Small-cap stocks rarely receive the attention they deserve in the massive medical technology (medtech) industry, which is dominated by bigger names like Intuitive Surgical (ISRG), Medtronic (MDT), Johnson & Johnson (JNJ), and Stryker (SYK).

Valued at $1.5 billion, Alphatec Holdings (ATEC), a spinal-surgery-focused medtech firm, is one such under-the-radar name that is steadily attracting Wall Street and investor attention. Its products are specifically designed to simplify complex procedures, improve reproducibility, and help surgeons treat spinal conditions more effectively.

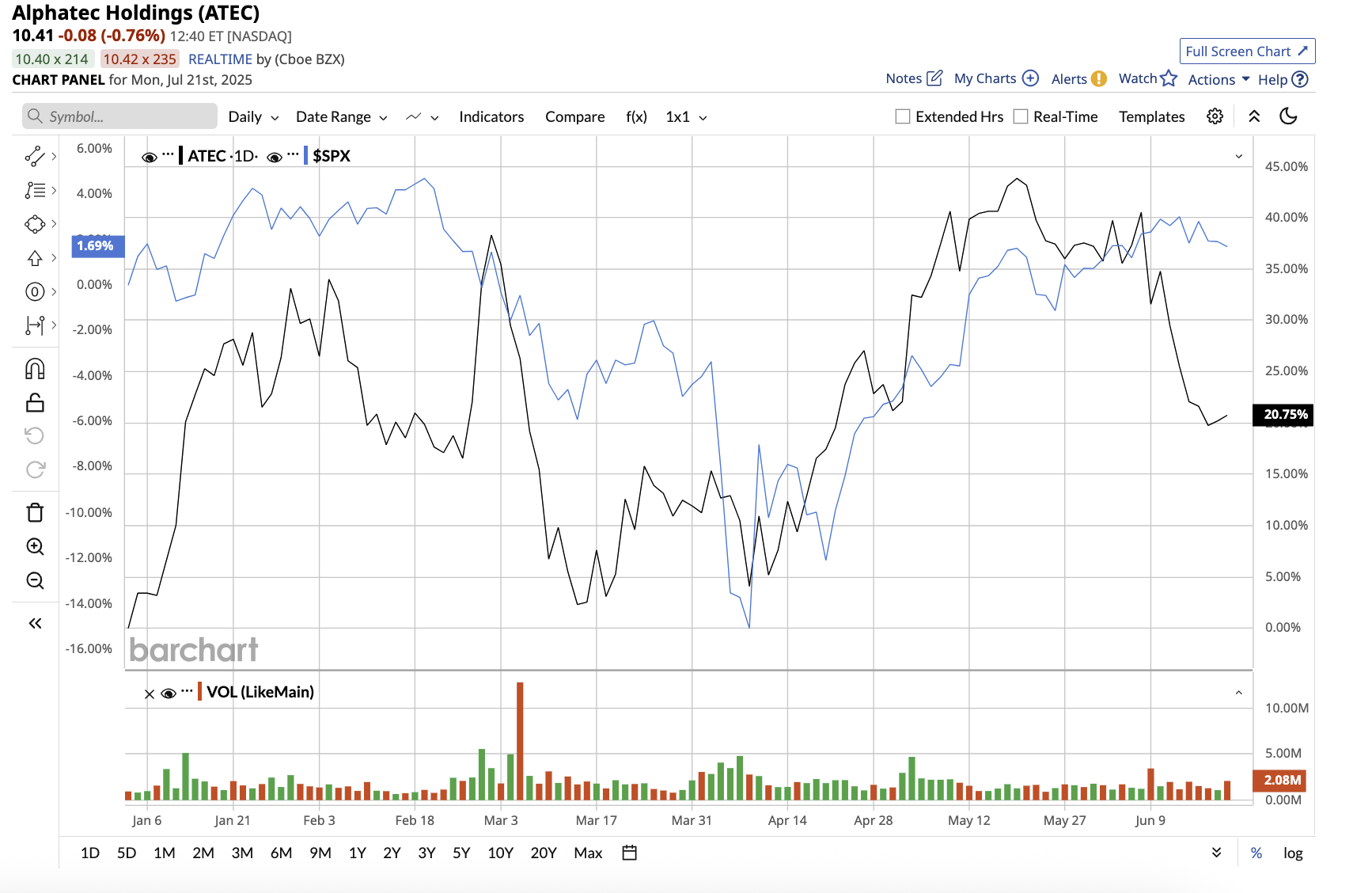

Alphatec stock has gained 13% year-to-date, compared to the S&P 500 Index’s ($SPX) gain of 7.7%. Let’s dig in to determine why Alphatec stock is a smart buy now.

Alphatec Is Setting the Stage for More Growth

Alphatec is known for using artificial intelligence (AI) to create advanced, integrated surgical systems that include implants, imaging, navigation, robotics, and biologics. The company’s goal is to revolutionize spinal surgery, making it safer and more effective for patients. Some of its innovative approaches include the Anterior/Posterior Cervical Discectomy & Fusion (ACDF/PCF), Lateral, Transforaminal, Anterior Lumbar Interbody Fusion (LTP/TLIF/ALIF), corpectomy systems, and PTP (Prone TransPsoas).

While ATEC is still a small-cap firm, its revenue growth, product adoption, and expanding footprint point to a company writing a strong growth story. In the first quarter, total revenue increased 22% year-over-year to $169 million, along with 24% growth in surgical revenue. The company has developed a loyal base of highly engaged surgeons, and more trained surgeons are adopting ATEC systems. Q2 saw an 18% increase in new surgeon adoption, which is a positive indicator for future growth.

Alphatec is aggressively investing in R&D and surgeon training, affecting short-term profits while increasing long-term value creation. R&D expenses totaled $16.6 million in the first quarter, resulting in a net loss of $51.9 million, or $0.35 per share. However, adjusted gross margin stood at an impressive 70% for the quarter. Alphatec ended the second quarter with $153.2 million in cash and cash equivalents. Its balance sheet is currently strong enough to support growth without excessive dilution.

Various factors, including aging demographics, a shift toward minimally invasive surgical methods, digitization, robotics, and surgeons demanding better tools, could drive the spine surgery market forward. Alphatec has established a strong moat by combining software, hardware, and biologics into a streamlined ecosystem focused solely on spine surgery solutions. Its rapid revenue growth, improving margins, and expanding moat indicate that the company is on track to profitability. CEO Pat Miles believes, “We are built to lead, and the best is yet to come.”

The company will release its second-quarter earnings on July 31. Analysts expect revenue to rise 22.5% to $178.8 million.

For the full year, analysts project revenue growth of 20%, which is consistent with management’s projections, with an additional 18.3% increase in 2026. Alphatec, trading at 2x forward sales, is a reasonable buy for a company with significant growth potential in the spine surgery market.

Is Alphatec Stock a Buy, Hold, or Sell?

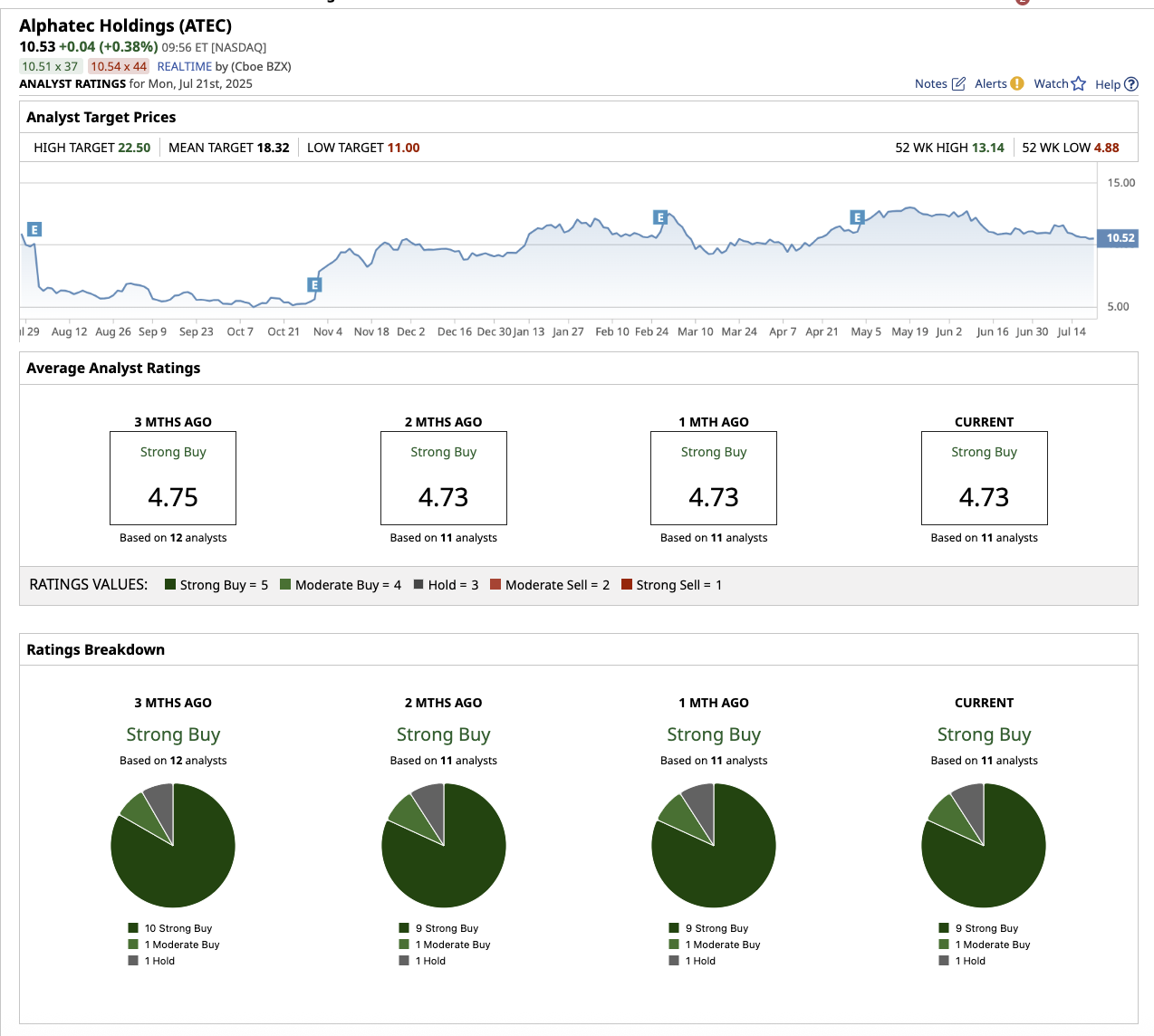

The consensus on Alphatec stock is a "Strong Buy.” Of the 11 analysts covering ATEC, nine have rated it a “Strong Buy,” one recommends a “Moderate Buy,” and one says it is a “Hold.” Based on its mean price target of $18.32, Wall Street expects the stock to climb as high as 74% from current levels. Furthermore, its Street-high estimate of $22.50 implies potential upside of nearly 113.6% in the next 12 months.

The Bottom Line on ATEC Stock

The global spine surgery market is massive, valued at more than $14.5 billion and expected to reach $19.1 billion by 2030. Alphatec is a small player in the medtech industry, but its focus on spine surgery solutions gives it a competitive advantage. Given this advantage, it is ahead of the competition.

Alphatec, like most small-cap biotech growth stocks, is highly volatile. However, it remains an excellent choice for those seeking exposure to medical innovation with genuine long-term upside and who are willing to bear the short-term risks.