Chesterfield, Missouri-based Bunge Global SA (BG) operates as an agribusiness and food company that produces and supplies plant-based oils, fats, and protein. Valued at $16.2 billion by market cap, the company’s products are used in a wide range of applications, including animal feed, cooking oils and flours, bakery and confectionery, dairy fat alternatives, plant-based meat, and infant nutrition. The global agribusiness and food company is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Nov. 5.

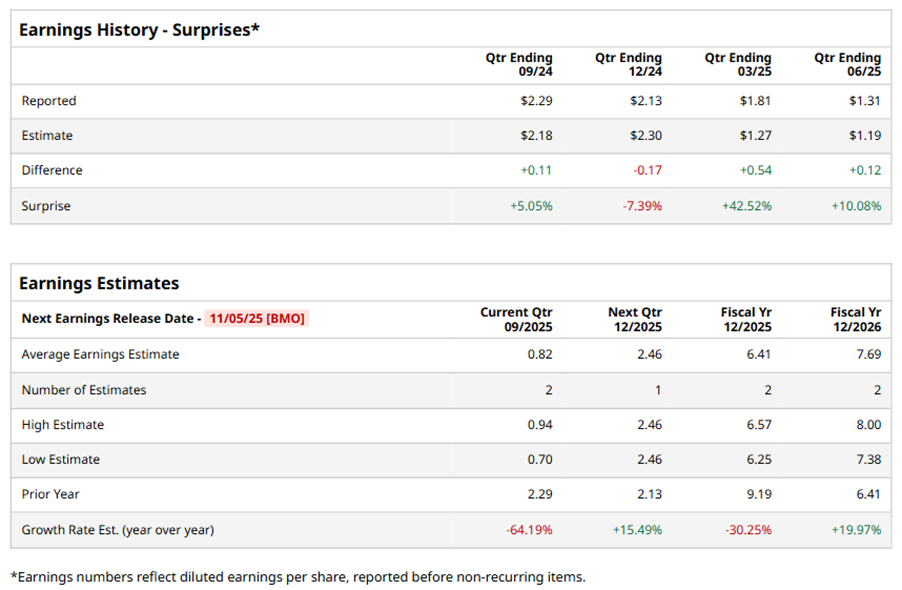

Ahead of the event, analysts expect BG to report a profit of $0.82 per share on a diluted basis, down 64.2% from $2.29 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect BG to report EPS of $6.41, down 30.3% from $9.19 in fiscal 2024. However, its EPS is expected to rise 20% year over year to $7.69 in fiscal 2026.

BG stock has significantly underperformed the S&P 500 Index’s ($SPX) 14.4% gains over the past 52 weeks, with shares down 16.5% during this period. Similarly, it underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% losses over the same time frame.

BG's weak performance is mainly due to pressures from cyclical commodities, geopolitical trade tensions, and integration challenges. Moreover, the tariffs China imposed on U.S. goods have hurt Bunge's revenue, especially in soybean trading.

On Jul. 30, BG shares closed up more than 5% after reporting its Q2 results. Its adjusted EPS of $1.31 beat Wall Street expectations of $1.19. The company’s revenue stood at $12.8 billion, down 3.6% from the year-ago quarter. BG expects full-year adjusted EPS to be $7.75.

Analysts’ consensus opinion on BG stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of nine analysts covering the stock, six advise a “Strong Buy” rating, two give a “Hold,” and one recommends a “Strong Sell.” BG’s average analyst price target is $89.78, indicating a potential upside of 10.9% from the current levels.