Ten-year bond yields dropped and steadied towards the end of the week after Labour came out with a somewhat more forceful defence of chancellor Rachel Reeves, giving assurances about her role and leading the markets to reverse their earlier alarm. The pound also rose against the dollar slightly and the FTSE 100 finished the week flat.

In business news, the cost of tariff impacts to UK SMEs was revealed in a survey showing they faced an average hit of £17,000 each, while fears continue over AstraZeneca pushing to leave the London Stock Exchange in favour of a US listing.

Elsewhere, new data shows one in four cars sold in the UK during June were electric vehicles, NS&I are reducing the rate on their Junior ISA and two people have been jailed for a combined 12 years for a £1.5m crypto scam.

Follow The Independent’s live coverage of the latest stock market and business news here:

Business news live - Friday

- High street sales continue real-terms decline

- SMEs face £17k average hit through tariff impact

- One in four cars sold in June were electric as sales rise again

- Bond yields fall further - big hedge funds bought the gilt dip

- UK's best-selling cars revealed for June and 2025 so far

- Pair jailed for combined 12 years over £1.5m crypto scam

Business news live - Friday

16:29 , Karl MatchettThe FTSE 100 is set to finish flat or near as makes no difference, bouncing back this afternoon after opening lower.

No US markets today remember as it’s 4th of July so we’re about wrapped up.

That’s it from us today and for this week - we’ll be back on Monday from 7am as usual so have a great weekend in the meantime.

Business news live - Friday

06:58 , Karl MatchettGood morning and welcome to the final workday of the week - and so our final business blog of the week.

We’ll have all the latest rolling news for you as usual, around the markets, the money, the key figures around the country and more.

Trade deal deadline approaching - stock markets could see heightened volatility

07:06 , Karl MatchettExpecting a return to the early April and May madness of the stock markets around the world might be the best mindset as we head into the next week.

That’s because the deadline for Trump’s tariff pause is 9 July and plenty of nations, or blocs, have not arranged agreements yet.

Not that investors should be panicking - but do be aware of the situation, Dan Coatsworth, investment analyst at AJ Bell, said.

“There is the potential for a market wobble if we don’t get substantial progress with trade talks over the next few days. Only a handful of countries have struck framework deals so far, suggesting there isn’t enough time for everyone to reach an agreement before the 9 July deadline.

“Investors might want to sit tight and ride out any volatility as history suggests markets bounce back from selloffs.”

High street retail stores continue real-terms decline

07:15 , Karl MatchettData from BDO’s High Street Sales Tracker suggests all is not well with UK retail.

The most recent information shows the ninth consecutive month that overall sales volume has fallen; while sales in-store grew 0.6 per cent, it’s way below the current rate of inflation (3.4 per cent in May) which means a real-term decline overall.

Online sales grew 4.3 per cent but more needs to be done, says Sophie Michael, head of retail at BDO.

“There is a growing gap between the performance of physical stores and online retail. Perhaps this is because online retailers have greater agility to adjust their inventory and promotional material to quickly align to consumer preferences, such as promoting summer outfits in extreme high temperatures and pivoting to waterproofs when the rain arrives,” Ms Michael said.

“Some retailers are making targeted investments to improve their store estates to attract more footfall, but we need to see this across the industry along with more support to revitalise our high streets. Store propositions need to be reinvented. Strategic and targeted investment is what is really required for retailers with a significant physical footprint to remain competitive. At the same time, retailers need to continue to invest in blending their physical and online offerings. Without this investment and local government support, we risk seeing further store closures which has a detrimental effect on our towns and communities.”

The true cost of Trump’s tariffs on UK small businesses

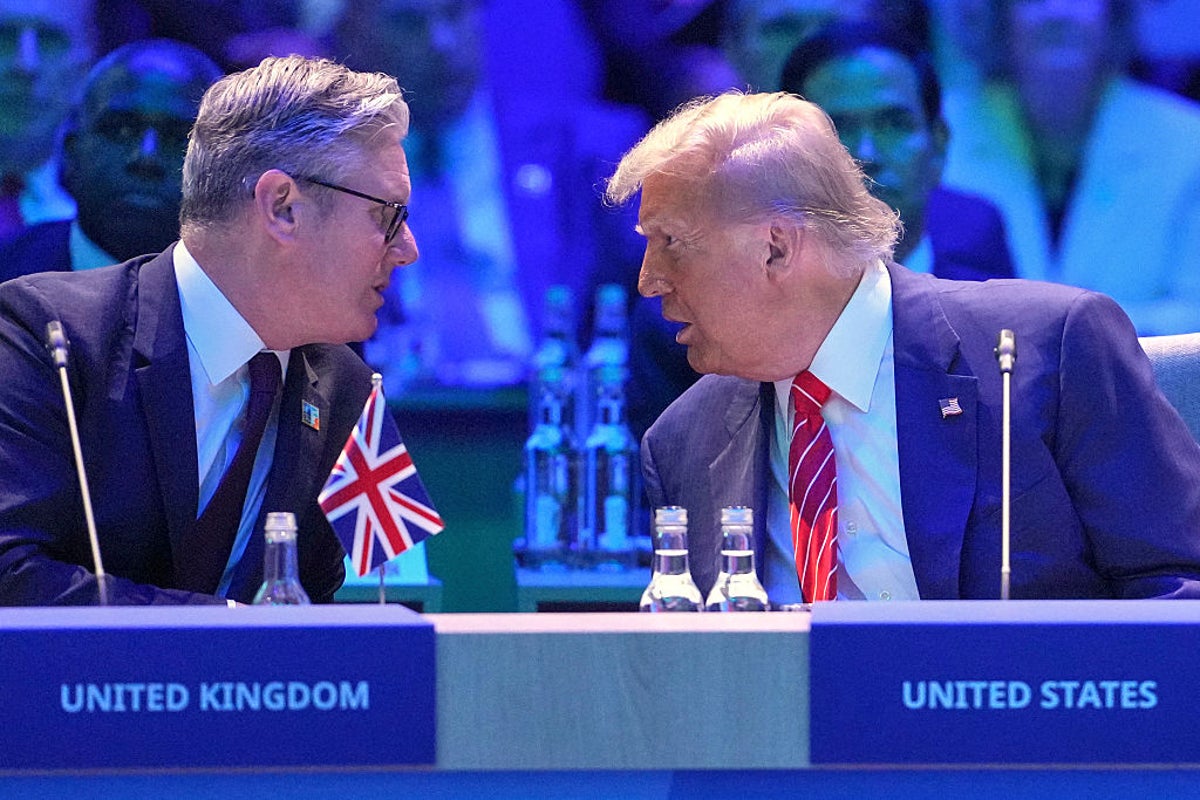

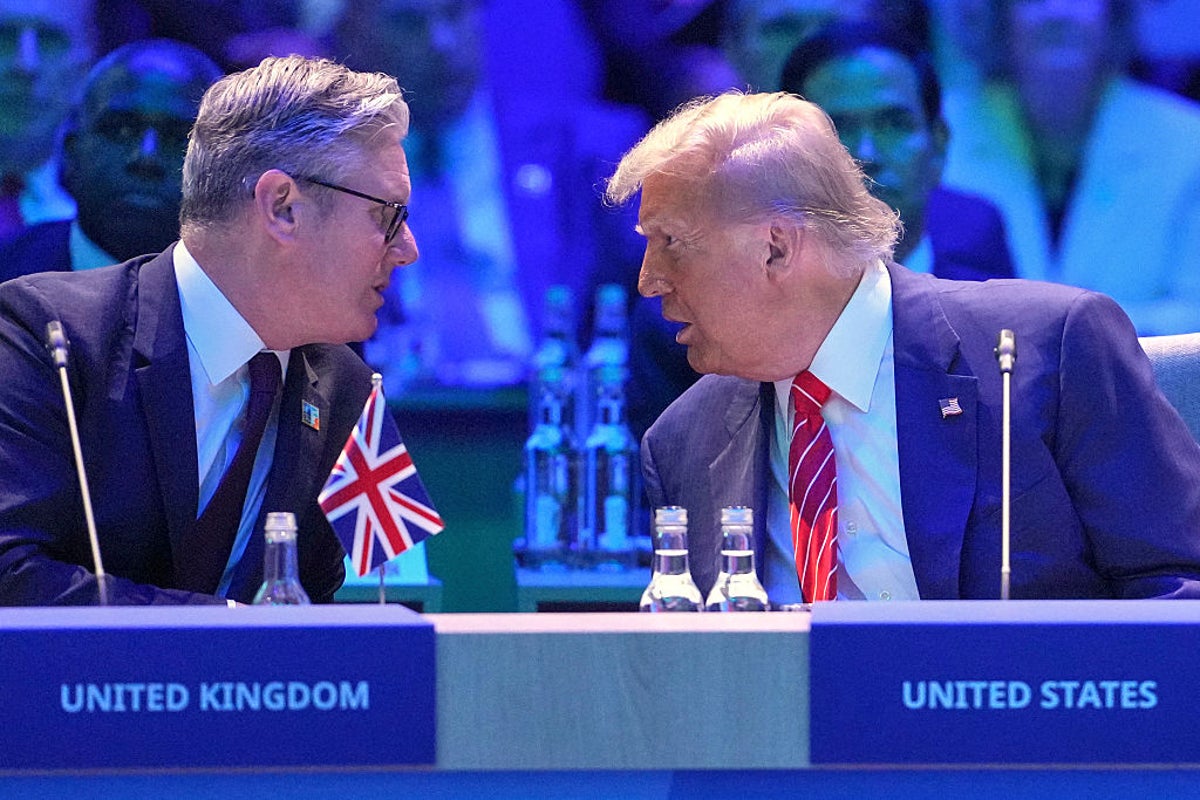

07:28 , Karl MatchettA third of small UK businesses fear losing up to £20,000 this year amid the uncertainty caused by Donald Trump’s new trade tariffs, a new report shows.

Across April and May, the US President announced - and then called a pause for - levies being placed on all goods imported to the US from other nations, as part of a plan to readdress trade balances. While the UK has since arranged a trade deal with the nation, many other countries or blocs have not done so and there remains uncertainty within some industries.

A new report looking at more than 500 small and medium enterprises (SMEs) across the UK has now revealed three in ten (30 per cent) estimate the cost of tariff knock-on effects to be between £10,000 and £20,000 this year, while two per cent believe it will cost them over £1m.

Full details here:

Revealed: The true cost of Trump’s tariffs on UK small businesses

EV sales rise in June - 25% of cars sold were electric

07:45 , Karl MatchettWe’ve heard more than once about how EV sales have been declining of late, but the data doesn’t showcase that.

One in four cars sold in June in the UK were electric and total EV market share for the year is 21.6 per cent.

Colin Walker, head of transport at the Energy & Climate Intelligence Unit (ECIU), said:

“EV sales for the month are up 46%, while petrol sales are down 11%, meaning more and more drivers are making the shift to cleaner and cheaper electric driving. And with the likes of Ford increasing their year-to-date EV sales by 333%, and Renault by 251%, we’re seeing more traditional manufacturers rising to the challenge of building and selling the electric vehicles that people increasingly demand.”

Nvidia shares reach new high - just shy of all-time most valuable company record

08:04 , Karl MatchettNvidia shares rose 1.3 per cent yesterday, closing at $159.34 - though they did briefly surpass the $160 mark.

Had they closed above that price, the total market capitalisation of the chip-maker would set a new all-time record as the world’s most valuable business ever, by market capitalisastion.

The current record is $3.915 trillion, set by Apple on December 26, 2024. Nvidia’s market cap is now $3.886tn (£2.842tn) - meaning it is more valuable than all the public listed companies in the UK combined.

Stock markets are closed in the US today for 4th July, but it appears a matter of time before Nvidia becomes the first $4tn company.

Ten-year bond yields drop further to ease fears

08:28 , Karl MatchettAfter the Rachel Reeves-related spike in gilt yields of a few days ago, there were real fears over borrowing costs...but only briefly.

A few statements later it started to subside and the sell off reversed, meaning the yield came back down accordingly.

This morning, the same again - the yield on 10-year bonds is now back down to 4.518 per cent.

For much of last week it was in the range of 4.49 to 4.51 per cent, so it’s certainly retraced back to expected levels.

BlackRock, Schroders and Fidelity International were among the big hedge funds to buy bonds during the sell-off in expectation it would be short-lived, reported the FT.

“We are ‘overweight’ the gilt market, we did add to that yesterday afternoon,” said Simon Blundell, co-head of European active fixed income at BlackRock.

Smaller business won't have to file extra accounts yet

08:45 , Karl MatchettThe government are placing a pause on regulations which would have forced small businesses to file extra accounts.

A policy brought in by the Conservatives would have seen firms with fewer than 50 employees and turnover under £10m have to disclose more detail in company numbers, but this has been placed on hold by Jonathan Reynolds, business secretary, report the Guardian.

Groups had opposed the new rules saying it would be costly and time-consuming.

Most popular stocks for investors in June

09:00 , Karl MatchettStock markets rose again in June - the S&P 500 is up just over 5 per cent in the last month and the FTSE 100 is just above flat over the same time.

Now, interactive investor, AJ Bell and Robinhood have published a list of the most popular stocks to have been bought on their platforms during June - with certain names overlapping on all three.

The top five in each case as are below.

ii:

- Rolls Royce

- Tesla

- BP

- Metals One

- BAE Systems

AJ Bell:

- Legal & General

- Rolls Royce

- BAE Systems

- Shell

- HSBC

Robinhood:

- Tesla

- Applied Digital

- CoreWeave

- Hims&Hers Health

- Robinhood

Reeves to announce pensions overhaul this month

09:19 , Karl MatchettWe’ve previously seen that Rachel Reeves is expected to talk about a Cash ISA limit cut at her Mansion House speech this month but now further details have emerged.

It seems a pensions overhaul is on the agenda too, with the FT reporting a review will be commissioned to look at auto-enrollment rates, state pension, self-employed retirement savings and more.

Company contributions could be on the line too.

Stock market volatility will 'likely' return with tariff deadline

09:40 , Karl MatchettMore changes in the stock market are likely over the coming weeks, in both directions, Justin Onuekwusi, chief investment officer at St. James’s Place, believes.

That’s on account of the upcoming trade tariffs deadline set by Donald Trump, which is 9 July.

“Tariffs may be tempting for politicians as a way to trade imbalances, but they come with economic risks. The IMF estimates that Trump’s tariff policies could shave 0.5% off global economic growth next year. In the near term, higher import costs could drive up inflation and squeeze US consumers,” he said.

“With the 90-day pause on reciprocal tariffs nearing its end, further volatility seems likely. While the UK has made progress on trade deals, the outlook for a comprehensive EU-US agreement remains uncertain. Meanwhile, negotiations with China remain complex and unresolved.”

UK construction output falls for sixth month running

10:31 , Karl MatchettData emerging today from S&P shows construction output falling in the UK for the sixth month running.

Optimism levels in the industry have fallen to the lowest levels since December 2022.

“Even the most optimistic of builders would struggle to declare the glass half full,” commented Gareth Belsham, director of Bloom Building Consultancy.

“Yes the overall contraction in industry workloads continues to ease, and housebuilders even saw output rise in June. That’s the good news.

“But on the other side of the ledger, commercial sector workloads fell sharply, declining at their fastest level since May 2020 - a month when Britain was in the teeth of the Covid pandemic. Infrastructure and civil engineering work contracted even more rapidly.”

Vauxhall warns factories could close due to net zero penalties

10:44 , Karl MatchettVauxhall’s owner has warned they could be forced to close some factories across Europe.

The reason given is harsh net zero penalties which are impossible to avoid unless EV sales double.

Stellantis director Jean-Philippe Imparato said: “I have two solutions: either I push like hell [on electric] ... or I close down ICE [fuel engines]. And therefore I close down factories.”

He said the targets in place presently to avoid fines are “unreachable”.

Half of small businesses could raise prices and a quarter want NI raise reversed

11:00 , Karl MatchettNew research from business insurance firm Simply Business has canvassed opinion on UK small and medium sized firms (SMEs) and there are decidedly mixed views when it comes to optimism on the future.

Close to half (43 per cent) say they are likely to raise prices this year to offset cost increases and despite that, only 17 per cent expect bigger profits this year, such are the cost pressures they are dealing with.

To that note, a quarter (24 per cent) say the government should reverse their call to raise National Insurance Contributions and almost one in five (18 per cent) fear they will be out of business within a year without changes to the economic environment.

FTSE 100 lower as housebuilders fall

11:20 , Karl MatchettThe FTSE 100 was just about up for the week before today but it looks likely to close in the red, with the benchmark index down 0.3 per cent today.

That fall is led by shares in housebuilders and some miners moving lower, with Barratt Redrow (-1.89 per cent) and Anglo American (-1.92 per cent) the two biggest fallers of the day.

Around Europe it’s similar with indices down in Germany, France, Netherlands, Spain and the EuroStoxx 50 too.

IPO fundraising hits 30-year low in London

11:41 , Karl MatchettFundraising for companies going public - listing their companies on stock markets - in London has hit the lowest level in the last 30 years.

Just five listings have occurred in the first half of the year on the London Stock Exchange, totalling £160m.

Meanwhile the LSE has seen several companies depart or announce plans to do so this year, including Glencore, Wise and Ashtead.

The CEO of AstraZeneca, the biggest firm in the FTSE 100, this week was revealed to want to move to the US too.

Economic slowdown linked to global uncertainty amid Trump tariffs

12:00 , Karl MatchettA slowdown in growth in Scotland’s economy is “largely due to higher global uncertainty” – with experts saying this is linked “particularly” to US President Donald Trump’s trade tariffs.

The Fraser of Allander Institute also highlighted a recent rise in inflation this year as having “played a role” as the economy “faltered”.

Economics experts at the Strathclyde University-based think tank have now downgraded their forecasts for growth.

Katrine Bussey for PA:

Economic slowdown linked to global uncertainty amid Trump tariffs – think tank

Revealed: The true cost of Trump’s tariffs on UK small businesses

12:30 , Karl MatchettA third of small UK businesses fear losing up to £20,000 this year amid the uncertainty caused by Donald Trump’s new trade tariffs, a new report shows.

Across April and May, the US President announced - and then called a pause for - levies being placed on all goods imported to the US from other nations, as part of a plan to readdress trade balances. While the UK has since arranged a trade deal with the nation, many other countries or blocs have not done so and there remains uncertainty within some industries.

A new report looking at more than 500 small and medium enterprises (SMEs) across the UK has now revealed three in ten (30 per cent) estimate the cost of tariff knock-on effects to be between £10,000 and £20,000 this year, while two per cent believe it will cost them over £1m.

Revealed: The true cost of Trump’s tariffs on UK small businesses

UK economy forecasted to grow at less than 1% this year

13:00 , Karl MatchettAnalysis by Allianz Trade suggests the UK economy will grow by just 0.9 per cent this year - and only 1.2 per cent in 2026.

Tax hikes, inflation and the current interest rate setting are all impacting on that and hampering short-term growth, with inflation only expected to “normalise to 2.5 per cent by 2026”.

Ana Boata, Head of Economic Research at Allianz Trade, added that global growth should be 2.5 per cent this year, the slowest since 2008 other than in recession periods.

'Inevitability’ to Grangemouth closure under Labour

13:30 , Karl MatchettThere was a “certain inevitability” that Grangemouth would close by the time Labour came to power last year, the UK’s energy minister has said.

Michael Shanks said the UK Government “did not take any option off the table” when asked about whether Scotland’s last oil refinery could have been nationalised.

But he said the plant was “far too far down the line” for the outcome to have been averted.

The plant ceased crude oil processing in April, with its closure causing the loss of 430 jobs.

The SNP had previously called for the UK Government to nationalise the site, which its owners said was losing £385,000 a day.

Craig Meighan, PA.

£20-30bn savings needed in autumn Budget

14:00 , Karl MatchettChancellor Rachel Reeves could need to tighten fiscal policy by £20bn-£30bn in the Budget this autumn, believes Andrew Goodwin, chief UK economist at Oxford Economics.

Further tax hikes will form the biggest chunk of savings, with an extension of the freeze on most thresholds also a likely option.

“The cost of abandoning welfare reforms and the earlier U-turn on winter fuel payments will likely pale into comparison to the increase in borrowing that will result from the Office for Budget Responsibility downgrading its optimistic growth forecasts,” Mr Goodwin said.

FTSE 100 mounts comeback, European stocks down

15:03 , Karl MatchettLate in the day the FTSE 100 has risen back to a flat level for Friday, now up 0.03 per cent - while European indices look set to finish the week down between 0.4 and 0.7 per cent for the most part.

Brent Crude Oil is down just over 1 per cent to $68, gold is up 0.14 per cent to $3,347 and the pound to dollar exchange rate is flat today, so around £1 - $1.3650.

Relatively calm way to end the week, considering what has happened to get us to this point.

UK's best-selling cars of the year revealed

15:48 , Karl MatchettNew data has revealed the UK’s best-selling cars for June and for the first half of the year.

Top seller last month was the Nissan Qashqai, with more than 5,000 new registrations according to the SMMT.

The Ford Puma and Tesla Model Y took the podium spots, ahead of the Vauxhall Corsa and MG HS.

Across 2025 so far, three of those same models make the top five - here they are in order, along with reported figures sold.

- Ford Puma, 26,355

- Kia Sportage, 23,012

- Nissan Qashqai, 22,085

- Vauxhall Corsa, 20,128

- Nissan Juke, 18,527

FCA confirm 2 people convicted for £1.5m crypto fraud

16:07 , Karl MatchettThe Financial Conduct Authority have confirmed the prosecution of two people in a crypto fraud case worth £1.5m.

The duo, Raymondip Bedi of Bromley and Patrick Mavanga of Peckham, have been sentenced for a combined 12 years after cold-calling people and selling fake investments.

At least 65 people were defrauded, the case stated.

Steve Smart, joint executive director of enforcement and market oversight at the FCA, said:

“Bedi and Mavanga ruthlessly defrauded dozens of innocent victims, and it is right that they have received these prison sentences. Criminals need to be clear that there is a cost to committing crime and we will seek to make them pay.”

Anyone affected by the scam is urged to contact the FCA.

Bristol to launch £18m investment into unified Business District

16:17 , Karl MatchettBusinesses across Bristol city centre have overwhelmingly voted in favour of creating a new central business district which will see £18m of direct investment in the area across a five-year period, it has been announced.

Steve Bluff, director of Redcliffe & Temple Business Improvement District and lead for the new Bristol BID, welcomed the result as a defining moment for the city: “It’s not every day a city centre gets the chance to reset its future. This is a business-led vision that puts local voices at the heart of shaping Bristol’s next chapter. The YES vote is more than an endorsement of a plan - it’s a clear commitment to collaboration, innovation and raising our collective ambition.”