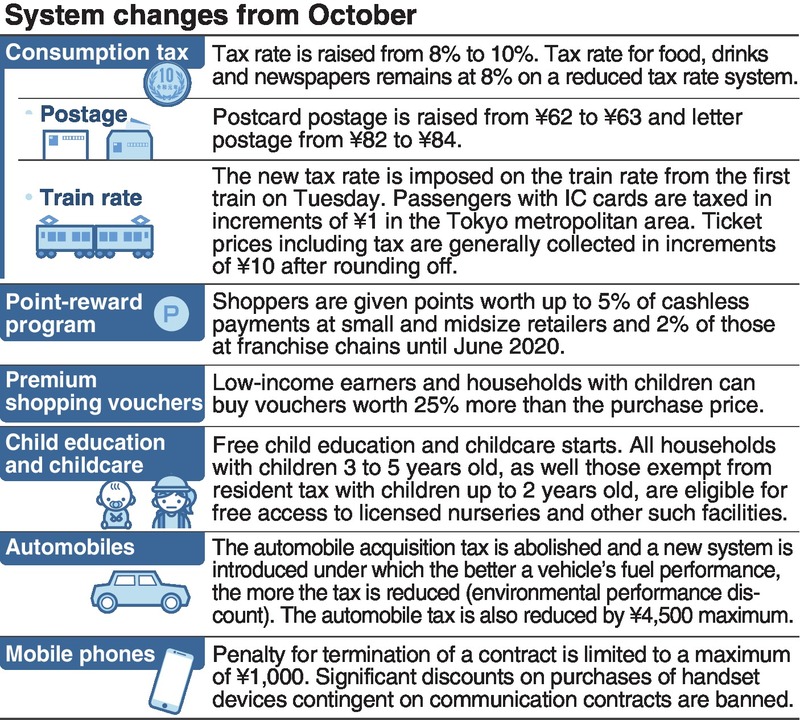

The consumption tax rate was to be raised to 10 percent from 12 a.m. on Tuesday.

At the same time, a new system including a reduced tax rate of 8 percent for food and drinks was to be introduced, along with a system for awarding points for cashless payments. Retailers and restaurants were making thorough preparations to prevent confusion.

On Monday morning a clerk at a Seikatsu Saika convenience store in Minato Ward, Tokyo, was busy applying price tags. Under the current price tag, he put a new one indicating the price at a 10 percent consumption tax, so the old tags could be easily removed after the store closed at 10 p.m., in preparation for its Tuesday morning opening.

"We want to switch the price tags smoothly to avoid confusion," the clerk said.

Convenience store operators were to switch their systems at 12 a.m. Tuesday, when the tax rate changes. If a cashier scans an item for a customer up until 11:59 p.m. on Monday, the tax rate will remain at 8 percent even if the payment is made after 12 a.m. on Tuesday.

In the case of family restaurants that are operating before and continue to operate beyond 12 a.m. on Tuesday, each business will handle the situation its own way.

The 8 percent tax rate was to be applied at a time set by each company for its cash register changeover. For example, McDonald's Japan will apply a 10 percent tax from 5 a.m. on Tuesday.

Various other systems related to people's daily lives will also change in October.

Part of the increased revenue from the consumption tax hike is to be used to make children's education and childcare free of charge. Households with 3- to 5 year-olds, and those who are exempt from resident tax and have children aged up to 2 were to be eligible for free access to facilities such as licensed nurseries and certified childcare centers. Households with children in kindergarten were to be provided up to 25,700 yen for each child monthly.

A system to supplement the pensions of low-income elderly people was also to be launched. A standard amount of 5,000 yen per month was to be added to the basic pension for the elderly, disabled and bereaved family members.

The government was to abolish the existing automobile acquisition tax, which is levied when a car is purchased, and introduce a new system imposing a tax based on the car's performance, including fuel efficiency. The better a vehicle's fuel performance, the more the tax will be reduced under the new system. The automobile tax for possessing a vehicle was also to be reduced.

The rules on mobile phone charges were also to change, such as limiting the penalty for terminating a contract to a maximum of 1,000 yen. These steps are expected to lower the barriers to users changing carriers.

Read more from The Japan News at https://japannews.yomiuri.co.jp/