Broadcom Inc.’s (NASDAQ:AVGO) CEO, Hock Tan, is doubling down on Ethernet as the default interconnect for the AI era, saying the company's networking architecture is essential for training large language models at scale.

AVGO shares are testing new highs. Track the latest developments here.

‘The Network Is The Computer’

During the company’s third-quarter earnings call on Thursday, Tan declared, “The network is the computer,” as he laid out the company’s AI infrastructure roadmap, spanning intra-rack scale-up, rack-to-rack scale-out, and data center-to-data center scale-across.

Tan emphasized that traditional architectures are struggling to keep up with evolving AI demands, noting that “customers are facing challenges as they scale to clusters beyond 100,000 compute nodes.”

See Also: Broadcom Vs. Nvidia: The AI Chip War You’re Not Watching

He then framed Broadcom's recently launched Ethernet solutions, such as the Tomahawk 6 and Jericho 4, as critical enablers of high-bandwidth, low-latency connectivity across massive AI clusters.

He contrasted Broadcom's open Ethernet approach with proprietary protocols like NVLink and UA Link, saying that “there's no need to go and create some cooked-up protocols,” emphasizing that its open approach was better than the closed ones pioneered by competitors.

Tan suggested that as more customers build their own custom AI accelerators, Ethernet will become increasingly dominant. "We are openly enabling Ethernet as a networking protocol of choice… with XPUs, for sure, it's all Ethernet,” he said.

Earnings Beat Estimates As Growth Accelerates

Broadcom released its third-quarter results on Thursday, reporting $15.95 billion in revenue, up 22% year-over-year, and ahead of consensus estimates at $15.83 billion. The semiconductor company reported a profit of $1.69 per share, which was again ahead of analyst estimates at $1.65 per share.

The company’s performance during the quarter was primarily led by continued strength in its custom AI accelerators, alongside its networking and VMware segments.

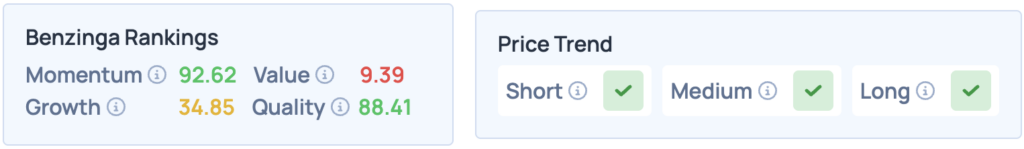

The stock was up 1.23% on Thursday, closing at $306.10, and is up 7.30% pre-market, following its earnings announcement. According to Benzinga’s Edge Stock Rankings, the stock scores high on Momentum and Quality, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Ken Wolter via Shutterstock