Bullish (BLSH), a crypto exchange backed by Peter Thiel’s Founders Fund, among other powerhouse investors, made a spectacular market debut under the ticker BLSH yesterday, Aug. 13, The company priced its IPO at $37 per share, exceeding the expected $32–$33 range, and raised approximately $1.1 billion with 30 million shares sold.

On day one, Bullish’s shares rocketed, peaking around $118, resulting in an astonishing gain from the IPO price. Investor appetite was so intense that trading halts were triggered amid the volatility. Given its high-profile backing and positive investor sentiments, should you add BLSH to your portfolio?

About Bullish Stock

Bullish is a crypto exchange and digital asset platform headquartered in the Cayman Islands. Bullish is particularly notable as the owner of CoinDesk, the influential crypto news, data, and index provider, following its acquisition in 2023.

When Bullish went public yesterday it raised about $1.1 billion and had set an initial valuation of around $5.4 billion. Driven by investor enthusiasm and a meteoric stock debut, its market cap surged, reaching around $10 billion currently.

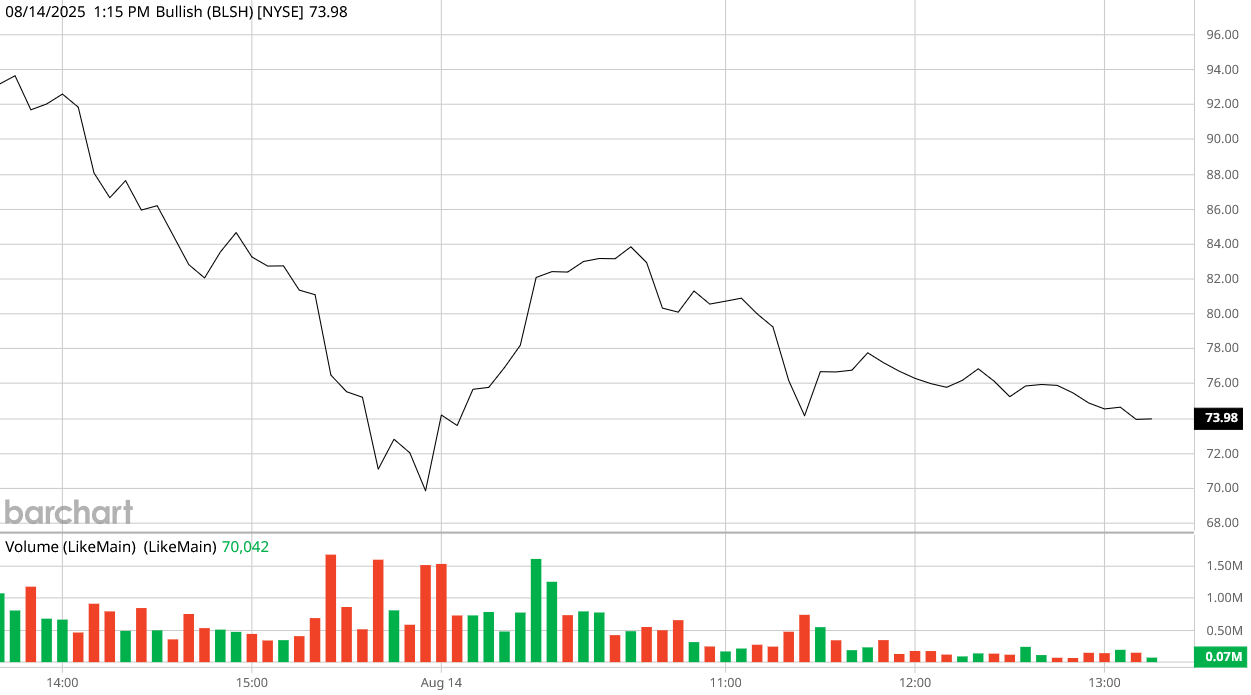

Bullish’s debut on the New York Stock Exchange was nothing short of dramatic. Priced at $37 per share, already above its revised offering range, it opened trading around $90, instantly surging approximately 143% above the IPO price. The momentum continued midday, with the stock lifting as high as $118, representing a staggering 218.9% intraday jump over its offering price. By close, Bullish settled around $68, still delivering an impressive gain of 83.8% from its IPO price.

As of this afternoon, BLSH sits around $74.

BLSH stock has not only defied expectations but also underscored intense investor fervor for institutional-grade crypto platforms.

Bullish Demonstrated Stable Digital Assets Sales

Bullish’s financial disclosures, as outlined in its SEC F-1 filing dated July 18, reveal both rapid growth and the inherent volatility of the crypto sector. The company swung from a net profit of $104.8 million in Q1 2024 to a net loss of approximately $348.6 million in Q1 2025. However, Bullish ended 2024 with a net income of $79.6 million, showing its ability to generate profitability in favorable market conditions.

The company has also seen impressive growth in its digital asset sales, climbing from $72.9 billion in 2022 to $250.2 billion in 2024, with the first three months of 2025 delivering $80.2 billion in digital asset sales, nearly flat versus $80.4 billion in the same period last year.

What Do Analysts Expect for BLSH Stock?

Bullish positions itself as an institutional-grade platform, mainly facilitating Bitcoin (BTCUSD) and Ethereum (ETHUSD) trading, unlike many retail-focused competitors. Analysts highlight this as a potential strength, offering comparatively lower risk and tapping into growing demand from institutional players.

Beyond Peter Thiel, Bullish’s investor lineup includes BlackRock (BLK) and ARK Invest evidence of strong demand from elite institutional funds.

Cathie Wood’s ARK Invest, known for focused investments in disruptive innovation, has purchased approximately 2.53 million shares of Bullish as the stock made its explosive debut. This purchase, valued at around $172 million, was allocated across three ARK ETFs. The ARK Innovation ETF (ARKK) picked up 1,714,522 shares, the ARK Next Generation Internet ETF (ARKW) added 545,416 shares, and the ARK Fintech Innovation ETF (ARKF) bought 272,755 shares.

Meanwhile, Michael Hall of Nickel Digital Asset Management pointed out that this institutional orientation could position Bullish “for more stable, recurring revenue than exchanges reliant on retail volumes, which tend to be cyclical and sentiment-driven.”

While analyst commentary remains limited, consensus leans favorable. Bullish stands out as a high-conviction, innovation-led entrant into the public markets, though its lofty valuation warrants careful consideration.