With a market cap of $11.3 billion, BXP, Inc. (BXP), formerly known as Boston Properties, is one of the largest publicly traded developers, owners, and managers of premier workplaces in the United States. Structured as a real estate investment trust (REIT), BXP focuses primarily on Class A office properties located in high-demand urban markets and is based in Boston, Massachusetts.

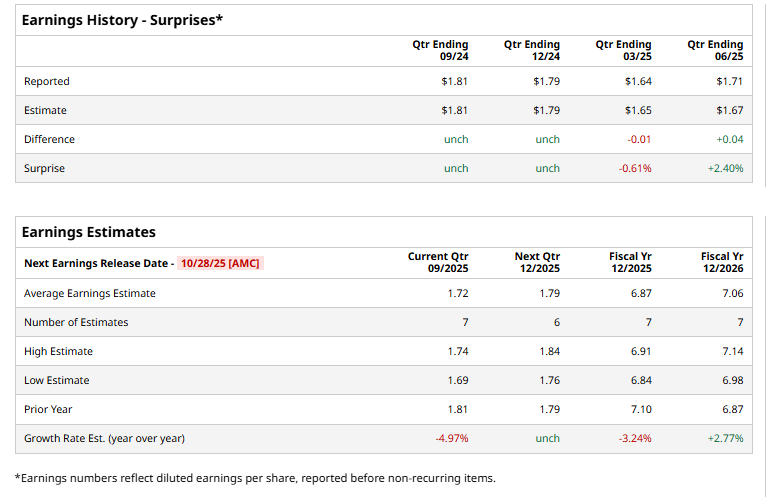

The REIT is expected to release its fiscal Q3 2025 earnings results after the market closes on Tuesday, Oct. 28. Ahead of this event, analysts project BXP to report an FFO of $1.72 per share, reflecting a decrease of 5% from $1.81 per share in the year-ago quarter. It surpassed or met Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion.

For fiscal 2025, analysts forecast the REIT to report FFO of $6.87 per share, down 3.2% from $7.10 per share in fiscal 2024. However, FFO is expected to grow 2.8% year-over-year to 7.06 in fiscal 2026.

BXP stock has dipped 21.2% over the past 52 weeks, trailing the broader S&P 500 Index's ($SPX) 14.8% gain and the Real Estate Select Sector SPDR Fund's (XLRE) 5.1% return over the same time frame.

On Oct. 14, Jefferies reaffirmed its “Buy” rating on BXP and set a price target of $84, reflecting confidence in the company’s long-term growth prospects. The firm praised BXP’s impressive portfolio of premium office and life sciences properties in top U.S. markets, noting robust leasing activity and disciplined balance sheet management as key strengths. Investors responded positively, sending BXP shares up 1.7% in the following trading session.

Analysts' consensus view on BXP stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 23 analysts covering the stock, nine suggest a "Strong Buy" and 14 give a "Hold." The average analyst price target of $78.89 implies a premium of 11.6% from the prevailing price levels.