/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) has a trailing twelve-month revenue of just below $60 billion. So when someone comes out with a $100 billion annual revenue estimate, people notice. If that someone is J.P. Morgan, investors pay even closer attention.

This is precisely what transpired earlier this week. J.P. Morgan analyst Harlan Sur came out with a positive note on three chip giants: Nvidia (NVDA), Advanced Micro Devices (AMD), and Broadcom (AVGO). He has called the growth figures for these companies conservative due to funding and execution concerns. He believes the AI accelerator market should continue to grow at a 40-50% CAGR.

Furthermore, he also added that Broadcom generating $100 billion in revenue by 2027 is a reasonable forecast. His estimates show that revenue from the OpenAI deal could be between $70 billion and $90 billion, as opposed to Wall Street estimates of $60 billion. Add in $20 or so from Google (GOOG) (GOOGL), and $100 billion looks like a reasonable estimate. Where many in the industry thought AI infrastructure spending had peaked, OpenAI is showing it hasn’t, and Broadcom is a big beneficiary of that.

About Broadcom Stock

Broadcom is a designer and supplier of semiconductor devices, networking equipment, and infrastructure software solutions. The company is headquartered in Palo Alto, California.

AVGO has delivered over 45% returns so far in 2025, which is 2.7x higher than the Nasdaq Composite’s returns of 16.97%. In the process, the stock touched its all-time high of $374.23 during the second week of September. The stock seems destined for more gains given their recent deal with OpenAI and an anticipation of over $100 billion in revenues from the AI space by 2027.

Given the surge in share price in 2025, one might see Broadcom as an overbought scrip. But the context behind such a bullish trend applies to many of its peers too, who are also witnessing a similar momentum amid accelerated activities within the AI space. AVGO currently trades at a forward GAAP price-to-earnings (P/E) multiple of 80.5x and a forward price-to-cash flow (P/CF) multiple of 49.1x. Although these appear to be inflated multiples at first. However, when compared with close peers such as AMD and ARM Holdings (ARM), the perception changes. AMD is currently priced at a forward GAAP P/E multiple of 104.2x and a forward P/CF multiple of 67.3x. ARM, on the other hand, trades at a forward GAAP P/E multiple of 193.7x and a forward P/CF multiple of 121.4x. In terms of enterprise value-based metrics, which incorporate a company’s leverage, the forward EV/EBITDA multiples for AVGO, AMD, and ARM currently stand at 39.9x, 57.3x, and 79.5x, respectively.

AVGO is among the rare dividend plays within its sector, exhibiting a five-year dividend growth rate of around 13%. The stock is currently offering a payout ratio of 37.5%, having delivered 14 consecutive years of annual dividend growth. The dividend yield of around 0.7% might not spark too much interest given the current valuation, but a quarterly payout frequency might entice investors looking for regular income. AVGO announced a second-quarter dividend of $0.59 per share back in September.

Broadcom Outpaces Revenue and Earnings Consensus

AVGO revealed its third-quarter performance on Sept. 4, and the results showed outperformance compared to consensus estimates. The company recorded revenues of almost $6 billion, beating estimates by over $129 million. The normalized EPS stood at $1.69, marginally outperforming the consensus by 2%. The results came after strong results in AI semiconductor solutions and the VMware segments.

During the second quarter earnings call, AVGO management provided guidance for the third quarter. Accelerated growth forecasts in AI semiconductors led to revenue projections of $15.8 billion for the quarter, along with 66% adjusted EBITDA margins.

While the earnings were also full of insights, some comments made by CEO Hock Tan at the Goldman Sachs Communacopia + Technology Conference 2025 on Sept. 9 are interesting. He was asked about 2027 revenues, and he refused to give an exact figure. However, he did say that his contract extension until 2030 was tied to one indicator: revenue. Without stating it directly, he told analysts to get the hint. If he is confident he can deliver to get the incentives of that contract extension, investors should be too.

What Analysts Are Saying About AVGO Stock

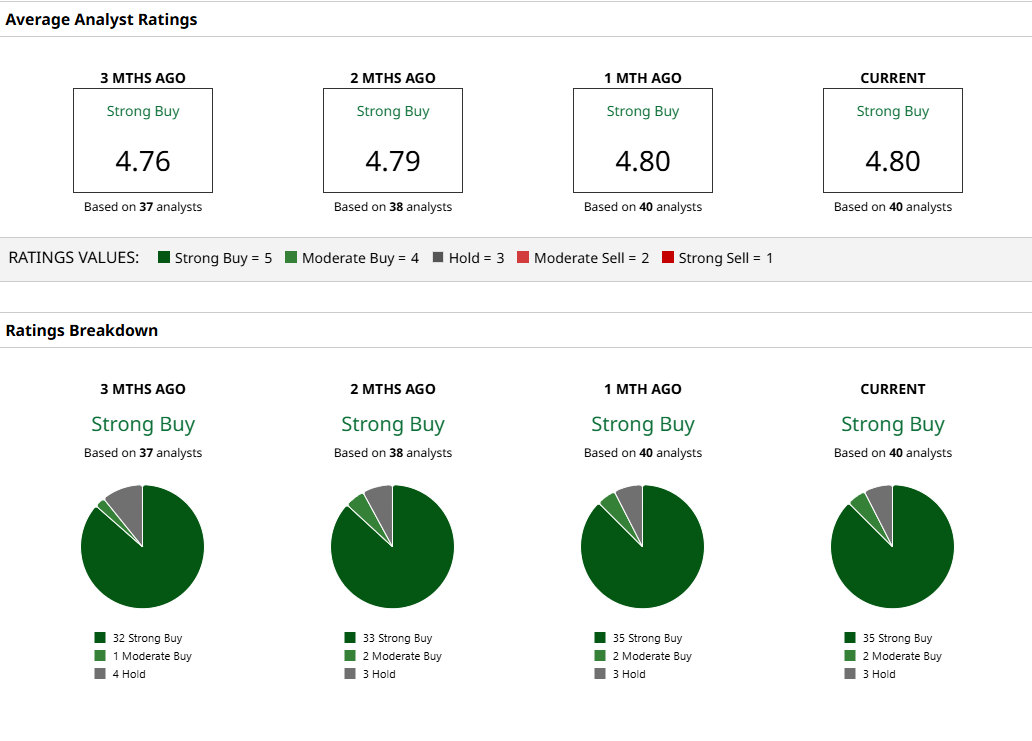

40 analysts on Wall Street cover AVGO, and 35 of them have a “Strong Buy” rating. The “Strong Buy” ratings are increasing as more analysts join in on the coverage. Two others give it a “Moderate Buy,” and three say “Hold.” There are no “Sell” ratings on the stock.

The highest target price of $460 presents upside of over 33%, but more interestingly, despite AVGO's stellar rally of 49% year-to-date (YTD), the average target price also offers more than 15% upside.