadence to ride on the waves of the AI Supercycle, from AI infrastructure build-out, to physical AI in autonomous systems, to the emerging frontier of science AI.

During the quarter, Cadence’s topline soared 20.2% year-over-year to $1.3 billion, exceeding the Street’s expectations by 1.3%. Meanwhile, its non-GAAP net income increased by 28.3% year-over-year to $449.9 million, and its operating cash flows skyrocketed 111.3% year-over-year to $864.6 million, boosting investor confidence.

The consensus opinion on the CDNS stock remains optimistic, with an overall “Strong Buy” rating. Out of the 22 analysts covering the stock, 16 recommend “Strong Buy,” one advises “Moderate Buy,” four suggest “Hold,” and one advocates a “Strong Sell” rating. Its mean price target of $375.75 suggests an 8.8% upside potential from current price levels.