The FTSE 100 rose in early trading on Friday morning, following a mixed session overnight in Asia and a flat day of trading in the US - though it has emerged Warren Buffett, the outgoing CEO at Berkshire Hathaway, has made a new £1bn purchase.

Investors and analysts alike are still dissecting Thursday’s UK economic data which showed a strong rise in productivity for June - but still a drop overall for the spring quarter of the year after a big first three months of 2025.

With interest rates having been cut last week the hope will be for businesses to step up their investment levels somewhat - but the jobs market remains uncertain and several businesses and organisations have said they are simply hamstrung by cost pressures, including National Insurance Contributions being hiked, still-high inflation and concerns over what comes next in the autumn Budget.

Follow The Independent’s live coverage of the latest stock market and business news here:

key points

- FTSE 100 rises on Friday with miners the top climbers, after flat US session

- Buffett's Berkshire Hathaway sells more Apple and buys new $1.6bn stake

- Plant protein firm Beyond Meat rejects claim it is filing for bankruptcy

- FTSE 100 'relegation' and 'Champions League' contenders - from investing expert

FTSE 100 falls and US stocks fail to spark ahead of weekend

16:34 , Karl MatchettOne final check on the stock markets before we check out for the weekend.

The FTSE 100 looked on course to finish flat but a sell-off this afternoon puts it in negative territory.

A loss of 0.34 per cent is a low point to finish on but the index is still up 0.56 per cent of the week.

Stateside, it’s decidedly mixed - the Nasdaq is down 0.37 per cent but the Dow is up 0.17 per cent.

That’s it for this week so see you again soon.

Business news live

08:14 , Karl MatchettGood morning all - one final day this week for our business and live financial news coverage for you.

As usual, Friday is somewhat quieter in terms of company reports and the like - so we’ll delve more into the news which matters to your wallet, look ahead to next week and bring you everything that matters around UK firms.

Business news live - FTSE 100 rises with miners leading way

08:26 , Karl MatchettA first look at the markets this morning and we can see the FTSE 100 has shot upwards early on, a 0.3 per cent rise led by four miners up between 2 and 3.1% each: Antofagasta is the biggest climber, followed by Glencore, Anglo American, Rio Tinto.

In both Germany and France the main index is up by about 0.45 per cent as investors look to finish the week on a high.

Last night, US trading was totally flat, with the Dow, Nasdaq and S&P 500 all within 0.03 per cent either side of the zero line.

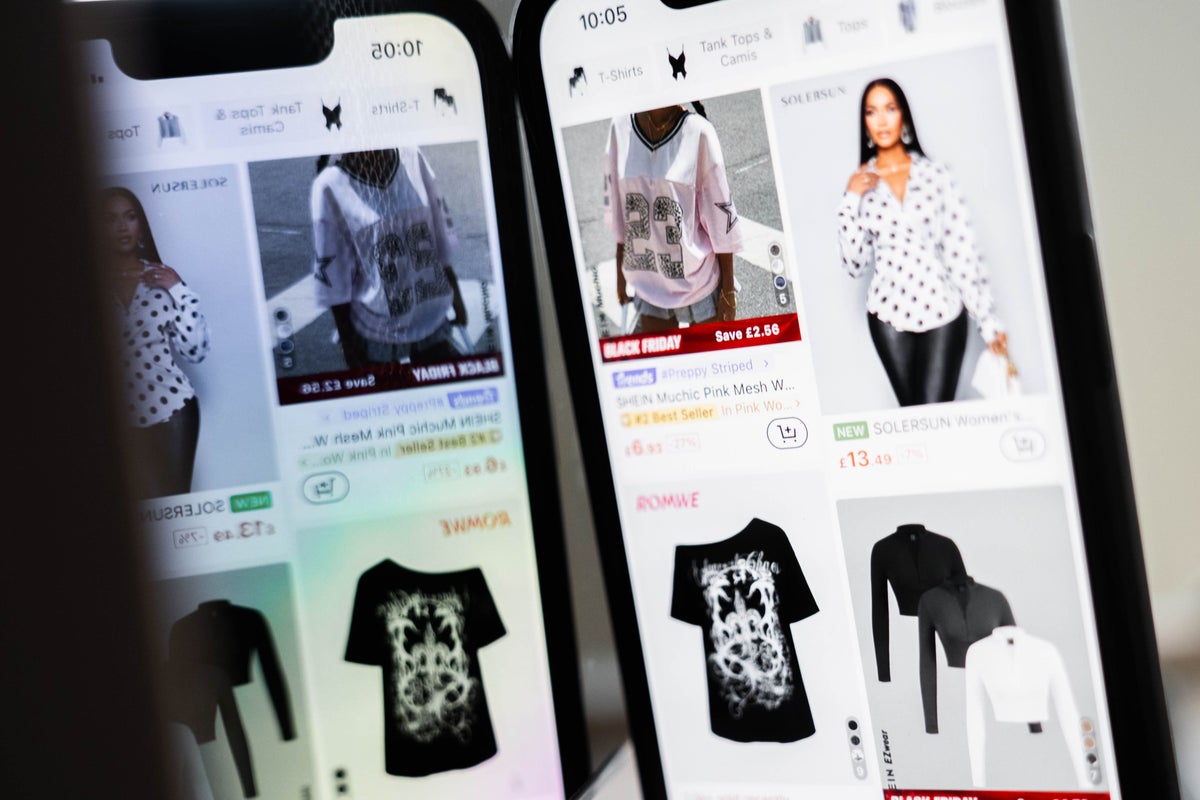

Shein’s UK sales surge 32% higher amid stock market float plans

08:45 , Karl MatchettFast fashion giant Shein has revealed its UK sales surged by almost a third last year ahead of plans to float the company.

Fresh accounts filed on Companies House also showed higher profits as its low-price products continued to attract growing popularity, particularly among younger shoppers.

It comes as the online retail group, which was founded in China and headquartered in Singapore, continues with efforts to secure a stock market IPO (initial public offering).

PA with full details:

Shein’s UK sales surge 32% higher amid stock market float plans

Warren Buffett takes new £1.1bn stake in healthcare giant

09:00 , Karl MatchettWarren Buffett is heading for retirement after announcing he’ll hand over the reigns at Berkshire Hathaway.

Despite that his moves in the stock market still carry serious weight - as shown by the fact UnitedHealth shares rose 10 per cent once it became known Buffett’s firm had taken a stake worth $1.6bn (£1.1bn).

Buffett used to own a large holding in the organisation before selling in 2010; now he’s back with a far bigger stake after the share price had fallen by more than half this year.

Berkshire also continued to sell Apple shares, while also buying Chevron, Domino’s Pizza and Constellation Brands.

Gaucho restaurants CEO issues stark warning to Reeves over tax hikes

09:20 , Karl MatchettA senior figure in the hospitality sector has sent a stark warning to Rachel Reeves ahead of the autumn Budget: “Your taxes are curtailing growth”.

Baton Berisha, chief executive of Rare Restaurants - the company which owns Gaucho and M restaurant brands - has called for National Insurance Contributions (NICs) to be restored to the level they were before April’s increase and said he had the backing of others in the industry wanting the same.

Pointing to Office for National Statistics (ONS) figures, Mr Berisha highlighted 84,000 jobs have been lost in the hospitality sector since the NICs hike took effect in April 2025 - equating to roughly 13,000 jobs disappearing per month since then.

Gaucho restaurants CEO issues stark warning to Reeves over tax hikes

Supermarkets could close due to rates increases

09:40 , Karl MatchettA report has suggested more than 100 large supermarkets across the UK could be forced to close due to rising rates.

Government plans to put up the amounts businesses must pay for big retail stores will make 50 Sainsbury’s stores, “tens” of Tescos and others for the likes of Asda and Morrisons unprofitable, the FT reported.

The larger supermarkets operate with thin profit margins, relying on huge bulk selling to generate cash.

They are reportedly displeased that the plans would also not hit discount rivals Lidl and Aldi, as they run smaller stores which would be unaffected by the plans.

Digital bank N26 seeks to remove company founders from board

10:00 , Karl MatchettA board fallout at digital bank N26 sees investors seeking to remove the founders.

The two who are now co-CEOs could depart by year’s end, reports the FT, with Germany’s regulator threatening sanctions on the firm due to risk management weaknesses.

A deal to remove the pair of co-owners could see them lose their veto rights in exchange for early investors taking a hit on expected returns.

Beyond Meat rejects claims it is filing for bankruptcy

10:20 , Karl MatchettThe plant-based protein company Beyond Meat - a massive post-Covid stock market smash hit which then saw its share price capitulate - has rejected reports it is set to file for bankruptcy.

Revenues dropped to $326m last year and only $144m in the first half of 2025.

The company has let go of all staff in China, suspending operations there, and further job losses were announced in north America - about 10 per cent of the total staff number altogether.

There were then some reports saying it was out of cash and filing or considering filing for bankruptcy - but the company have come out refuting that.

In early 2021 company shares were about $178; in the past five years they have lost 98 per cent of value and are now around $2.63 per share.

Recent media stories suggesting that Beyond Meat filed for bankruptcy are unequivocally false. We have not filed nor are we planning to file for bankruptcy.

— Beyond Meat (@BeyondMeat) August 15, 2025

Go Beyond.

Lloyds becomes UK’s first bank to introduce £300 rule from end of this month

10:40 , Karl MatchettLloyds customers will soon be able to use a new app feature to deposit coins and banknotes into their account at the same time as dropping off a parcel or picking up a pint of milk in stores.

The feature uses a barcode, enabling people to deposit up to £300 per day in notes and coins, up to a maximum of £600 a month.

People will be able to pay money in at more than 30,000 locations which have PayPoint.

More from PA:

Two of the UK’s biggest bakeries to combine to make bread giant

11:00 , PAAssociated British Foods (ABF), the owner of Kingsmill, Ryvita, and Twinings, is set to acquire the historic Hovis Group, merging it with its own bakery arm.

The multinational confirmed on Friday that an agreement has been reached to buy Hovis from private equity owner Endless. The deal will "combine" the production and distribution activities of Hovis with ABF’s Allied Bakeries business, which produces Kingsmill and Allinson’s bread.

This strategic move is expected to yield "significant costs synergies and efficiencies", aiming to create a sustainably profitable bread business.

FTSE 100 x Premier League crossover: Relegation candidates

11:20 , Karl MatchettWith the football returning tonight in the Premier League’s opening game of 2025/26, investment platform IG have had themselves a bit of fun - picking out three firms primed for relegation (potentially dropping out of the FTSE 100 or struggling with share price losses) and three who are heading for the Champions League (big possible gains ahead).

Chris Beauchamp, chief market analyst at IG, makes his picks and predictions...

M&S faces struggle amid soaring wage bill and tough competition

Marks & Spencer faces an uphill battle despite modernisation efforts across food and digital channels. Rising wage costs and supply chain pressures continue to squeeze margins, while the general merchandise division remains sluggish. The high street environment stays fiercely competitive, with inventory issues and subdued consumer spending adding to the challenges. M&S needs to demonstrate stronger growth momentum to climb out of the relegation zone.

B&M’s run of poor performance forces manager out

B&M European Value Retail has endured a brutal year, with shares plunging over 50% after weak holiday trading and profit warnings culminated in the CEO's departure. Discounter competition and margin pressure have intensified, while the push to revamp online operations adds complexity. Cost control and promotional strategies may help stabilise the business, but the market remains unconvinced about any quick turnaround given the tough consumer backdrop.

British Land can’t tempt fans back to the stadium

British Land continues to struggle as weak office demand and elevated borrowing costs squeeze the commercial property giant. London vacancy rates remain stubbornly high, with hybrid working patterns suggesting the office recovery could prove longer and more painful than anticipated. Refinancing risks and sluggish property valuations add further pressure, leaving BLND exposed if economic uncertainty drags on.

FTSE 100 x Premier League crossover: Champions League contenders

11:40 , Karl MatchettAnd continuing the theme, here are the three Champions League contenders from Chris Beauchamp, chief market analyst at IG:

Alphawave can ride AI-tsunami to challenge for the title this season

Alphawave IP Group sits at the centre of the semiconductor intellectual property boom, providing crucial technology for high-speed data connectivity. The company benefits from megatrends driving global tech infrastructure, with AI, advanced chips, and 5G creating surging demand. A growing international client base, strong order pipeline, and profitable business model position Alphawave for potential "Champions League" status.

SSE has strong options off the bench to help it weather inflationary pressures

SSE occupies prime position in the UK's green energy transition as a major wind, hydro, and grid operator. The utility combines defensive regulated earnings with long-term growth from decarbonisation investments. Strong policy backing for net zero and proven ability to weather inflationary pressure make SSE one of the most dependable performers for the season ahead.

Fan-favourite Greggs set to keep performing

Greggs continues to outmanoeuvre consumer sector peers through market share gains and operational innovation. The bakery chain has maintained its expansion drive with hundreds of new store openings, while delivery partnerships and menu diversification drive growth. Brand loyalty and adaptability help Greggs maintain momentum despite cost-of-living headwinds, marking it as a "top four" contender.

Student loans and how to manage uni finances

12:00 , Karl MatchettIf you were celebrating A Level results yesterday - or more probably, if your loved ones were - then it’s soon time to take stock of what’s next.

For those heading to university here are a couple of key pieces to read up on:

- How student loans work and when you repay them

- How to manage your money at uni - and the best student bank accounts

Supermarket giant says it will pay customers to report shoplifters

12:30 , Karl MatchettSupermarket chain Iceland is set to offer customers a £1 reward for actively spotting and reporting shoplifters in their stores.

Richard Walker, the retailer's executive chairman, confirmed that shoppers who alert staff to offenders will receive the payment directly to their membership card.

The move comes as the business faces an estimated £20 million annual hit from the cost of shoplifting.

He added the £20 million cost of theft limits the amount that the company can pay back out to its colleague and restrains its ability to lower prices.

Supermarket giant says it will pay customers to report shoplifters

Elderly urged to use gardening instincts to prevent fraud

13:20 , Karl MatchettOver 65s are are being urged to apply the same habits they rely on when gardening, such as sharing local knowledge and advice, to helping to protect themselves against financial fraud.

Take Five to Stop Fraud has partnered with BBC Gardeners’ World’s Rachel de Thame and the National Allotment Society to launch a new awareness drive called “protect your patch”.

Research commissioned by Take Five among 1,000 people across the UK aged 65-plus found that 94 per cent have either a garden or allotment.

Three in 10 (29 per cent) older people would go to family and friends for gardening tips but only one in 10 (10 per cent) would ask them for tips on financial fraud, according to the survey carried out by Censuswide in July.

Union demand no job losses from breadmakers' deal

13:49 , Karl MatchettThe employment union Unite are quick to pounce on any company movements and today’s bread-making deal, with Kingsmill's agreement to purchase Hovis, is no exception.

Unite general secretary Sharon Graham said:

“While there is still a long way to go before any buyout happens, Kingsmill and Hovis must ensure that jobs are protected. Unite represents workers at both companies and we will not tolerate attacks on jobs, pay or conditions. Unite will be working to ensure that Kingsmill and Hovis fully involve the union in any decisions that impact our members.”

Pandora prepares to raise prices further as it faces hit from US tariffs

14:20 , Karl MatchettPandora has revealed a drop in UK sales as the jewellery brand hiked prices in response to soaring silver and gold costs, and as it prepares to take a financial hit from US tariffs.

The Danish company said it was considering raising its prices further to help mitigate the impact of increased costs.

Its total global revenues were 7.1 billion Danish kroner (£820 million) between April and June, 3% higher than the same period last year when compared like-for-like.

But in the UK, sales dropped 9% year-on-year, which Pandora said partly reflected a weak end-of-season sale.

It is preparing to step up marketing efforts to draw in more customers over the second half of the year.

Pandora prepares to raise prices further as it faces hit from US tariffs

Inflation set to edge higher - expert

14:40 , Karl MatchettUK inflation is set to have edged higher last month as summer spending pushed up flight and hotel costs, and food prices continue to climb.

One economist said an “Oasis bump” could have contributed to higher accommodation prices in July.

Consumer Prices Index (CPI) inflation is widely expected to have increased in July, from the 3.6% rate recorded in June, when the Office for National Statistics publishes its latest dataset on Wednesday.

Sanjay Raja, senior economist for Deutsche Bank, said he was estimating that price pressures will have pushed CPI to 3.8% last month.

More here.

Labour can’t hit ‘working people’, so now they’re after people who used to work

15:05 , Karl MatchettWhatever weasel words they may use to justify any changes to inheritance tax, the message is clear: you’re better off not making money under Labour, because they will get you in the long run, writes Chris Blackhurst

Labour can’t hit ‘working people’, so now they’re after people who used to work

Gaucho restaurants CEO issues stark warning to Reeves over tax hikes

16:05 , Karl MatchettA senior figure in the hospitality sector has sent a stark warning to Rachel Reeves ahead of the autumn Budget: “Your taxes are curtailing growth”.

Baton Berisha, chief executive of Gaucho Restaurants, has called for National Insurance Contributions (NICs) to be restored to the level they were before April’s increase and said he had the backing of others in the industry wanting the same.

Pointing to Office for National Statistics (ONS) figures, Mr Berisha highlighted 84,000 jobs have been lost in the hospitality sector since the NICs hike took effect in April 2025 - equating to roughly 13,000 jobs disappearing per month since then.

Gaucho restaurants CEO issues stark warning to Reeves over tax hikes