The yields on UK ten year bonds rose sharply on Wednesday as Keir Starmer failed to guarantee the job of chancellor Rachel Reeves, resulting in higher borrowing costs, before stabilising after a Labour statement said Ms Reeves was “going nowhere”. That didn’t stop market speculation, as the pound also sank in reaction - but today has seen a partial recovery on both counts. The FTSE 100 has also been on the rise on Thursday.

Meanwhile, news across the business world saw TSB confirm it would be bought by Santander to create the UK’s third-biggest bank, pending approval, and AstraZeneca’s CEO has held conversations over moving the biggest firm on the London Stock Exchange to a US listing. Elsewhere, Microsoft are cutting 9,000 jobs as the race to employ AI for tasks continues, while Thursday also sees The Independent show how Trump tariffs are impacting small and medium businesses across the UK.

Follow The Independent’s live coverage of the latest stock market and business news here:

Business news live - Thursday

- Microsoft cut 4% of global workforce in ongoing push to utilise AI

- Bond yields start to fall again after Reeves given backing

- FTSE up 0.5 per cent in early trading as pound recovers agains the dollar

- Exclusive: Tariff impact costing SMEs £17,000 on average

- NS&I issue new Junior ISA rate and new fixed income bonds

Business news live - Thursday

16:31 , Karl MatchettOne final story emerging as we take off for the evening.

Superdrug paid out £45m in dividends for 2024 to the Hong Kong billionaire Sir Li Ka-shing, who owns the business through his firm CK Hutchison.

The drugstore posted pre-tax profits of £137m.

That’s it for us today - we’ll be back at 7am as usual so catch you then and have a good evening.

Stock markets rise in UK and US

16:15 , Karl MatchettGood day in the green for investors on both sides of the Atlantic.

Approaching the close of play, the FTSE 100 is up 0.5 per cent today, with Natwest the biggest riser, 3.17 per cent to the good.

Pharma firms AstraZeneca and GSK are the laggards, 2.33 and 1.77 per cent down respectively.

Stateside, the S&P 500 is up 0.78 per cent and the Nasdaq is above that at 0.91 per cent.

Solar panel maker First Solar is leading the way there, almost 8.5 per cent up, with big-name risers including Expedia (+4pc), Intel (+2.5pc) and Boeing (+2pc).

Premium Bonds paid out 70m prizes worth £5bn

16:00 , Karl MatchettMore NS&I detail now as their 24/25 annual report has been released.

They show a total of more than 70 million prizes being paid out through Premium Bonds, totalling more than £5bn to savers.

The government received a net total of £9.75bn from NS&I - above the £9bn target.

Do you have Premium Bonds? Let us know in the comments - along with your best win from this year!

After fixed bonds? There are better interest rates available...

15:44 , Karl MatchettThose NS&I bond issues may be of interest to some if they want to get a guaranteed amount over the coming years...but there are definitely better rates on the market at the moment.

Here’s our roundup of savings rates - we cover easy access and Cash ISA rates in here too but there are fixed-rate deals to consider further down.

They start at 4.43 per cent and above, so it’s definitely worth looking around rather than diving straight into the NS&I ones.

Best savings accounts for your cash before expected interest rates cut this summer

NS&I announce new Junior ISA rate and British Savings Bonds

15:26 , Karl MatchettNS&I, the owner of Premium Bonds, have announced a new Junior ISA rate which comes into effect from 18 July.

JISAs allow up to £9,000 to be put into an account annually to accrue tax-free savings for children, who can access and use them from age 18.

Their new interest rate for the product is 3.55 per cent.

Additionally a range of new 2, 3 and 5-year bonds have been confirmed, available immediately.

They each have an income rate of 3.85 per cent to 3.88 per cent AER.

Andrew Westhead, NS&I Retail Director, said: “[These products are] in response to changes in the wider market and will ensure we continue to offer a range of fixed-term options while balancing the interests of savers, taxpayers and the broader financial services sector.

“This is the first change to our Junior ISA interest rate in nearly two years, reflecting our ongoing commitment to helping young people save for their future.”

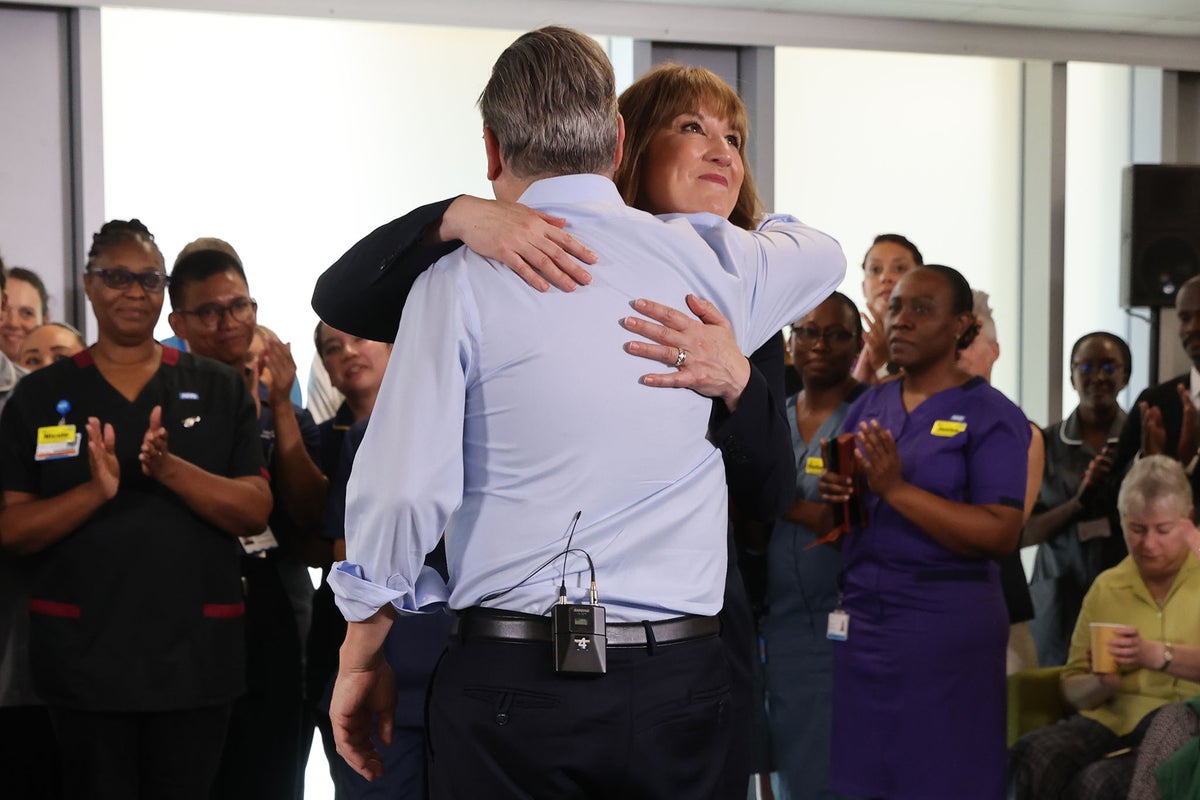

Rachel Reeves’s brave face cannot mask the challenges she now faces

15:00 , Karl MatchettIf there were any doubts about Sir Keir Starmer’s plans for Rachel Reeves, the prime minister and his chancellor have gone all out to try and put them to bed.

A day after she sat crying through Prime Minister’s Questions on live television, the chancellor sat smiling and cheering through the prime minister’s speech outlining a 10-year plan for the NHS.

Hours earlier, the PM had effectively tied his fate to that of his chancellor, declaring that “we work together, we think together” and that Ms Reeves will be in place until the next general election and - optimistically - beyond.

Archie Mitchell on what’s next for the chancellor:

Reeves’s brave face cannot mask the challenges she now faces

UK service sector growing at fastest rate in nearly a year

14:45 , Karl MatchettThe UK’s services sector is growing at the fastest rate in ten months, a new report shows.

The S&P Global UK services PMI survey scored 52.8 for the month of June, up from 50.9 in May. A reading above 50 means the sector is growing; below it means it is contracting.

Some companies still highlighted economic conditions were limiting growth prospects, while the data also shows easing inflation and lowered hiring.

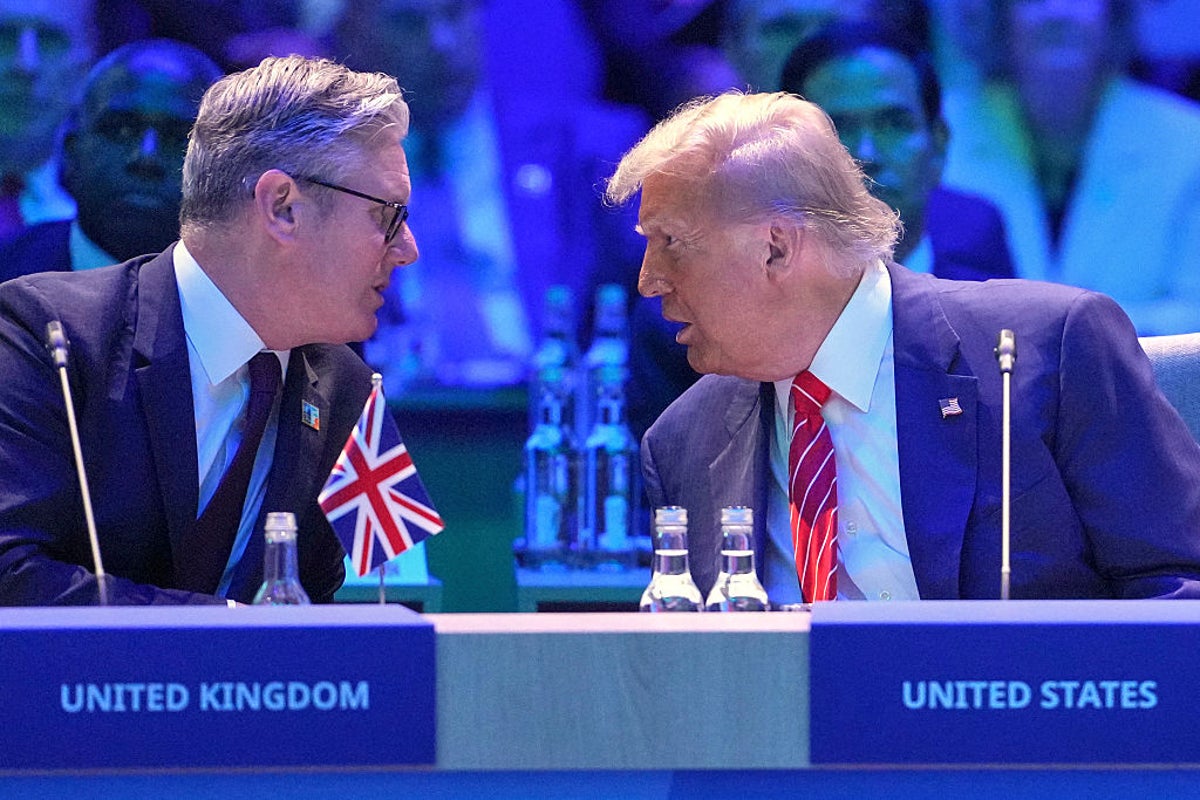

US jobs market remains strong - interest rates cut looking unlikely

14:27 , Karl MatchettDonald Trump hasn’t been shy about letting the world know he wants the Fed to cut interest rates - but they’ve been standing firm.

With the next opportunity for change approaching, a continued slowdown in jobs might have increased pressure to do exactly that...but a surprise drop in unemployment has instead emerged.

Lindsay James, investment strategist at Quilter, said:

“The US economy continues to confound expectations, with the labour market adding 147,000 jobs in June, well above consensus expectations and recent averages. Furthermore, the unemployment rate fell to 4.1%, suggesting that the US economy remains in robust shape. Nervousness has begun to creep into the US jobs market and with the end of the 90-day pause in reciprocal tariffs ending next week, it was thought that the slowdown was under way.

“However, for now this seems to be far from the case. These job numbers will get far more attention than usual too because investors are watching for any sign that the labour market is beginning to weaken sufficiently to trigger an interest rate cut in July.

“Ultimately, this gives Jerome Powell and the Federal Reserve the cover it will want to hold rates at the next meeting.”

Exclusive: Tariffs costing small businesses £17,000 on average

14:14 , Karl MatchettOne of the first studies into the impact of Trump tariffs has been produced and The Independent has exclusively seen the data on how it’s affecting small and medium-sized businesses in the UK.

It’s not a pretty picture for importers and exporters - who are naturally not all equipped to deal with the added challenges such volatility in financial markets that these trade deal sagas have led to.

The average cost to them is expected to be around £17,000 - and two per cent of SME’s think the impact will run past £1m.

“There’s a lot of hidden activity - SME businesses are constantly dealing with change,” Jonathan Andrew, chief executive at Bibby Financial Services, told The Independent. “Firms are making constant operational changes and even small businesses are having to assess how things impact on your own business.

“Doing nothing isn’t an option - that’s the reality of tariffs which is dawning now.”

Read the full report here:

Revealed: The true cost of Trump’s tariffs on UK small businesses

Which tax rises could Rachel Reeves introduce to pay for the £5bn welfare U-turn?

13:20 , Karl MatchettMillie Cooke, our political correspondent, has looked at the upcoming budget to predict where taxes are coming:

This week’s embarrassing climbdown on welfare saw the government’s benefits reforms gutted almost entirely, while savings from the bill were slashed from £5bn to nothing.

In the wake of the U-turn, there are now growing questions over how the government will raise the money to fill the black hole in the public finances.

Ministers have already squeezed significant savings out of their departments in cuts that were unveiled at last month’s spending review, meaning there is now a mounting expectation that the chancellor will be forced to raise taxes instead.

Which tax rises could Rachel Reeves introduce to pay for the £5bn welfare U-turn?

UK markets update: Pound, bonds, FTSE 100

13:00 , Karl MatchettNow into the afternoon after a positive morning session, it’s worth a look at how all the major markets are faring following the Rachel Reeves-related fallout of yesterday.

The pound is a little lower against the dollar than mid-morning but remains up 0.06 per cent for the day: £1 is $1.3658.

Much-watched 10-year bond yields are inching their way up and down across the day but in a downtrend - the yield movement is down 1.67 per cent today, which leaves the actual yield at 4.544 per cent.

And the FTSE 100 is having a fairly decent day, up 0.47 per cent to push close to a full 1 per cent gain for this week so far.

Calls for ISAs to allow investment in private assets

12:50 , Karl MatchettPeople should be allowed to invest in private assets within their ISAs, says the Investment Asssociation boss.

It is a contentious issue and one which requires an awful lot of education around before it becomes possible, but Chris Cummings said it could have a “profound” impact on people’s wealth come retirement.

Amid concerns over liquidity in the private market, the IA chief said “that’s what a cash account is for.”

Ryanair cancel 170 flights after air traffic control strikes

11:59 , Karl MatchettRyanair have cancelled 170 flights due to French air traffic control strikes.

The flights are across Thursday and Friday and include destinations such as Greece, Spain and the UK.

CEO Michael O’Leary said: “Once again, European families are held to ransom by French air traffic controllers going on strike.

“It is not acceptable that overflights over French airspace en route to their destination are being cancelled/delayed as a result of yet another French ATC strike.”

Shares are down 1.2 per cent today and up 0.6 per cent across a month.

Taichi Tech fined £170,000 for unfair terms and conditions

11:39 , Karl MatchettAn online gambling firm has been fined £170,000 for regulatory failures including the use of unfair terms and conditions.

Taichi Tech Limited, trading as Fafabet, will also have to undergo a third-party audit to ensure it has effective anti-money laundering and safer gambling procedures, the Gambling Commission said.

An investigation found that Taichi Tech’s terms claimed that it had “the right at their own discretion to close accounts or forfeit winnings”.

The regulator concluded that the firm breached the “fair and open” licensing condition by including a discretionary term allowing the operator to close customer accounts or forfeit winnings without clear justification.

The investigation also found failures relating to anti-money laundering and social responsibility breaches.

Josie Clarke, PA.

Revealed: Two-thirds of small businesses would now vote Remain after profits hit by Brexit

11:20 , Karl MatchettTwo-thirds of small and medium UK businesses would now vote to remain in the EU after seeing their profits harmed by Brexit, new analysis shows.

A survey of more than 500 importers and exporters found 66 per cent would choose to stay in the bloc, up from 53 per cent who voted that way during the referendum in 2016. The percentage of those who would vote to leave was 29 per cent, down from 32 per cent.

The findings, from research carried out by Critical Research, appear to be a direct response to the fact that costly rising regulations and red tape burdens have harmed the profitability of their businesses.

65 per cent of responders said the increased demands on them to comply with trade regulations have “significantly” affected their overall profits. More than half (56 per cent) said Brexit has directly made their business less-competitive within the context of the global marketplace.

Full details:

.jpeg?trim=822,0,51,1298&width=1200&height=800&crop=1200:800)

Two-thirds of small businesses would now vote Remain after profits hit by Brexit

US stock market futures flat after mixed Asian results overnight

11:00 , Karl MatchettLast night saw a real mix of trading in Asia.

Japan’s Nikkei 225 ended essentially flat, but the Hang Seng in Hong Kong was down more than 0.6 per cent.

In Australia and Singapore trading was flat, India’s Nifty 50 fell 0.16 per cent and the Shanghai composite rose 0.18 per cent.

Meanwhile, the forward-looking data for US stocks shows a very slight rise is on the cards, so far at least.

The Dow, Nasdaq and S&P 500 are all projected to rise, but each of them less than 0.1 per cent so far.

Skills shortage jeopardising pledge to build 1.5 million homes

10:39 , Alan Jones, PAA critical shortage of skilled workers is jeopardising the Government’s pledge to build 1.5 million new homes by 2029, according to research.

Skills development organisation City & Guilds surveyed employers, training providers and employees, finding 76% of construction firms are struggling to recruit the skilled people they need, with 84% agreeing the industry is suffering from critical skills shortages.

The latest outlook from the Construction Industry Training Board suggests the industry needs to recruit 239,300 workers by 2029 to be able to meet the projected demand for the 1.5 million homes target.

Skills shortage jeopardising pledge to build 1.5 million homes, report warns

M&S to spend £300m on shop openings and upgrades

10:21 , Karl MatchettFollowing the cyber hack earlier this year, Marks & Spencer say they will spend £300m in an accelerated programme to revamp existing stores and open 16 new ones.

A dozen of those new shops will be food halls.

Stuart Machin, CEO, said: “We have to go fast. I’m hoping by 18 months’ time, half of our store estate will be new or renewed.”

The move comes in a bid to win back shoppers after online and store sales were severely impacted by the hack, which is expected to also cost around £300m.

OpenAI and Oracle agree $30bn a year deal for data centres

09:59 , Karl MatchettOpenAI will pay Oracle around $30bn a year to lease 4.5GW of power.

Multiple data centres across the US will operate to satisfy that demand, the FT reports, in an expansion of the country’s Stargate project.

It is due offer both further innovation and increasing consumer demand for AI.

Aviva to give staff £500 in shares after £3.7bn Direct Line takeover

09:47 , Karl MatchettAviva will hand out £500 to each staff member following a £3.7bn takeover of insurance rival Direct Line.

That includes 23,000 staff at Aviva and 8,500 at the smaller firm, to celebrate the deal.

Staff will need to hold the shares for a minimum of three years, Aviva said.

Aviva shares are up 0.4 per cent today, at 608.60p per share.

MPs back foreign investors owning minority stakes in UK newspapers

09:24 , Karl MatchettForeign investors have stepped closer to buying part of the Telegraph, as MPs backed relaxed laws on foreign ownership of UK newspapers that will allow them to own up to 15%.

The Commons voted overwhelmingly in favour of a change to the law by Labour which would allow foreign firms to buy minority stakes.

It is the latest turn in a tumultuous two-year takeover process for the 170-year-old newspaper business.

More here:

MPs back foreign investors owning minority stakes in UK newspapers

FTSE 100 rises and pound recovers

09:18 , Karl MatchettIt’s not just the 10-year gilts which are settling this morning - the pound is recovering too.

The GBP is about 0.15 per cent higher this morning against the US Dollar, after it too fell yesterday following Reeves’ tears and Starmer not initially backing her job yesterday.

But it all looks rather more settled this morning.

The FTSE 100 is also up a strong 0.5 per cent in morning trading, well ahead of Germany’s DAX at 0.3pc and France’s CAC40 at 0.18pc.

10-year bond yields are falling again after Reeves given Starmer backing

08:44 , Karl MatchettYesterday’s gilt sell-off send the yield spiralling, giving quick fears over borrowing costs on the UK government’s multi-trillion debt.

However, that yield is on the way back down again.

It’s not quite to the same level as it was 24 hours ago, we should note, but it’s down to 4.54 per cent.

Yesterday’s spike reached as high as 4.67 per cent, having been around 4.49 per cent at about 11am.

It’s the market to keep a close eye on today.

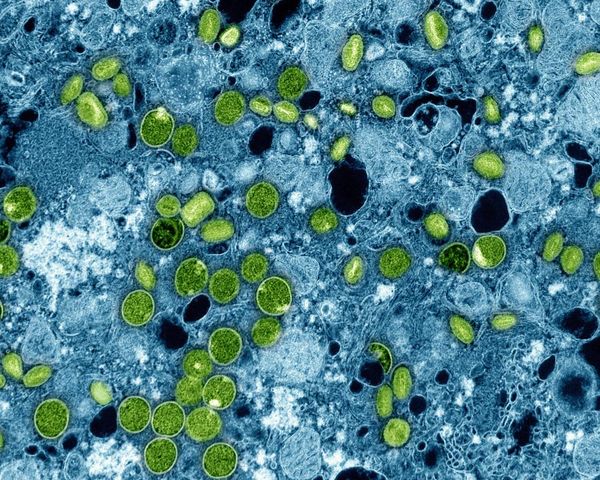

UK AI companies given $2.4bn in funding this year

08:35 , Karl MatchettA report from HSBC says UK AI startups were handed $2.4bn by venture capital funding in the first half of this year.

That figure was almost a third (30 per cent) of all UK VC raised – the highest share on record.

Across the board, startups raised more than $8bn in the first half of the year.

In terms of sectors, health and fintech were the leaders in drawing investment.

Currys reports rise in profits and reinstalls dividend

07:59 , Karl MatchettElectricals retailer Currys has posted its final results this morning, announcing a profit of £162m to the year ended in April.

Notably, for the first time since 2023 it will also pay a dividend, of 1.5p per share.

Chris Beauchamp, chief market analyst at IG, said: "This looks like a very solid update from Currys, and one that will help support the shares after the 25 per cent gain so far this year. The dividend has made a return, and performance looks good across the broad range of the business. At 7 times earnings, the shares look cheap compared to the more positive outlook, which is rare thing to say in UK stocks right now."

Fears over £160bn blow to London’s stock market as AstraZeneca considers listing move to US

07:40 , Karl MatchettThe boss of AstraZeneca, the biggest company on the London Stock Exchange, has discussed shifting the pharmaceutical firm’s stock market listing to the US.

Such a move would be the biggest hit to the stock market yet, following some huge departures such as £10bn financials firm Wise and £40bn mining business Glencore, among others.

The pharmaceutical firm however is far bigger by market capitalisation, currently worth just over £161bn – more than BP, National Grid and Lloyds Bank combined.

The Independent understands the company acknowledges the CEO’s concerns as being longstanding, especially regarding new products, while conversations are ongoing with the UK government over support for the wider pharmaceutical industry, particularly when it comes to supporting the commercial environment to become a global superpower in the sector.

Full details:

£160bn fear for London’s stock market as UK’s biggest firm considers US move

Microsoft cut another 9,000 jobs globally

07:28 , Karl MatchettMicrosoft are cutting 9,000 jobs, 4 per cent of its workforce, with job cuts to come in areas including Xbox and mobile game studio divisions.

There were cutbacks of around 6,000 redundancies in May.

It comes after senior bosses told staff to ensure AI was being more widely used for tasks, saying it was “no longer optional”.

Bond yields rose after Starmer failed to back Reeves

07:15 , Karl MatchettWe’ll dive back into the latest data shortly, but first an explanation of yesterday’s bond market turbulence.

After Keir Starmer didn’t give a firm answer that chancellor Rachel Reeves would stay in her job, investors reacted by selling off 10-year government bonds.

That send the prices down and the yields therefore up, before stabilising more than 3.5 per cent higher for the day after Labour released a statement saying Ms Reeves was going “nowhere”.

It was the fastest rise in 10-year gilts since 2022 and Liz Truss’ mini budget farce.

Business confidence at rock bottom with more tax raids expected

07:06 , Karl MatchettUK firms are signalling growth might be off the cards for most and confidence about what lies ahead is evaporating.

A report from the British Chambers of Commerce (BCC) highlighted the precarious nature of the situation.

“UK businesses are rattled, with less than half expecting to see their turnover grow in the next year, according to the BCC. Weak confidence means businesses are likely to be battening down the hatches, and that doesn’t bode well for economic growth. The tax burden appears to be high on the list of concerns for businesses, which is only to be expected after the big national insurance hike they’ve had to swallow,” said Danni Hewson, head of financial analysis at AJ Bell.

“The problem is the chancellor is likely to be coming back for another tax raid this autumn, albeit unlikely to be at the same scale as 2024. Given that businesses have already done a lot of heavy lifting, it seems more likely the tax hammer will fall elsewhere. But even if consumers get saddled with tax rises, that limits their discretionary spending and still spells trouble for UK businesses.”

Business news live - Thursday

06:58 , Karl MatchettGood morning and welcome to The Independent’s regular rolling coverage across the worlds of business and finance.

Today there’s a big old list to look through early on:

Stock markets, bond yields, Trump tariffs, business confidence and more.

Let’s get into it.