The markets ended Friday on a high note and began Monday with a strong push higher. The same can be said for Bristol-Myers Squibb (BMY), which leaped this morning.

The New York drugmaker's shares were up as much as 8.3% shortly after the open and at last check were more than 5% ahead.

The rally comes after the company received Food and Drug Administration approval for its plaque-psoriasis treatment, Sotyktu. The news is also hitting Amgen (AMGN), with that company's shares down about 3.5% on the news. As TheStreet previously reported:

“The drug, which Bristol Myers said could launch as early as this month, is expected to challenge the $2.3 billion market current controlled by Amgen's Otezla therapy.”

Trading Bristol-Myers Squibb Stock

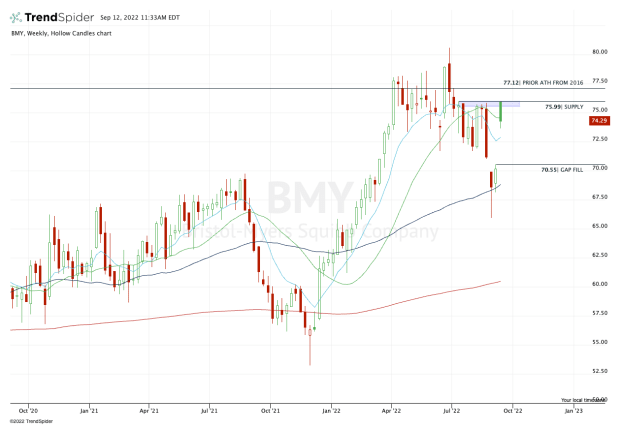

Chart courtesy of TrendSpider.com

It’s been a volatile stretch for Bristol Myers stock, which had a 13% peak-to-trough decline from Aug. 22 to Aug. 30, falling in six straight sessions.

At today’s high, though, the shares were up more than 15% from the Aug. 30 low, climbing in eight of nine trading sessions.

Three weeks ago, it gapped down to start the week. Now it’s gapping up and as the weekly chart above shows, it’s creating quite a bit of choppiness in the process.

Perhaps most interesting is today’s gap-up.

The move thrust Bristol Myers stock above the 10-week and 21-week moving averages -- but right into a critical supply area at $76. In a stretch that included six out of seven weeks, the shares traded above $75 but failed to close above $76.

In the trading world, that’s what we call “overhead supply” — essentially, resistance.

In that respect, take note of today’s high before the fade: $75.99.

On the plus side, it makes the upside level to watch quite obvious. A move over $76 (and even better, a close above it) could put Bristol Myers stock on pace to challenge its high near $80.

On the flip side, as long as it’s below $76, Bristol-Myers stock may struggle to maintain upside momentum.

If the selling pressure actually accelerates from current levels, it puts the gap-fill level near $70.55 back in play.