Amazon’s (AMZN) two-day sales event — Prime Day — is winding down and ends on July 13.

With Amazon stock currently 40% off its highs, some investors are wondering if now is the time to buy with the share price sporting a hefty discount.

Amazon traded pretty well ahead of its stock split last month, but it has struggled since.

Further, it has badly lagged some of the larger stocks in tech, namely Apple (AAPL), Microsoft (MSFT) and Alphabet (GOOGL) (GOOGL).

On the plus side, Amazon has done a pretty good job of holding recent support. Does that give investors enough of a reason to get long or will doing so just end up being another Amazon Prime Day mistake?

Let’s look at the charts.

Trading Amazon Stock

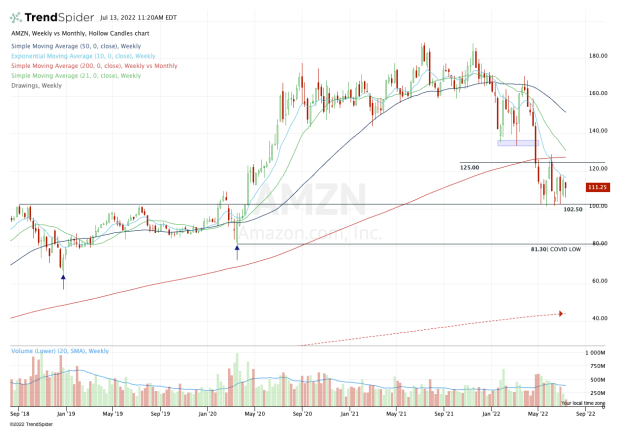

Chart courtesy of TrendSpider.com

Amazon stock double-topped near $185, failed to hold range support at $145, then broke below 2022 support near $135. It triggered a flush down to the low-$100s, which was a major breakout zone in 2020. For now, that's holding as support.

That’s Amazon’s price action in a nutshell.

From here, bulls have a very clear line in the sand when it comes to support, as the $100 to $103 area has been stout so far. The closer investors can buy near this level, the lower their risk will be, as a clean break below this zone can be their out.

Could Amazon stock fall into the $80s, which was support before covid, while the March 2020 low sits down at $81.30? Yes, it could fall that far — anything is possible in a bear market, so those who do decide to be long must respect when a stock breaks below support.

On the upside, the levels are also very clear. Currently, the 10-week moving average has been active resistance. Notice that Amazon stock has not closed above this measure since late March.

If it can do so and clear the $117 to $118 zone, then it opens the door up to $125. This level has been resistance on multiple rally attempts, as has the 200-week moving average. Just above this zone is the declining 21-week moving average.

A rally to this zone — the $125 to $130 area — would be a reasonable target for short-term traders. If the stock is able to push through it, it puts prior support in play near $135.

The bottom line is pretty simple: Amazon stock has been a relative weakness candidate versus both the indices and large tech stocks like Apple and Microsoft. That said, it’s sitting just above must-hold support. As long as it holds, Amazon has the potential to push higher, but it needs to clear active resistance for any meaningful upside.