With back in bullish mode it’s a good time to run Barchart’s Bull Call Spread Screener.

A bull call spread is an options strategy that a trader uses when they believe the price of an underlying stock will move higher in the short term.

To execute the strategy, a trader would buy a call option and sell a further out-of-the-money call option with the following conditions:

- Both call options must use the same underlying stock

- Both call options must have the same expiration

- Both call options must have the same number of options

Since the strike price of the sold call is higher than the strike price of the bought call, the initial position will be a net debit.

The bull call spread profits as the price of the underlying stock increases, similar to a regular long call.

The difference between a bull call spread and a regular long call is that the upside potential is capped by the short call.

The purpose of the short call is to mitigate some of the overall costs of the strategy at the expense of putting a ceiling on the profits.

Losses are also capped, in this case by the debit taken when you execute the trade.

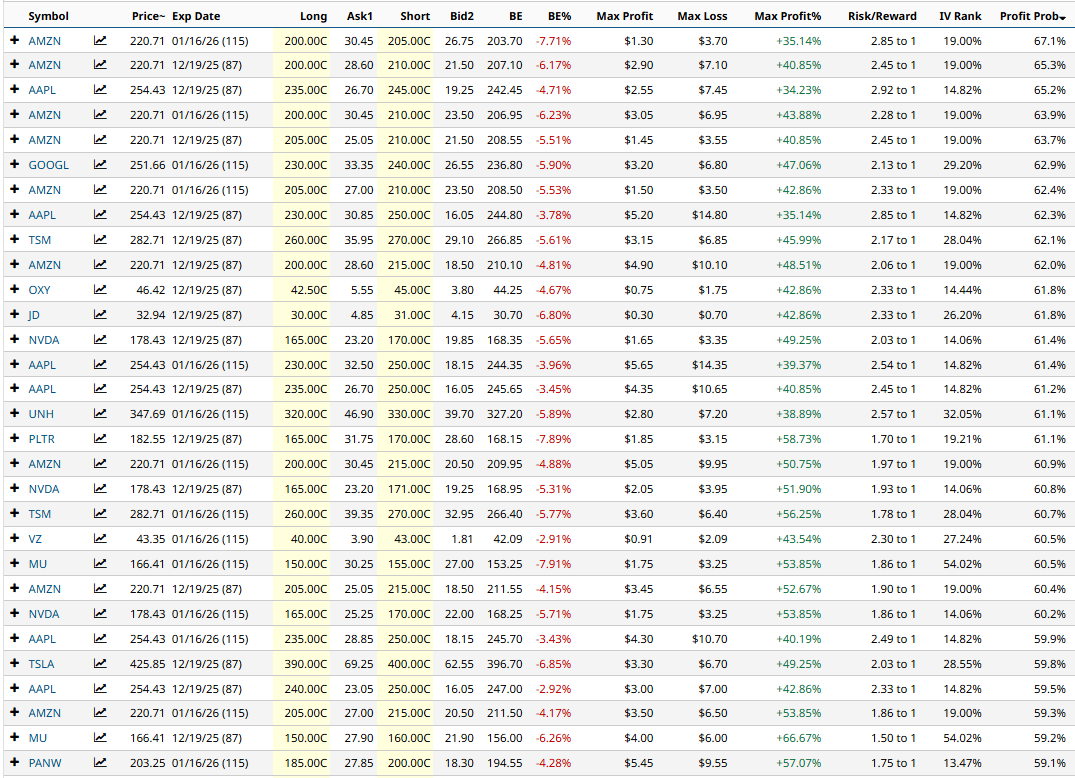

Let’s take a look at Barchart’s Bull Call Spread Screener for September 24th:

As you can see, the scanner shows some interesting Iron Condor trades on stocks such as, AMZN, AAPL, GOOGL and TSM.

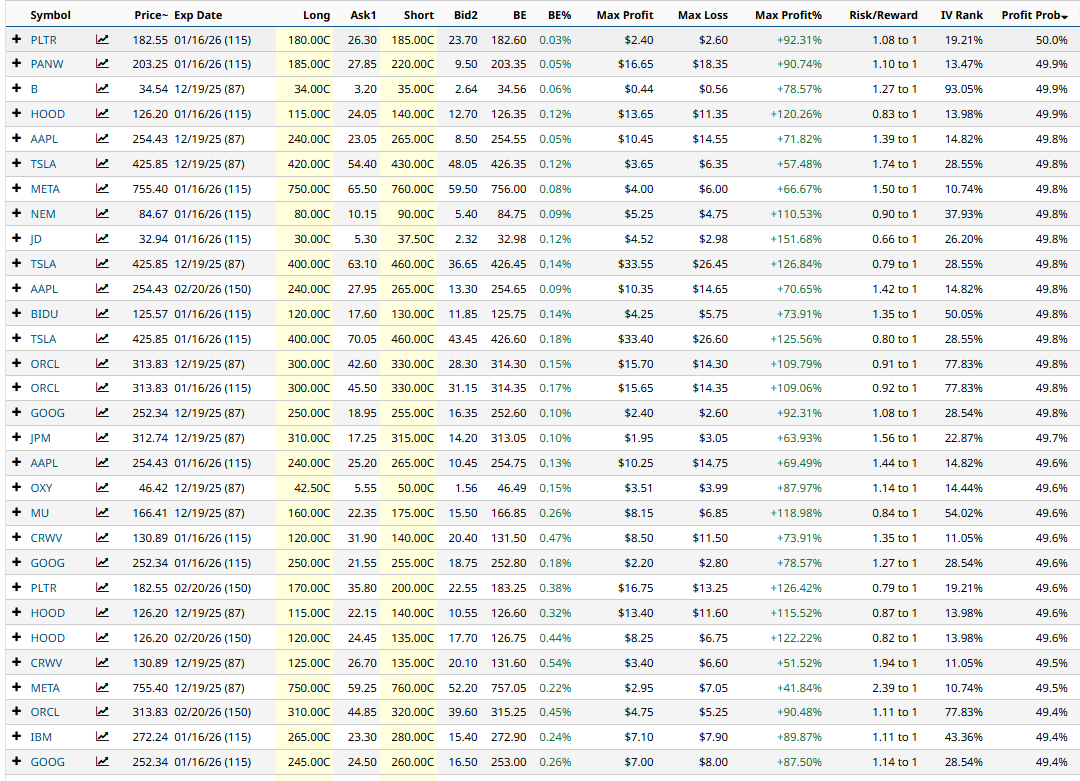

Let’s adjust the scanner to make sure we are only looking for bull call spreads on stock with a Buy rating and Mark Cap above 40 billion.

This scan gives us the following results:

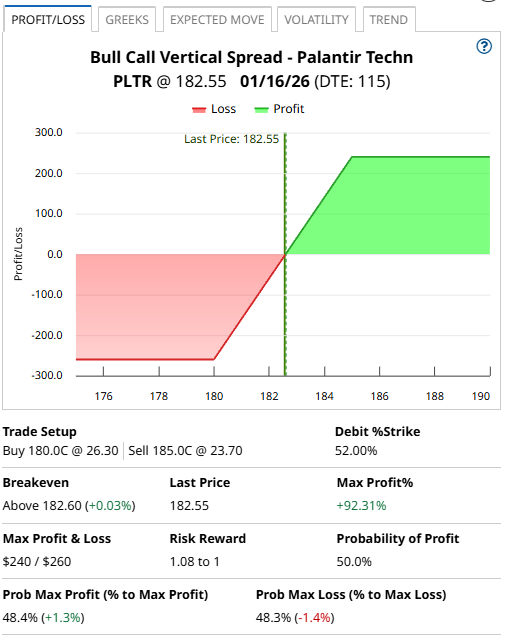

Palantir Bull Call Spread Example

Let’s take a look at the first line item – a bull call spread on Palantir (PLTR).

This bull call spread trade involves buying the January expiry $180 strike call and selling the $185 strike call.

Buying this spread costs around $2.60 or $260 per contract. That is also the maximum possible loss on the trade. The maximum potential gain can be calculated by taking the spread width, less the premium paid and multiplying by 100. That give us:

5 – 2.60 x 100 = $240.

If we take the maximum gain divided by the maximum loss, we see the trade has a return potential of 92.31%.

The probability of profit is 50%, although this is just an estimate and does not indicate the probability of achieving the maximum profit.

The spread will achieve the maximum profit if Palantir closes above $185 on January 16. The maximum loss will occur if Palantir closes below $180 on January 16, which would see the trader lose the $260 premium on the trade.

The breakeven point for the Bull Call Spread is $182.60 which is calculated as $180 plus the $2.60 option premium per contract.

The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

PLTR is showing an IV Percentile of 21% and an IV Rank of 19.21%. The current level of implied volatility is 52.40% compared to a 52-week high of 108.75% and a low of 39.00%.

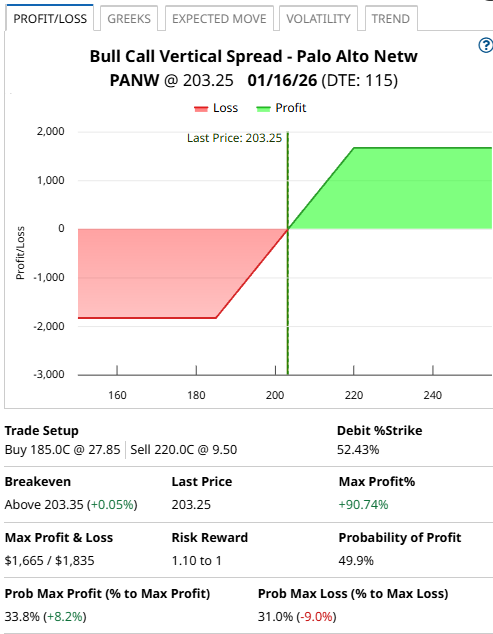

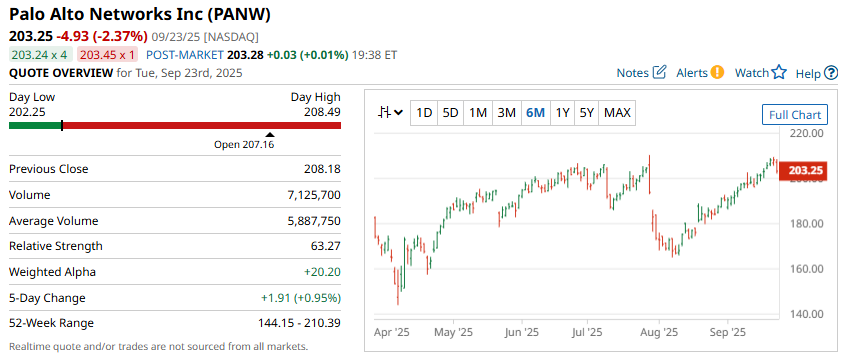

Palo Alto Networks Bull Call Spread Example

Let’s look at another example, this time using Palo Alto Networks (PANW).

This bull call spread also uses the January expiry and involves buying the $185 strike call and selling the $220 strike call.

This trade would cost $1,835 and have a maximum potential profit of $1,665.

The Barchart Technical Opinion rating is a 88% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed below 70%. The market has dropped from overbought territory. Beware of a potential mean reversion.

PANW is showing an IV Percentile of 32% and an IV Rank of 13.47%. The current level of implied volatility is 29.85% compared to a 52-week high of 60.39% and a low of 25.10%.

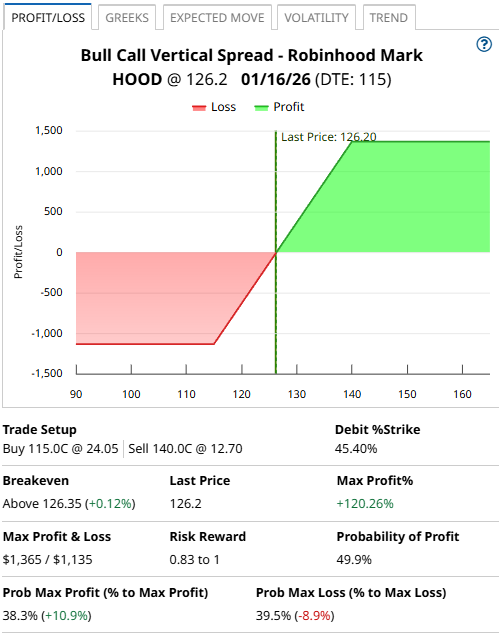

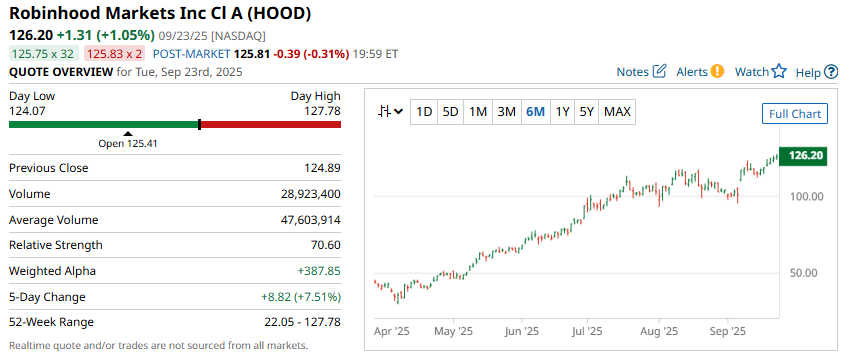

Robinhood Bull Call Spread Example

Let’s look at one last example, this time using Robinhood Markets (HOOD).

This bull call spread also uses the January expiry and involves buying the $115 strike call and selling the $140 strike call.

This trade would cost $1,135 and have a maximum potential profit of $1,365.

The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

Relative Strength just crossed above 70%. The market has entered overbought territory.

HOOD is showing an IV Percentile of 3% and an IV Rank of 13.98%. The current level of implied volatility is 57.16% compared to a 52-week high of 114.38% and a low of 47.86%.

Mitigating Risk

Thankfully, bull call spreads are risk defined trades, so they have some build in risk management. The most the PLTR example can lose is $260 while the PLTR call spread has risk of $1,835 and HOOD has risk of $1,135.

For each trade consider setting a stop loss of 25-30% of the max loss.

Also keep an eye on key support levels and moving averages.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.