The UK economy flatlined in July, failing to add any growth to the meagre figure of 0.2 per cent for the three months from May. A Treasury spokesperson admitted the economy “does feel stuck”, while shadow chancellor Mel Stride called the government “distracted from the problems the country is facing.”

A statement from the British Chambers of Commerce said the government should look elsewhere in the Budget rather than expecting firms to continue to both foot the bill and also turn around the economy: “The Government has acknowledged it has asked a lot of business in the past year. Our message is now clear - there must be no more taxes on business in the Autumn Budget. The Chancellor must focus on unlocking growth and productivity through business.”

Elsewhere, the FTSE 100 has continued to rise this week, while gold is at record levels and bitcoin has pushed back up to $115,000 in the past couple of days.

Follow The Independent’s live coverage of the latest stock market and business news here:

Key points

- UK economy flat in July and grew only 0.2 per cent across three months

- Labour blame Tories for economic slowdown

- Tories blame Labour for economic slowdown

- British Chambers of Commerce demands no more taxes for businesses in Budget

Money saver: Kids go free on National Express this month

16:11 , Karl MatchettOne last one for this week: if you’re taking a coach across the UK this month, National Express are running a promo up to 30 September where children can travel for free.

Use the code KIDSFREE when booking online or on app and for each paying adult ticket, up to three kids can travel with them for nothing.

Details and the terms you need to be aware of are here but otherwise...happy travelling!

Have a good weekend, all.

Business and Money - 12 September

08:05 , Karl MatchettMorning all - lots to get through once more, starting with the latest economic data and reaction to it.

It’s not pretty!

Latest economic data: No growth in July, 0.2% in 3 months

08:14 , Karl MatchettRight let’s attack everything in order on the UK economy front then.

First up, today’s ONS data, nice and clear:

- No growth in July at all

- Manufacturing pulled back 1.3% in July

- 0.2% growth overall in the three months May-July

- Services and construction grew most across that three-month period

Liz McKeown, ONS director of economic statistics, said: “Within services, health, computer programming and office support services all performed well, while the falls in production were driven by broad based weakness across manufacturing industries.

“Falls in production were driven by broad-based weakness across manufacturing industries.”

Read the full detail below - we’ll bring you all the reaction as we go here in the live blog.

UK economy flatlined in July after sharp contraction in manufacturing

Political response: Labour blame Tories for economic slowdown

08:22 , Karl MatchettYou’ll be unsurprised to hear the initial political responses to the latest figures.

The government say it’s the result of what came before; the Tories say it’s all down to poor decision making in the here and now.

Isn’t it amazing how it’s never anything to do with anything anybody has ever done within their own collectives?!

Anyway...

A Treasury spokesperson said: “We know there's more to do to boost growth, because, whilst our economy isn't broken, it does feel stuck.

“That’s the result of years of underinvestment, which we’re determined to reverse through our Plan for Change. We’re making progress: growth this year was the fastest in the G7; since the election, interest rates have been cut five times, and real wages have risen faster than they did under the last government.

“There's more to do to build an economy that works for, and rewards, working people.”

Political response: Tories blame Labour for economic slowdown

08:30 , Karl MatchettIn response, Sir Mel Stride MP, shadow chancellor of the exchequer, says the prime minister needs to turn around the ship being steered so far by Rachel Reeves.

“Any economic growth is welcome - but this Government is distracted from the problems the country is facing,” he said.

“While the Government lurch from one scandal to another, borrowing costs recently hit a 27-year high - a damning vote of no confidence in Labour that makes painful tax rises all but certain.

“It is little wonder that Starmer has stripped Reeves of control over the budget. But sidelining her is not enough - he must also reject her failed economic approach that has left Britain poorer.”

The lead economist from the Confederation of British Industry (CBI), Ben Jones, adds:

“The government cannot tax its way to growth and continue to raid corporate coffers. With the Autumn Budget fast approaching, the Chancellor must deliver a decisive, pro-growth package by committing to serious tax reform. It's the structure of our system - from punitive business rates to the restrictive VAT threshold and stamp duty - that holds back economic progress, not just the rates themselves.”

Economic reaction: Better than it seems on a wider-lens view?

08:40 , Karl MatchettMonth-to-month clearly it’s not great and even across three-month periods matters are grim.

But the chancellor may take some solace from some experts suggesting that the year-long growth may still exceed expectations, even if that doesn’t make it stellar growth across the board.

Thomas Pugh, chief economist at leading RSM UK said: “The flatlining of GDP in July raises a sense of deja vu with last year when the economy grew rapidly in the first half before stagnating through the second.

“Indeed, the growth outlook is more challenging for the rest of the year.

“Rising inflation, a weakening labour market and confidence-sapping speculation about the budget will combine to slow growth from 0.5% q/q in the first half of the year to around 0.2% q/q in the second.

“However, that would still be enough for growth to come in at around 1.3% this year, above the OBR’s March forecast of 1%. That will be some consolation to chancellor Reeves.”

British Chambers of Commerce demands no more taxes for businesses in Budget

08:41 , Karl MatchettAlready, reaction to the economic data is quickly looking forward and wondering how this will impact on the Budget.

The British Chambers of Commerce says the government cannot continue to lean on businesses for taxes and still expect them to lead growth.

Stuart Morrison, research manager at BCC said:

“The business landscape remains challenging, particularly for SMEs, with cost pressures impacting investment, recruitment and trade. While our latest economic forecast suggests growth of 1.3% this year, that’s largely down to stronger-than-expected activity in Q1, before the impact of national insurance and tariffs.

“Inflation is proving stubborn, meaning for businesses struggling with the cost of borrowing, the pace of further interest rate cuts is likely to be slower than expected.

“The Government has acknowledged it has asked a lot of business in the past year. Our message is now clear - there must be no more taxes on business in the Autumn Budget. The Chancellor must focus on unlocking growth and productivity through business. Our recent Blueprint for Growth contains practical ideas to get businesses investing, recruiting and trading.”

FTSE 100 rises again despite economic fears

09:00 , Karl MatchettStock markets continue in the green today as investors follow recent patterns of optimism.

US markets finished strongly last night, the S&P 500 up 0.85%, with Asian stocks following suit overnight - Japan, Hong Kong and Australia were (or still are) up at least 0.7%.

It’s not quite as strong in London and on the continent this morning but the FTSE 100 is still up 0.24%.

German’s DAX is up 0.34%, France’s CAC 40 is up 0.14%.

We’ll keep an eye on it as we go but economic data doesn’t seem to be dampening investor enthusiasm.

GDP reaction: 'Few positives' and

09:20 , Karl MatchettA few more expert takes now on the morning data around the UK economy.

Scott Gardner, investment strategist at Nutmeg:

“Few positives can be found from this latest batch of GDP data with UK economic growth coming to a standstill during July and little sign of expansion across any of the key industries that make up the monthly reading.

“If growth is the top priority, the economy’s recent sluggishness is bad news ahead of the upcoming Budget. Key will be unlocking growth in the housing sector, which has seen a slowdown in recent months as speculation around new taxes in the Budget mount and housebuilding remains underwhelming. As the economy struggles to build on the momentum from the start of this year, the outlook for UK growth needs to improve or tough decisions will need to be made by the Chancellor in November.”

Lindsay James, investment strategist at Quilter:

“Speculation is already rife about which taxes will be raised, and without the ability to raise the main revenue generators – income tax, national insurance and VAT – the government is left with targeting multiple sectors for small amounts of revenue. This is increasing the headwinds for the UK economy and with still over two months to go, GDP readings for the second half of the year are unlikely to pretty reading. For government under as much pressure as it is at the moment, this will be a very difficult corner to get itself out of.”

Thomas Pugh, chief economist at RSM UK:

“It’s all but guaranteed that the Bank of England (BoE) will hold interest rates at 4.0% at its meeting on Thursday. The committee will stick to its gradual and cautious guidance, as it continues to try to balance rising inflation with a weakening labour market. We expect a 7-2 vote split. Looking ahead, we think the Bank will keep interest rates on hold until February.”

Gold is at a record price - why are people buying and how can I invest?

09:40 , Karl MatchettThe gold price has soared to a new record high amid concerns about the impact of President Trump’s radical trade policies.

This week, the yellow metal’s price reached $3,600 per troy ounce (the unit used to weigh precious metals), up 42 per cent higher from a year ago.

That upward march could continue further, with December futures markets tipping $3,700 already and some experts predicting it could pass $4,000 by next year.

But “buy low, sell high” is the age-old investment advice. So, for those who haven’t yet invested, is it too late?

Gold is at a record price - why are people buying and how can I invest?

'Autumn Budget is a huge opportunity' for government to help small businesses

10:00 , Karl MatchettSmall businesses fear bearing the brunt of further changes when it comes to taxes and employment costs and one organisation representing SMEs wants the government to back them with meaningful change.

Policy chair of the Federation of Small Businesses (FSB), Tina McKenzie, said:

“July’s flat GDP result is a disappointment, and is another sign that the economy is stuck, rather than firing on all cylinders. Small business owners will now be hoping to see accelerating growth over the second half of the year.

“Small firms’ confidence going into the summer months was at a low ebb. Flat or near-flat growth, with only a small uptick over the previous three months, is not enough to allow small firms to cope with increased costs. Too few firms will be able to invest to drive the expansion that is needed for the economic recovery we all want to see, which will be contingent on their success.

“July’s Small Business Plan, which FSB worked on extensively in partnership with the Government, contains a wealth of great proposals to help get small businesses on the growth track. We look forward to seeing them put into action as soon as possible.

“The Autumn Budget is a huge opportunity for the Government to make life easier for small firms, to everyone’s benefit. Making business rates fairer for small businesses must be a priority, to reduce the burden of this day-one cost that discourages new openings and deters investment, suppressing the recovery of high streets. The Government should expand Small Business Rates Relief and make full use of new powers to deliver permanently lower multipliers for small retail, hospitality and leisure firms.

“Increasing the VAT threshold would encourage greater levels of economic activity, and would lead to additional tax revenue in the crucial final year of the Chancellor’s fiscal rules, according to the OBR and the Treasury.

Pharma giant ditches £1bn London research hub and says UK ‘is not internationally competitive’

10:20 , Karl MatchettA major global pharmaceutical firm said its decision to back out of a £1bn research hub partway through construction is because the UK is “not internationally competitive”.

The move by US-based firm Merck, known as MSD across Europe, is the latest setback for Britain, despite Labour having put life sciences as a key pillar to support across business in the new industrial strategy earlier this year.

A government spokesperson said the UK “has become the most attractive place to invest in the world”, but that was dismissed by a statement from Merck, which warned that more companies would be making similar decisions.

Pharma giant ditches £1bn London research hub and says UK ‘not competitive’

35-year mortgage deals? Experts divided on merits of long-term debt

10:40 , Karl MatchettBuyers are being urged to carefully consider whether 35-year mortgages are really right for them, amid rising demand.

While longer terms can mean lower monthly repayments, it also means you’ll have property debt for a lot later in life and the added interest across that time means you’ll pay way more for the same equity.

Some house market figures are divided on the issue.

Omer Mehmet, managing director at Trinity Finance, said: “Stretching mortgages to 35 years is like sticking a plaster on a broken bone. It makes the numbers look nicer today, but leaves first-time buyers saddled with decades of debt and eye-watering lifetime costs.

“Instead of gimmicks that mask the problem, lenders and policymakers need to tackle the real issue — house prices that have sprinted far ahead of wages. To that end, we need to build more homes.”

Craig Fish, director at Lodestone Mortgages, disagrees on the problem but agrees on the solution. “Ultra-long mortgages aren’t the big bad wolf they’re often made out to be. For younger buyers, stretching the term to 35 or even 40 years can be the difference between getting on the ladder or not.

“The key point is this: mortgages are rarely ‘set and forget’ for decades. Most people review every 2-5 years, which creates regular opportunities to shorten the term or switch strategy. So yes, longer terms can ease affordability pressures today, but they’re not a silver bullet.”

The key is deciding who needs which type, says Mike Staton of Staton Mortgages. “There is definitely a place in the market for 35-40 year mortgages. Removing this as an option removes a viable pathway for somebody to get on the property ladder.”

Smaller businesses' share price suffer after weak economic report

11:00 , Karl MatchettThe FTSE 100 is up 0.29 per cent this morning - positivity out of kilter with the earlier economic news.

A big reason for that is fairly simple: big companies operate across multiple markets.

For smaller UK businesses - those in the FTSE 250, which is down 0.15 per cent so far, it’s perhaps more relevant how the domestic market performs, says Russ Mould, investment director at AJ Bell.

“It’s never a good look for a country to be stuck in the mud, and the GDP data will put even more pressure on chancellor Rachel Reeves to find a way to plug the gap in public finances without derailing the economy.

“News the economy flatlined in July wasn’t a shock to investors as most economists hadn’t expected any growth. That’s why the news didn’t cause a wobble on the UK stock market, with the FTSE 250 holding firm in early trading. However, the GDP result will do nothing to improve business sentiment, and ongoing uncertainty could lead more companies to take a cautious approach and that doesn’t bode well for UK domestic earnings – and therefore share price – growth.”

Major high street name offers £200 for switching your current account

11:20 , Karl MatchettCurrent account switch offers come and go with regularity - if you’re not weirdly wedded to being with a single brand for a particular reason, it can provide you with a decent cash boost to your savings to look around.

A few days ago Co-op Bank launched their £175 switch offer (£100 up front, £25 a month for three months) and now today Lloyds have gone bigger.

They are giving new arrivals through the CASS method £200 for joining, along with the usual perks like Disney plus and access to better interest rates on savings accounts.

There are of course terms you must meet and other options if you either don’t want Lloyds or have already had their switch offer previously.

First direct are offering £175 too, for example.

High street crisis deepens with 400 of Britain’s largest shops at risk of closure

11:40 , Karl MatchettSome of Britain’s largest shops, including supermarkets and department stores, are at risk of closure if the government proceeds with plans to include them in a higher business rates tax band, industry leaders have warned.

The British Retail Consortium (BRC) said its latest analysis suggested that 400 large-format stores could be at risk of shutting down, should they be subjected to the proposed business rates surtax on premises with a rateable value over £500,000.

High street crisis deepens with 400 large shops at risk of closure

The latest ONS trade data is out and here’s what the British Chambers of Commerce have to say about it.

“The first month of reduced automotive tariffs has had a positive effect on US exports alongside more certainty on the outlook for other manufactured goods sectors,” said BCC head of trade policy, William Bain.

“But far more work is needed on US tariffs. That means delivering the promised zero percent tariffs on steel and aluminium goods, long term certainty for pharmaceuticals, and securing lower levies on other goods if possible.

“The performance of our trade in goods with the EU continued its recent upward trend but the UK-EU reset negotiations need to deliver quickly. Firms are clamouring for cuts to red tape and lower compliance costs.

“There is also a warning in the data as services exports cooled off in July reflecting business concerns about wider economic headwinds. The government needs to focus on the fundamentals to boost UK trade.

“That means lowering tariffs, removing regulatory barriers, boosting supply chain cooperation, and improving access to export support and finance. The faster, simpler and cheaper trade is for UK companies, the higher our exports will be.”

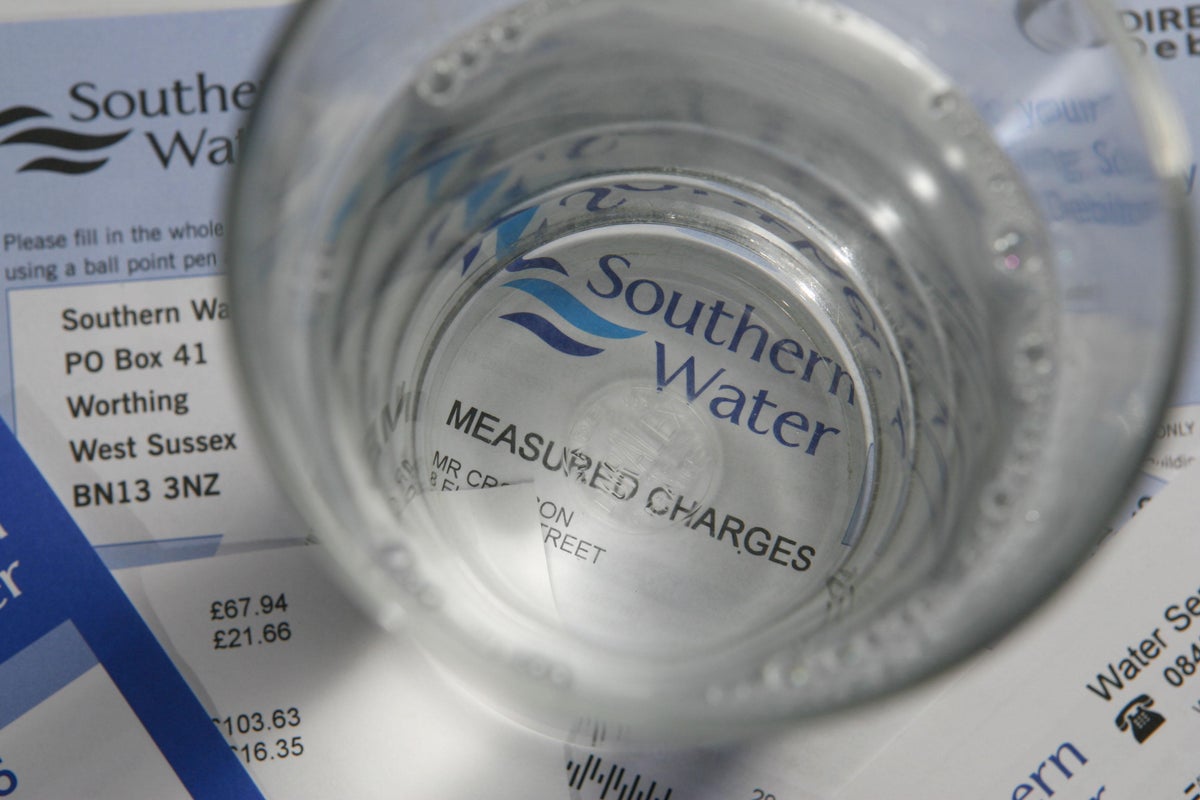

More people forced to cut back on groceries to keep up with water bills, charity says

12:20 , Karl MatchettAlmost one in five households struggled to pay their water bill in the last year, Citizens Advice has said.

The advisory service found more than a fifth (21 per cent) of those who struggled to pay found themselves falling into debt with their supplier.

The survey, taken at the beginning of August, and following the largest single-year increase in household water charges since privatisation of the industry, found that more than two fifths (42 per cent) of those finding it hard to keep pace with their bills had been forced to cut back on groceries and energy as a result.

Over a third of those struggling (35 per cent) were rationing water, including by cutting showers, toilet flushes and clothes washing.

More people cutting back on groceries to pay water bills, charity says

Restaurant bookings plummeted by two-thirds in London as Tube strike crippled capital

12:40 , Karl MatchettBookings for restaurants and other hospitality venues in London have fallen by 67 per cent this week because of strikes that crippled Tube services, new research suggests.

Hospitality site Access Hospitality said there had been a “sharp decline” in consumer behaviour as a result of the travel chaos.

The study showed that cancellations of bookings surged by more than half as a result of travel uncertainty.

More details here.

FTSE 100 on the rise - miners lead the way

13:00 , Karl MatchettIt’s more upward momentum from the FTSE 100 as we have our lunchtime checkin - the index is up 0.4 per cent today so far.

Leading the charge are miners Glencore (3.3%) and Antofagasta (2.5%), with Beazley plc also up more than 3%.

Less than a third of the 100 firms are down for the day, most of those only marginally - JD Sports is the biggest faller so far, 1.8% in the red.

Major high street bank launches new £200 cash offer to switch your current account

13:30 , Karl MatchettAnother high street bank has joined the battle to attract new customers with a new cash switch offer.

Lloyds Bank is offering a market-topping £200 for anyone willing to move their money.

Current account switch bonuses are commonplace in the UK, with plenty of lenders bringing them in. By using the Current Account Switch Service (CASS) consumers can make the change for free and with ease, and it usually takes only a week or two after notifying your bank that you’re leaving and which bank you want to join.

Full details here:

Major bank launches new £200 cash offer to switch your current account

US stocks set to open lower today

13:52 , Karl MatchettThe Nasdaq is poised to open flat, but the Dow (-0.2%) and the S&P 500 (-0.1%) will both be in the red when markets open in the US shortly.

Job markets cooling, a big recent reaction by investors to interest rate cuts probabilities and the wider geopolitical landscape are all seeming to impact today.

The two biggest companies by market cap, Nvidia and Microsoft, are both poised to rise on opening however.

Barclays chief urges Government to limit wage rises and avoid hiking bank taxes

14:10 , PAThe boss of Barclays has said the UK Government should limit pay rises for public sector workers and renewed calls to avoid hiking taxes for banks in the upcoming Budget.

CS Venkatakrishnan, chief executive of the banking group, told the Financial Times that wage inflation was a problem across the UK economy.

“We need to find a way to curb wage inflation,” he told the newspaper, saying that expenditure needs to be restrained “at the government level” particularly in relation to rising wages for public sector workers.

Wage inflation has been a concern for economists and policymakers as it can contribute to overall prices across the country remaining elevated.

However, employers have been under pressure to raise pay for their staff who face a squeeze from the higher cost of living.

More here.

Microsoft avoids antitrust fine by separating Teams from Office

14:25 , Karl MatchettMicrosoft have agreed with the regulator to make a clear separation between its Teams software and the Office package of tools.

The EU has agreed not to fine Microsoft as a result, which arose as a result of complaints five years ago by Teams competitor Slack.

“Today's decision therefore opens up competition in this crucial market, and ensures that businesses can freely choose the communication and collaboration product that best suits their needs,” said EU competition chief Teresa Ribera.

Experts predict slight rise in inflation for August figures

14:40 , Karl MatchettNext week we’ll get official data on the latest inflation figures in the UK.

CPI inflation rose to 3.8% in July and we saw yesterday Barclays analysts are expecting it to remain the same level for August.

Oxford Economics however, estimate that the headline rate will increase slightly to 3.9%.

“This reflects our view that further upward pressure from food prices and a smaller drag from the petrol category should more than offset the impact of a modest fall in services inflation due to July's temporary spike in air fares unwinding,” said economist Edward Allenby.

Tax firm calls for Lifetime ISA reform in Budget

15:00 , Karl MatchettBlick Rotherberg, tax and business advisory firm, say the Lifetime ISA needs an overhaul and the government should withdraw the contributions made to it at present - saving £3bn a year in the process.

The LISA can be used for first house purchases or retirement savings, adding £4,000 a year to which the government tops up your contribution by 25%.

But use them for any other purpose - or if your house doesn’t fit the criteria like maximum prices - and you’ll actually lose more than you’ve saved.

“Drawing down on these LISA funds when you are not making a first-time house purchase or before you are 60, will lead to a clawback on the bonus paid by the Government as well as a 5% charge applied on the amount withdrawn. Meaning LISA funds become nearly untouchable for many people,” said senior associate Tom Goddard.

“To put the £3bn per year cost of LISA’s into context, it is 36% of the annual IHT tax take in 2024/25. In the Autumn Budget, the Government should drop its contributions to LISAs, making them a £3bn saving and allow people to take up to 50% out of their existing funds without restriction, to bring some much-needed cash into the economy.

“Even when used for their intended purpose there are issues with LISA’s. There is a cap on the first-time buyer’s house purchase of £450,000. That may seem like a lot, but it does create an unfortunate juxtaposition with the Shared Ownership scheme that was also introduced to help first time buyers.”

It will take more than a £6 ‘meal deal’ to shake up Pret

15:20 , Karl MatchettIt’s about time the embattled food chain offered a sandwich lunch plus drink and crisps for under a tenner – but office workers are still sore from all the years of eye-watering ‘Pretflation’. Will they bite, asks James Moore?

FTSE drops to finish week near flat

15:48 , Karl MatchettAn end-of-day fall is not uncommon of late for the FTSE 100 and it looks to be the case again today, with investors running out of steam ahead of the weekend.

Having been up around 0.4% for much of today, a slump in the past hour leaves the index up just 0.07% - though it has still risen more than 1 per cent across this week as a whole.

In the US, tech stocks are up - the Nasdaq is 0.4% up - but little movement elsewhere can be seen, with the S&P 500 flat and the Dow down almost 0.4%.