With all eyes on tech stocks this morning because of Nvidia (NVDA), Snowflake is not one that is making investors very happy.

Shares of Nvidia are exploding to all-time highs on better-than-expected earnings. Snowflake is falling despite Wall-Street-beating quarterly results.

Although the cloud-services provider beat on earnings and revenue estimates, its guidance disappointed investors — and they didn’t waste any time letting the company know.

The stock was down about 16% at last check and was off 19% at the low.

Don't Miss: Apple Stock Has Two Buy-the-Dip Spots (and One Is Really Attractive)

Snowflake commanded a lot of attention during its September 2020 initial public offering, with the valuation swelling. Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) and Salesforce (CRM) both took stakes, too.

The valuation ultimately shot up toward $130 billion. Now, though, the stock has come under considerable pressure despite the company’s high growth rate.

Is there a buying opportunity here?

Trading Snowflake Stock on Earnings

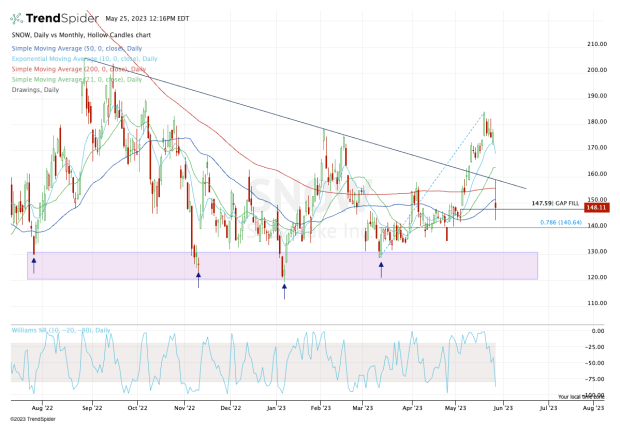

Chart courtesy of TrendSpider.com

Bullish traders don't have a lot on Snowflake's daily chart to hang their hats on.

The stock opened below the 50-day and 200-day moving averages, temporarily rallied back above them and then was rejected again.

That said, here are a few positives.

First, the stock filled the gap from May 3 near $147.50. It’s also holding the May low at $142.44 (and came within a dollar of that mark this morning). Clearly, buyers keep stepping in near this area.

It’s also holding up above the 78.6% retracement, although I would have liked to see this level tested today.

So how do traders navigate from here?

Don't Miss: Buy or Sell Anheuser-Busch Stock? Here's Where It May Find Support.

Keep a close eye on the $140 to $143 area. That’s the 78.6% retracement and this month’s low. A break of this zone could put the $120 to $130 area in play, which has been a huge support zone over the past few quarters.

Those who like the long-term story could consider scooping up some shares in this zone.

On the upside, the bulls need a move up through the post-earnings high near $160. Ideally in that scenario, SNOW shares would go on to fill the gap up near $172.

But with the bearish reaction to the quarter, that type of rally does not look especially likely in the short term.

For now, it’s simple. Watch $140 to $143 to see whether it holds as support.

Invest like a pro – for less. Our Memorial Day sale is on now! Get exclusive stock picks and ideas from our experts.