Broadcom Inc. (NASDAQ:AVGO) CEO Hock Tan said artificial intelligence could become a much larger part of the global GDP, at a time when AI-related investments are ramping up across industries.

AI Could Add $10 Trillion To Global Economy

In an interview with CNBC's Jim Cramer on Monday, Tan said the current global GDP sits around $110 trillion, with 30% of that figure "valued from industries related to knowledge-based, technology-intensive."

"And you put in generative AI, you create intelligence in a lot of other aspects of society,’ he said, adding, “That 30% will grow to 40% of all GDP. That's $10 trillion a year."

‘We Feel Very Good About It’: Tan On OpenAI Deal

Broadcom makes chips and networking equipment. It has been a huge beneficiary of the AI boom as hyperscalers buy up its products.

On Monday, the company announced a partnership with OpenAI to jointly build and deploy 10 gigawatts of AI accelerators.

Tan praised OpenAI as "one of those few players in the forefront of creating foundation models," highlighting the company's $500 billion valuation despite being privately held.

"We feel very good about it. Because each of these guys need a lot of compute capacity for them to basically play in this game and eventually win this game of creating the best foundation model in the world," Tan said.

Last month, Broadcom said it had secured $10 billion in chip orders from an unnamed client and is working closely with multiple major cloud and AI companies.

See Also: China's Silence Is Scarier Than Tariffs—5 Ways It Could Hit Trump Hard

Price Action: Broadcom shares climbed 9.88% to close at $356.70 on Monday, before falling 2.50% in Tuesday pre-market trading at last check, according to data from Benzinga Pro. Shares are up nearly 54% year-to-date.

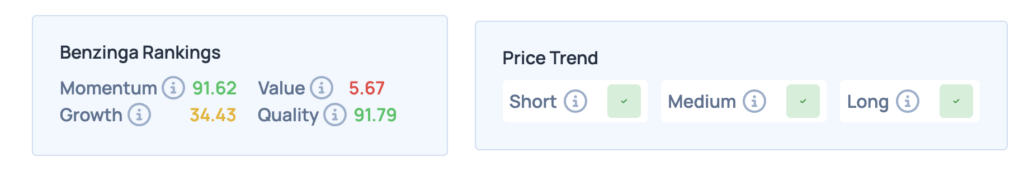

Benzinga’s Edge Rankings indicate strong momentum and quality for the stock, while value is low, suggesting it’s likely overvalued. The price trend is positive across short, medium, and long-term timeframes, signaling broad bullish sentiment.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock