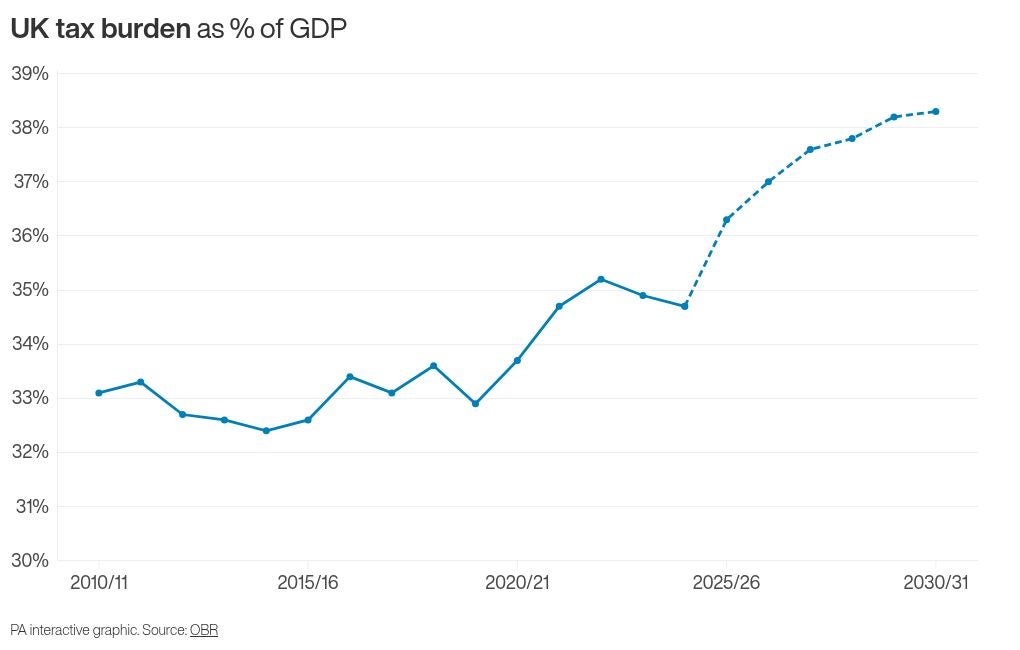

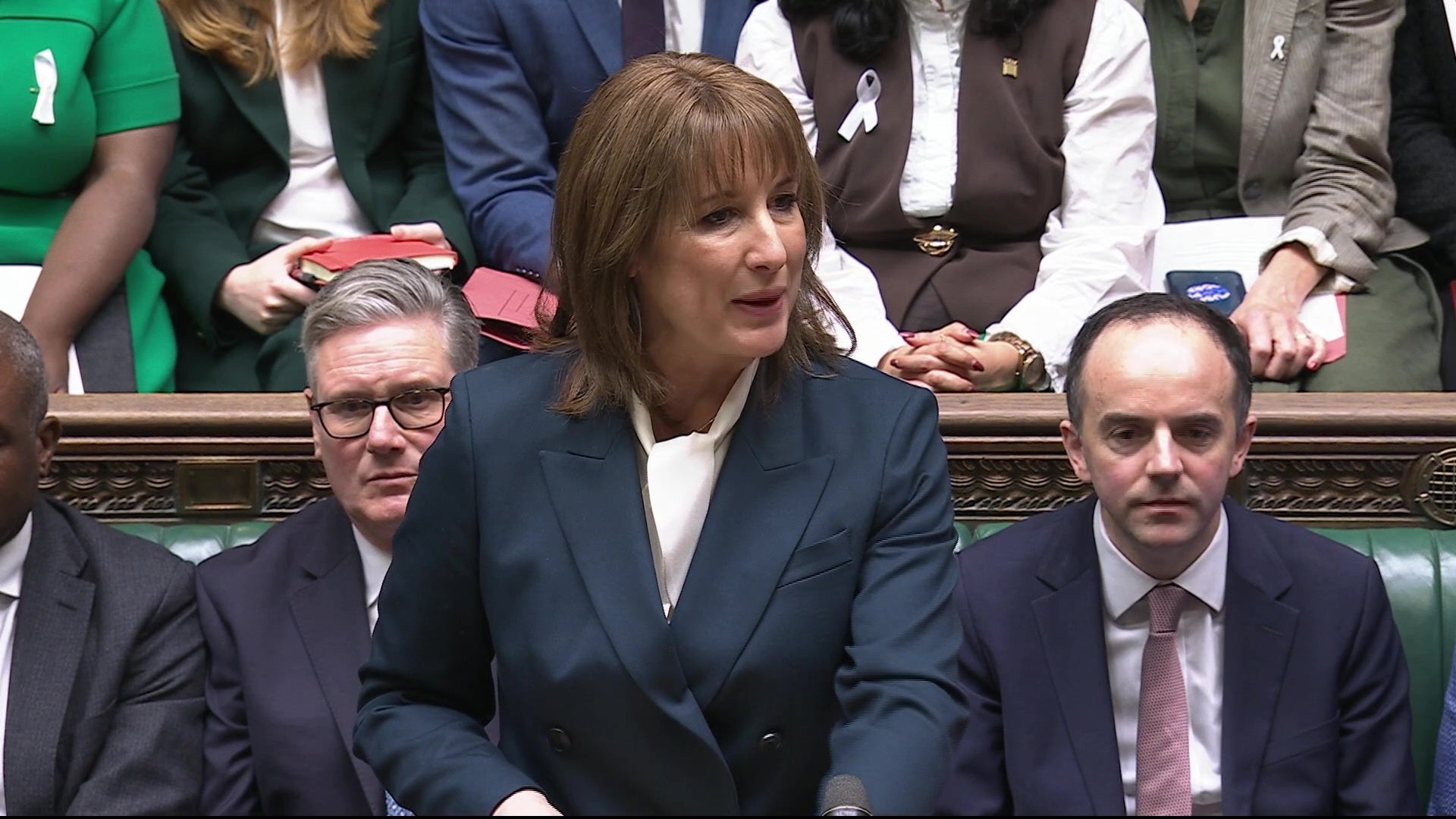

Chancellor Rachel Reeves has delivered her second Budget, laying out a series of tax rises as she aims to fill a black hole in the public finances.

Ms Reeves also announced a series of measures aimed at helping people who are currently struggling with living costs, including a long-expected end to the two-child limit on benefits.

The Chancellor was gazumped in laying out her Budget by the unexpected early publication of the Office for Budget Responsibility (OBR) analysis of her plans.

Here, the PA news agency looks at the tax rises and cost-of-living measures the Chancellor announced at the Budget on Wednesday.

– Economic growth

The OBR has increased its forecast for economic growth this year from 1% to 1.5% but downgraded its forecasts for the following four years.

Growth has been downgraded in 2026 from 1.9% to 1.4%, in 2027 from 1.8% to 1.5%, in 2028 from 1.7% to 1.5% and in 2029 from 1.8% to 1.5%.

– Fiscal headroom

The amount of headroom the Chancellor has against economic shocks has been raised by tax hikes in the Budget, according to the OBR.

Ms Reeves claimed in the Commons she would “more than double” the fiscal headroom.

The leeway the Government has against the Chancellor’s day-to-day spending rule will widen to £22 billion in 2029-30, £12 billion more than in March, the Budget watchdog said.

In future, the Chancellor will ask the OBR to assess whether she is meeting her fiscal rules just once a year, in the autumn Budget, rather than twice a year.

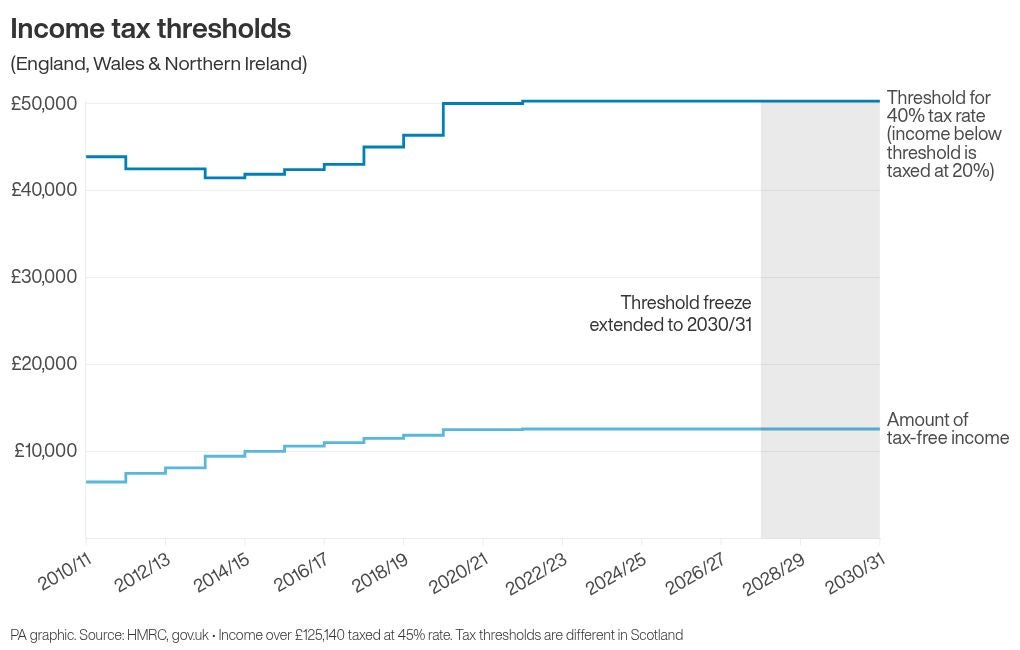

– Income tax thresholds

The Chancellor will extend the freeze on income tax thresholds until 2030, a move previously described as a “stealth” tax rise, but which Ms Reeves billed as “asking everyone to make a contribution”.

This will drag more people into paying the tax for the first time, and others into paying a higher rate, as wages rise.

The OBR said the freeze in tax thresholds would result in 780,000 more basic-rate, 920,000 more higher-rate and 4,000 more additional-rate income tax payers in 2029/30, and estimated it will raise about £7.6 billion in 2029-30.

– Pensions and salary sacrifices

Ms Reeves will limit the amount of money people can put into their private pension pot, through a scheme called a salary sacrifice, before it incurs tax.

Anything above the new £2,000 cap will incur national insurance contributions from 2029, a move which has been estimated to raise £4.7 billion in 2029-30 and £2.6 billion in 2030-31. At the moment there is no limit.

Chancellor @RachelReevesMP has left Number 11 to deliver her Budget to the @HouseofCommons. pic.twitter.com/Qm9bcRn0Z7

— HM Treasury (@hmtreasury) November 26, 2025

– Property taxes

A “high-value council tax surcharge” will be introduced on properties worth more than £2 million, a so-called “mansion tax”.

Four price bands will be introduced, rising from £2,500 for a property valued between £2 million to £2.5 million, to £7,500 for a property valued at £5 million or more, all uprated by inflation each year.

It will raise £0.4 billion in 2029-30, with all money going to central Government, rather than local authorities as usually happens with council tax.

Ms Reeves also announced taxes targeted at landlords, telling the Commons: “It’s not fair that the tax system treats different types of income so differently, and so I will increase the basic and higher rate of tax on property savings and dividend income by two percentage points, and the additional rate of tax on property and savings income by two percentage points.”

– Business taxes

The Chancellor said she would introduce “permanently lower” business rates for more than 750,000 retail hospitality and leisure properties.

The rates, which Ms Reeves said would be the “lowest rates since 1991”, will be paid for through higher rates on properties worth more than £500,000, including the warehouses used by “online giants”.

– Electric vehicles tax

Drivers of electric vehicles (EVs) will have to pay 3p per mile under a new tax introduced by the Chancellor, which is expected to rise annually with inflation.

The move is in part to make up for falling revenues from fuel duty, as more motorists move towards EVs.

– Gambling tax

Ms Reeves will increase the levy on remote gaming from 21% to 40% next year, in a bid to deter people from a form of gambling, the Chancellor said, was associated with the “highest levels of harm”.

She will also abolish bingo duty from next April.

These steps are estimated to raise £1.1 billion by 2029-30.

– Two-child benefit cap scrapped

The two-child cap is being scrapped from April and is expected to lift “450,000 children out of poverty”, the Chancellor said.

The cap has prevented parents from claiming universal credit or tax credits for more than their first two children. It was introduced by the Conservative government in 2017, and has been widely criticised by Labour MPs and anti-poverty advocate groups.

The move is estimated to cost £3 billion by 2029-30, according to the OBR.

– Travel costs

A cut to fuel duty will be extended as a means of holding down the price of petrol at the pump.

The tax has been held at 57.95p since 2011, but the effective rate paid by drivers since 2022 has been 52.95p as a result of a “temporary” 5p cut.

Rail fares have also been frozen for a year.

The Motability scheme, which helps disabled people with the cost of a car, will meanwhile no longer offer “luxury vehicles”, Ms Reeves said.

– Isa reforms

The annual cash Isa limit will be reduced to £12,000. The aim of reducing the limit from £20,000 is to encourage more people to invest their money in stocks and shares instead.

“Someone who has invested £1,000 a year in an average stocks and shares Isa every year since 1999 would be £50,000 better off today… than if they’d put the same money into a cash Isa,” Ms Reeves told the Commons.

– Energy bills

The Chancellor said she was taking action to get energy bills down and cut the cost of living, with an average of £150 cut from the average household bill from next year.

Ms Reeves said she would do this by scrapping the ECO (Energy Company Obligation) scheme introduced by the Tories in government, which she claimed had cost households £1.7 billion a year on their bills.

Budget ‘missed opportunity’ to tackle rising cost of living – O’Neill

Millions more dragged into paying higher income tax in Reeves’s £26bn Budget squeeze

‘I’m a landlord - renters will pay the price for Labour’s war on landlords’

Sir Grant Shapps criticises ‘catastrophic’ budget after receiving knighthood

Bank customer with ‘phobia of Pride flags’ loses case against NatWest

Budget does not go far enough in public service investment – Stormont minister