/Broadridge%20Financial%20Solutions%2C%20Inc_%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Lake Success, New York-based Broadridge Financial Solutions, Inc. (BR) provides investor communications and technology-driven solutions for the financial services industry. With a market cap of $26.7 billion, Broadridge operates through Investor Communication Solutions (ICS), Global Technology and Operations (GTO), and other segments.

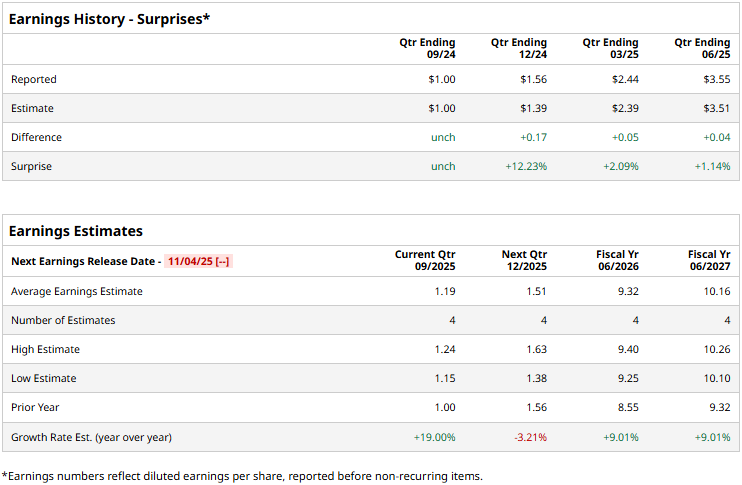

The financial IT services provider is gearing up to announce its first-quarter results before the market opens on Tuesday, Nov. 4. Ahead of the event, analysts expect BR to report a non-GAAP profit of $1.19 per share, up a staggering 19% from $1 per share reported in the year-ago quarter. Furthermore, the company has matched or surpassed analysts’ earnings expectations in each of the past four quarters.

For fiscal 2026, Broadridge is expected to deliver an adjusted EPS of $9.32, up 9% from $8.85 in fiscal 2025. While in fiscal 2027, its earnings are expected to increase 9% year-over-year to $10.16 per share.

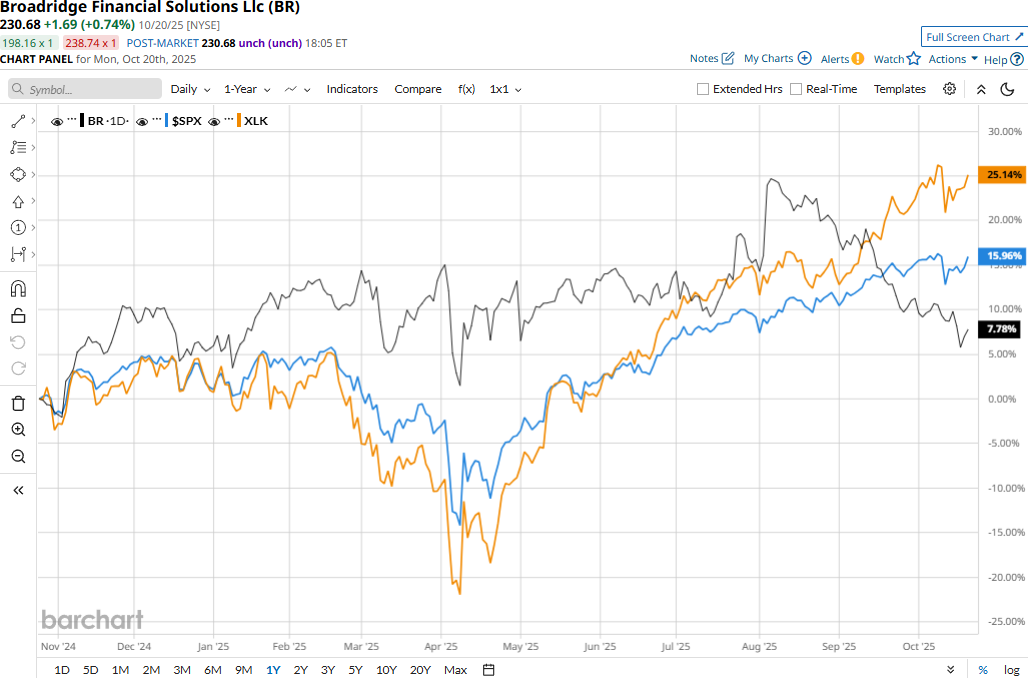

Broadridge’s stock prices gained 5.3% over the past 52 weeks, notably lagging behind the S&P 500 Index’s ($SPX) 14.8% gains and the Technology Select Sector SPDR Fund’s (XLK) 24.8% surge during the same time frame.

Broadridge Financial’s stock prices surged 6.8% in the trading session following the release of its better-than-expected Q4 results on Aug. 5. The company’s products have continued to help innovate and modernize capital markets and the wealth management industry. Its revenues for the quarter increased by 7.4% year-over-year to $1.4 billion, surpassing the consensus estimates by 61 bps. Meanwhile, due to margin contraction, its adjusted EPS inched up by a modest 1.4% year-over-year to $3.55, but surpassed the Street expectations by 1.1%.

Further, Broadridge remains confident in its 2026 growth trajectory. The company expects its recurring revenues to increase 5% - 7% on a constant currency basis and adjusted EPS to surge 8% - 12%.

However, analysts remain cautious about the stock’s prospects. BR maintains a consensus “Hold” rating overall. Of the nine analysts covering the stock, opinions include three “Moderate Buys” and six “Holds.” Its mean price target of $277.57 suggests a 20.3% upside potential from current price levels.