/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix (NFLX) has been on a solid run, with shares soaring 83% over the past year. The streaming leader has navigated a challenging economic backdrop with strong resilience, boosting membership numbers, successfully implementing subscription price hikes, and expanding its new advertising revenue stream. All of this has strengthened its financial performance and, in turn, powered the stock’s rally.

However, with such a sharp climb, its valuation looks stretched. NFLX trades at a forward price-earnings (P/E) multiple of about 47.1x, well above its rivals. A comparison with Disney (DIS) highlights NFLX’s premium valuation tag. Disney shares are priced at a much lower forward P/E ratio of 20x, while it is projected to post double-digit earnings growth in 2025 and 2026.

Notably, Netflix deserves a premium multiple due to its ability to reinvent itself continually. From leading the charge into original content to launching ad-supported tiers, the company has shown it can adapt quickly to maintain its growth trajectory. Its rich content library and global reach further support its leadership position. Still, with shares priced this high, investors are paying steeply against the EPS growth forecast.

For context, analysts expect Netflix earnings to grow 31.4% in 2025 and 23.4% in 2026. While its EPS growth trajectory remains solid, it is not enough to warrant such a lofty multiple unless the company continues to outpace expectations consistently.

So, does Netflix have the catalysts to keep driving strong growth, beat expectations, and justify its premium valuation? Let’s take a closer look.

What’s Ahead for Netflix?

Netflix continues to prove why it commands a premium over peers in the streaming industry. It has consistently surpassed Wall Street’s expectations with impressive growth and profitability. Over the last four quarters, the company has consistently beaten earnings estimates, driven by a combination of revenue growth and margin expansion.

In the most recent quarter, revenue jumped 16% year-over-year, driven by subscriber growth, price increases, and higher advertising income. Importantly, this momentum was broad-based, with every geographic region delivering strong growth. The streaming giant’s profitability was equally solid, with operating income marking 45% growth and margins expanding from 27% to 34%. EPS rose 47% to $7.19, reflecting how scale and effective monetization strategies are driving bottom-line strength.

Looking ahead, Netflix appears well-positioned to maintain this streak. Engagement remains strong as subscribers consumed more than 95 billion hours of content in the first half of the year, up 1% despite a backloaded 2025 release schedule. The second half looks particularly strong, featuring the return of hit shows such as Wednesday, Nobody Wants This, Alice in Borderland, and the final season of Stranger Things. These titles are expected to drive engagement and drive the subscriber base.

Netflix has also broadened its content by making a calculated push into live programming, a fast-emerging area of demand. This move could attract new audiences and diversify its content offering.

The company’s monetization strategies are working well. Its recent price adjustments have been met with favorable responses in customer acquisition and churn metrics, giving Netflix room to reinvest in content and technology. Meanwhile, advertising is fast-growing into a powerful catalyst. Netflix aims to double ad revenue in 2025, supported by the rollout of its proprietary Ads Suite across global markets. This platform enhances targeting, measurement, and ad formats, creating more value for advertisers, in turn, driving its revenue.

Is Netflix a Buy, Sell, or Hold?

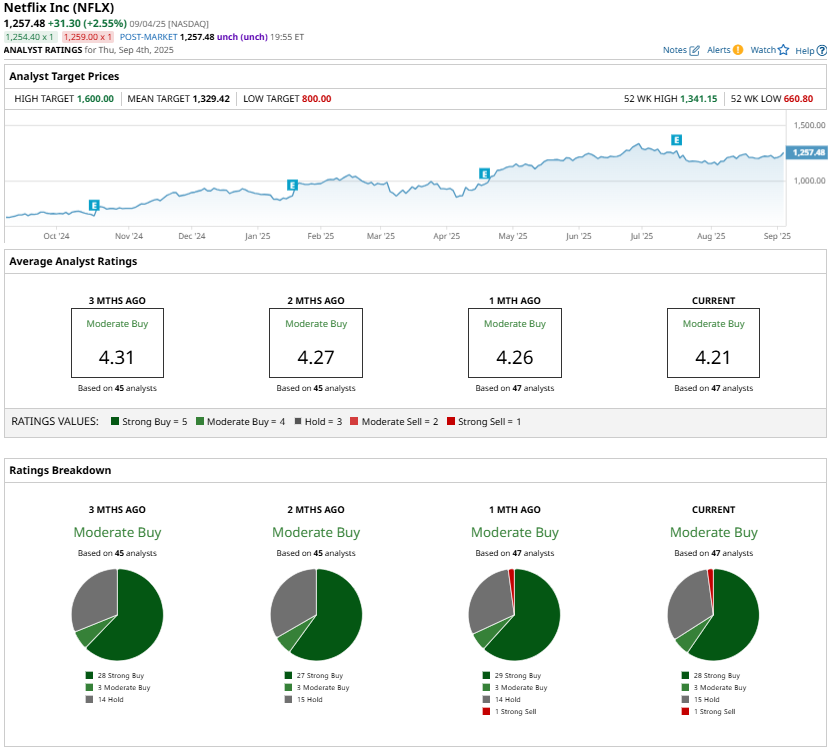

Analysts remain cautiously optimistic on Netflix, maintaining a “Moderate Buy” consensus, reflecting both confidence in the company’s growth and strategy, and also highlighting that valuation leaves little room for disappointment.

However, Netflix is set to drive engagement, deliver solid revenue, and expand margins in the coming quarters. With a strong content pipeline and effective monetization initiatives, the company could continue beating estimates that could justify its stretched valuation, making it a compelling long-term play.