BTC Digital Ltd. (NASDAQ:BTCT) surged by over 35% in after-hours trading on Thursday. Renewed momentum in the crypto sector, marked by Bitcoin’s recent all-time high, is fueling this rally.

The stock’s price rose from $3.75 to $5.14, marking a 37.43% increase.

What Happened: The after-hours jump in BTCT’s stock price follows a period of relative stability. The digital asset platform’s stock has been trading between $3.42 and $3.85 over the past 24 hours, with a previous close of $3.46. The company’s market cap is currently at $28.19 million.

The surge in BTCT’s stock price came after the company announced significant progress in its Georgia mining project. The project is set to incorporate liquid-cooling technology, a development that has piqued investors’ interest.

Earlier in 2025, the company expanded its proprietary mining operations by deploying 400 new Bitmain Antminer T21 machines, adding about 76 PH/s of Bitcoin mining hash rate. This move was seen as a significant step in BTCT’s growth strategy.

Why It Matters: The recent gain in BTCT’s stock price comes at a time when the cryptocurrency market is experiencing a renewed surge. In May, shares of crypto-linked stocks and Bitcoin miners were trading higher after Bitcoin reached a new all-time high, rising above $110,000. This included companies like MARA Holdings Inc. (NASDAQ:MARA), Strategy Inc. (NASDAQ:MSTR), Canaan Inc. (NASDAQ:CAN), and HIVE Digital Technologies Ltd. (NASDAQ:HIVE).

BTCT’s recent stock surge also follows a trend of information technology stocks experiencing significant movements. In June, 12 Information Technology Stocks experienced significant movements in the after-market session, including BTCT and Alpha Modus Holdings (NASDAQ:AMOD).

Price Action: According to Benzinga Pro data, BTCT stock jumped 29.33% after hours to $4.85 following progress updates on its Georgia mining project.

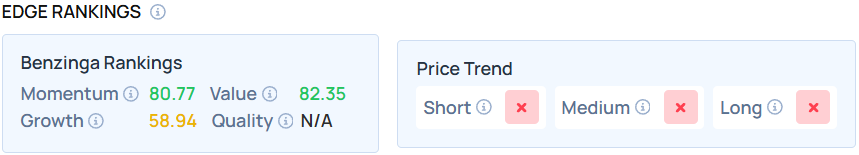

Benzinga Edge Stock Rankings highlights BTC Digital Ltd has a strong Value score of 82.35. Find out how rivals in the crypto asset industry rank.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock