/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Broadcom (AVGO) has announced a stock-based compensation plan for its chief executive officer, Hock Tan, which effectively binds his payout to the company achieving ambitious AI milestones.

Tan has received over 610,000 AVGO shares as part of his new contract, but they won’t fully vest unless the chipmaker generates at least $90 billion in AI revenue for any 12-month period between 2028 and 2030.

The company’s board has even agreed to double that award if AI revenue surpasses $105 billion – and as much as triple it if it goes beyond $120 billion.

Failure to hit $60 billion, though, will require Hock Tan to forgo the compensation in its entirety. At the time of writing, Broadcom stock is up some 150% versus its year-to-date low set in early April.

Why Tan’s New Contract Is Positive for Broadcom Stock

AVGO’s performance-linked equity award for CEO Hock Tan aligns executive incentives directly with long-term shareholder value.

By tying compensation to AI revenue milestones, the chipmaker signals confidence in its growth trajectory and commitment to artificial intelligence leadership.

This structure reduces short-termism, encourages strategic execution, and reassures investors that management is financially invested in delivering results.

If Broadcom hits these targets, it will mean massive growth in its AI business, likely driving earnings, valuation, and AVGO stock price higher.

Broadcom shares extended gains on today’s update, reflecting investors’ belief in both the feasibility of the goals and the credibility of Tan’s leadership.

AVGO Shares Seen Climbing to $400

Hock Tan’s new contract update arrives only days after Broadcom delivered a blockbuster quarter and an earnings call that some dubbed “the best we’ve seen all season.”

AVGO also announced a new $10 billion customer at the time that made Bank of America analysts raise their price on the AI stock to $400, indicating potential upside of another 10% from here.

According to the investment firm, the unnamed new client is likely OpenAI, and the announcement reinforces the narrative that AVGO stock is indeed “taking more share” in the fast-growing AI market.

How Wall Street Recommends Playing Broadcom

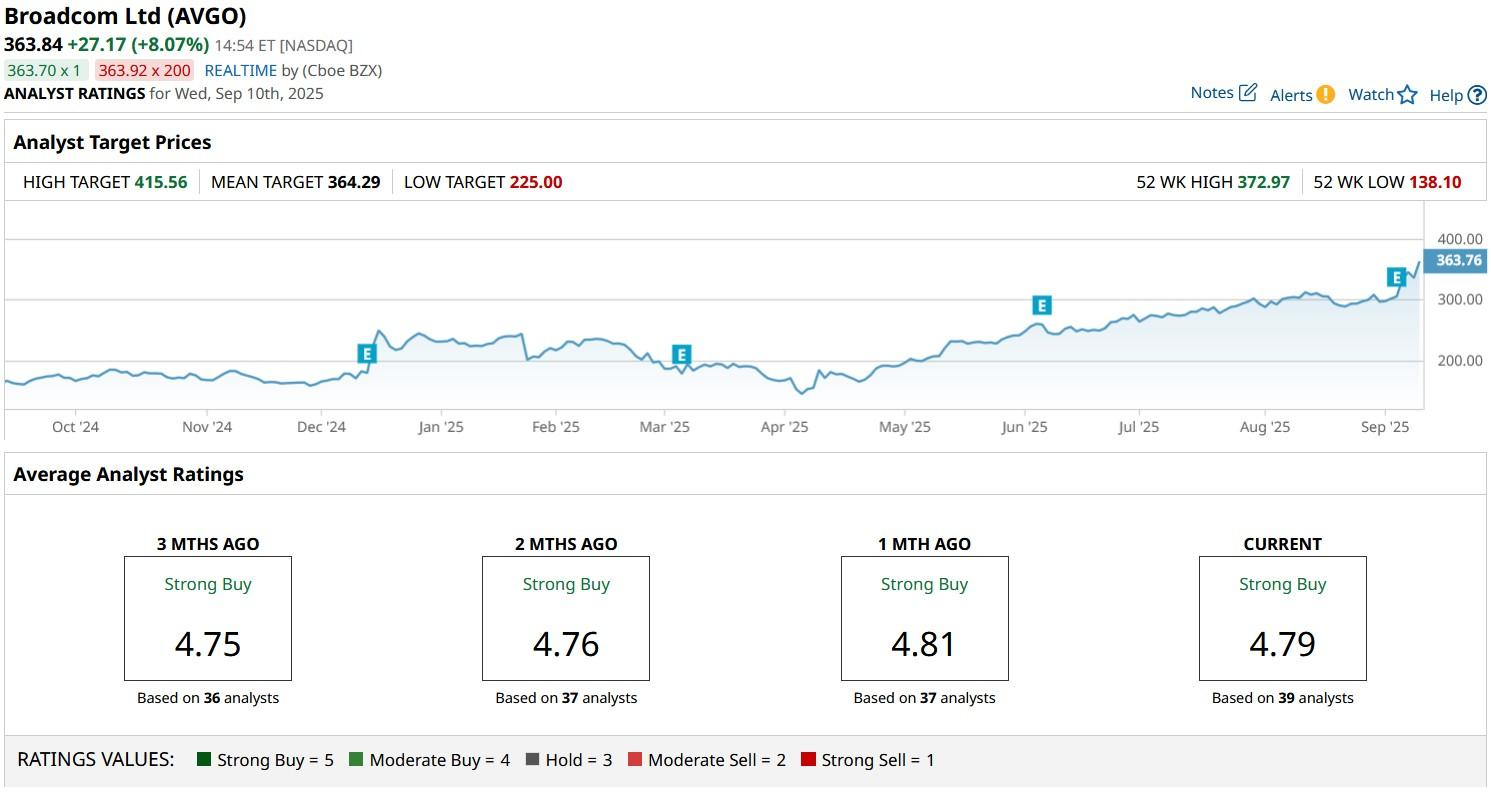

Other Wall Street analysts upwardly revised estimates for Broadcom stock after the company’s Q2 earnings this week.

The consensus rating on AVGO shares currently sits at “Strong Buy” with price objective going as high as $416, indicating potential upside up another 15% from here.