/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

The AI chip market is growing at a rapid pace, with the global semiconductor industry expected to top $697 billion in revenue this year, an increase of more than 11% from 2024, according to Statista. Much of this growth is being driven by generative AI and rising demand from large tech platforms.

In this environment, Broadcom (AVGO) landed its fourth major AI customer, which multiple analysts believe to be OpenAI, through a $10 billion order for specialized AI server racks. The company disclosed on Sept. 5 that the customer placed production orders for its custom-designed artificial intelligence chips.

Following the announcement, AVGO stock jumped 19.54% in just five days. The company also reported record revenue of $15.95 billion for Q3 2025, up 22% from the prior year, with its AI semiconductor revenue climbing 63%.

The challenge now lies in valuation. Does this OpenAI partnership justify adding AVGO shares to portfolios at current prices, or has the recent rally pushed the stock beyond attractive entry points? Let’s find out.

How Broadcom’s Earnings Stack Up

Broadcom operates across both semiconductors and infrastructure software, with a business that ranges from building custom chips for hyperscalers to offering VMware-based enterprise solutions. This mix has paid off for investors.

AVGO has climbed more than 131% over the past year and is up another 45% so far in 2025.

The move has pushed valuations higher, with a forward price-to-earnings (P/E) ratio of 61x, well above the sector average of 24x. Even at those levels, Broadcom continues to offer income support through dividends, yielding 2.30% compared to the technology sector’s 1.37%. The company has increased its payout for 15 years in a row and now pays $0.59 per share each quarter, with a forward payout ratio of 25.8%, leaving plenty of room for future growth.

The latest financial results explain why investors are willing to pay a premium. Revenue for the third quarter reached a record $15.95 billion, up 22% year-over-year (YoY). Profitability remained strong, with adjusted EBITDA of $10.7 billion, or 67% of revenue. GAAP net income came in at $4.14 billion, while non-GAAP figures nearly doubled that at $8.4 billion. Diluted earnings per share were $0.85 on a GAAP basis and $1.69 on a non-GAAP basis, showing the strength of underlying operations. Free cash flow was also impressive, coming in at $7.02 billion, equal to 44% of sales, reflecting Broadcom’s ability to convert revenue into consistent cash returns.

What’s Powering Broadcom’s Next Leg of Growth

The single biggest driver for Broadcom right now is a $10 billion order for custom AI chips, widely believed to be from OpenAI. Reports indicate the two companies worked together to design semiconductors that are expected to launch next year.

This adds OpenAI to Broadcom’s existing roster of major customers like Alphabet (GOOG) (GOOGL), Meta (META), and ByteDance. Winning a hyperscaler of this size strengthens Broadcom’s position in the fast-growing AI market and creates a steady source of demand in one of the most expensive areas of technology.

Alongside its chip business, Broadcom is leaning on software to win enterprise deals. A recent partnership with Walmart (WMT) highlights this approach. Broadcom was tapped as a strategic vendor for virtualization software, using VMware Cloud Foundation to modernize Walmart’s private cloud and edge operations around the world. These kinds of relationships have the potential to deliver recurring, long-term revenue from companies outside the hyperscaler group.

Broadcom is also expanding deeper into the AI ecosystem through new partnerships. Its collaboration with Nvidia (NVDA) will bring advanced AI capabilities into VMware Cloud Foundation, helping enterprises and cloud providers train and deploy new models more easily. At the same time, Broadcom’s expanded partnership with Canonical focuses on optimizing container-based and AI workloads, combining open-source software with VCF to cut costs and speed up the delivery of next-generation applications.

What Wall Street Sees Ahead for Broadcom

Looking to the fourth quarter of fiscal 2025, Broadcom expects revenue of about $17.4 billion, which would be a 24% increase from last year, with adjusted EBITDA likely to hold near a strong 67% margin. Analysts forecast earnings per share of $1.48 in October 2025, up 18.4% from the same quarter a year ago.

HSBC recently reinforced this positive trend by upgrading Broadcom from “Hold” to “Buy” and raising its price target by 70% to $400. Analyst Frank Lee highlighted Broadcom’s ASIC, or application-specific integrated circuit, business as a key driver, saying it has been undervalued compared to its growth potential.

HSBC now projects ASIC revenue to reach $28.4 billion in fiscal 2026 and $42.8 billion in fiscal 2027, pointing to accelerating demand for customized, high-performance chips that Broadcom is well placed to deliver.

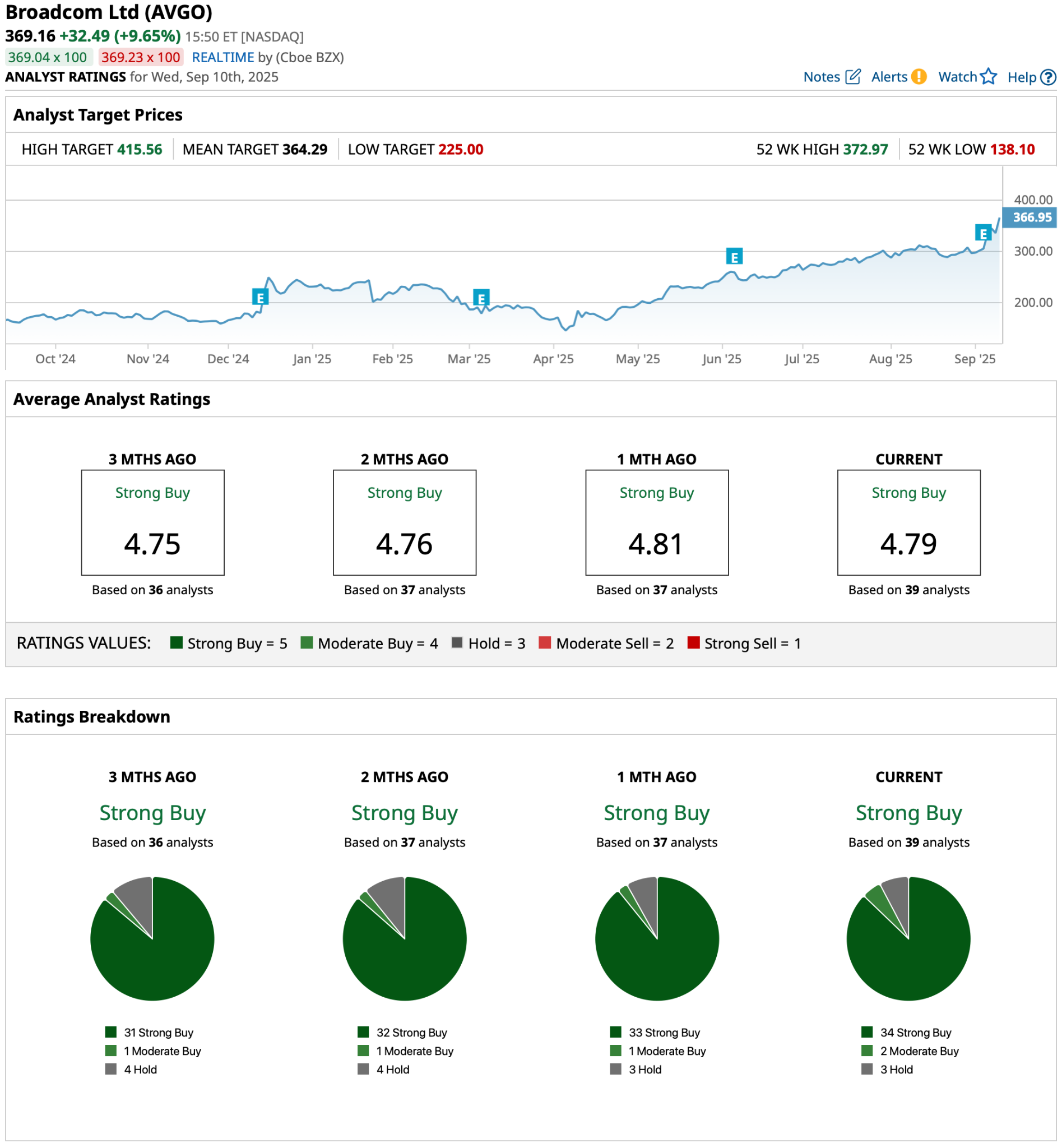

Other analysts share the same view. All 39 covering AVGO currently rate the stock a consensus “Strong Buy,” with the average price target set at $364.29. At a current share price of about $336.67, that leaves an expected upside of nearly 8.2% from here.

Conclusion

Broadcom’s reported $10 billion win with OpenAI is a game-changer, putting it firmly among the top tier of AI chip suppliers, but the stock isn’t cheap. At a forward P/E more than double the sector average, a lot of that optimism is already priced in. Still, with earnings accelerating, new enterprise partnerships rolling in, and analysts unanimously bullish, it’s hard to argue against adding AVGO if you’re thinking long term. Shares may see some near-term consolidation after the recent run-up, but the direction looks higher over the next year as AI adoption ramps up and Broadcom’s custom chip pipeline starts delivering in full.