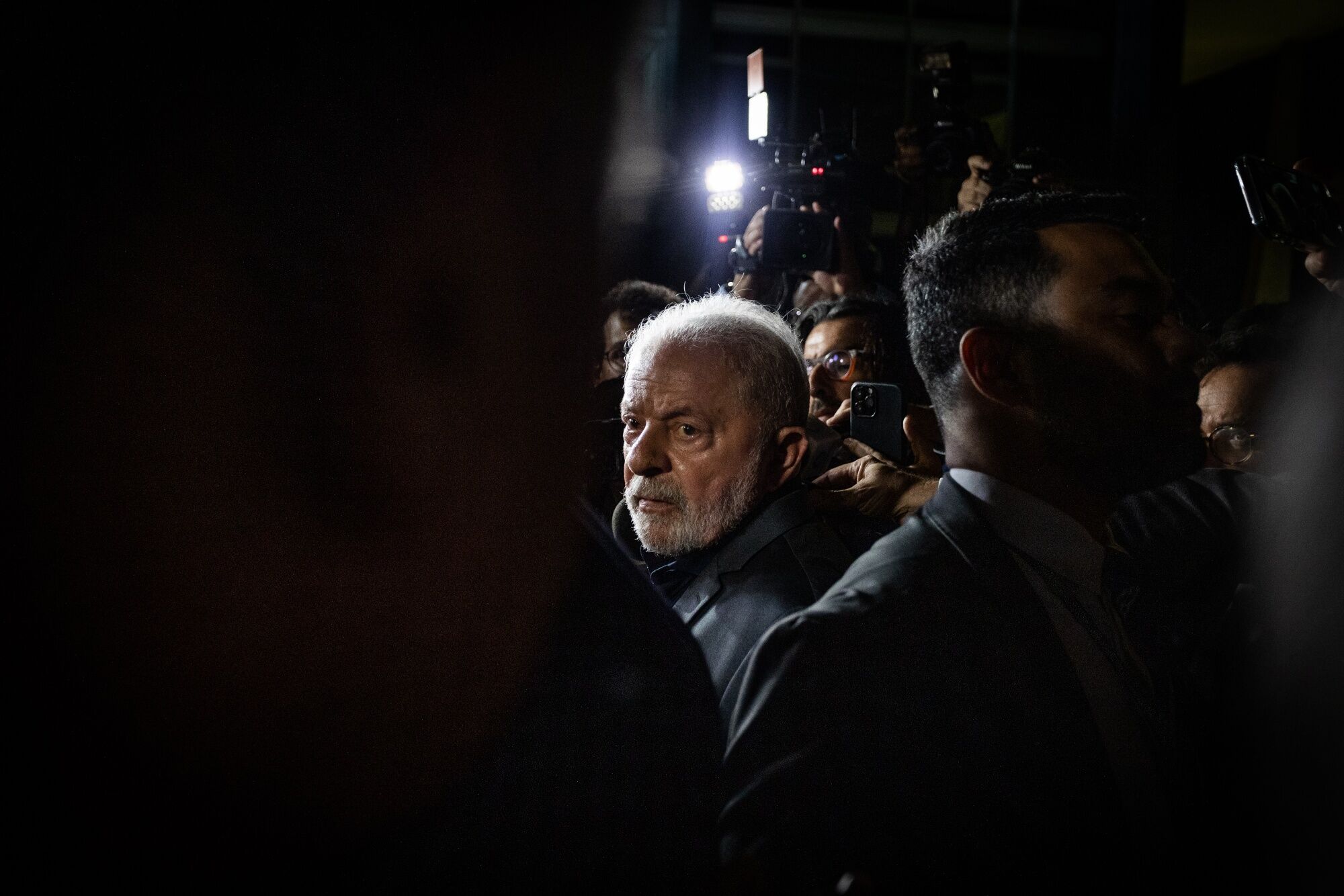

Brazil’s central bank kept its key interest rate unchanged, defying intense pressure from President Luiz Inacio Lula da Silva and his team for looser monetary policy.

The bank held the Selic at 13.75% for the fifth straight meeting late on Wednesday. In a statement, policymakers mostly kept the tone of their prior communications, including a warning of additional rate hikes if the pace of price increases doesn’t slow as expected. They also wrote that inflation expectations have shown “additional deterioration,” especially in longer-term forecasts.

“On one hand, the recent reinstatement of fuel taxes has reduced the uncertainty of the fiscal results in the short term,” they wrote. “On the other hand, the current scenario, marked by high volatility in financial markets and deanchored long-term inflation expectations from the targets, requires further attention when conducting monetary policy.”

The unanimous decision flies in the face of criticism from Lula and some of his closest aides, who have berated policymakers for holding borrowing costs at a six-year high at the expense of economic growth. Less than two hours after the central bank’s announcement, Finance Minister Fernando Haddad told reporters that the bank’s statement is “very concerning” because it leaves room for a rate hike. He added that the central bank may hurt Brazil’s fiscal accounts because “the economy needs to work” to support government tax income.

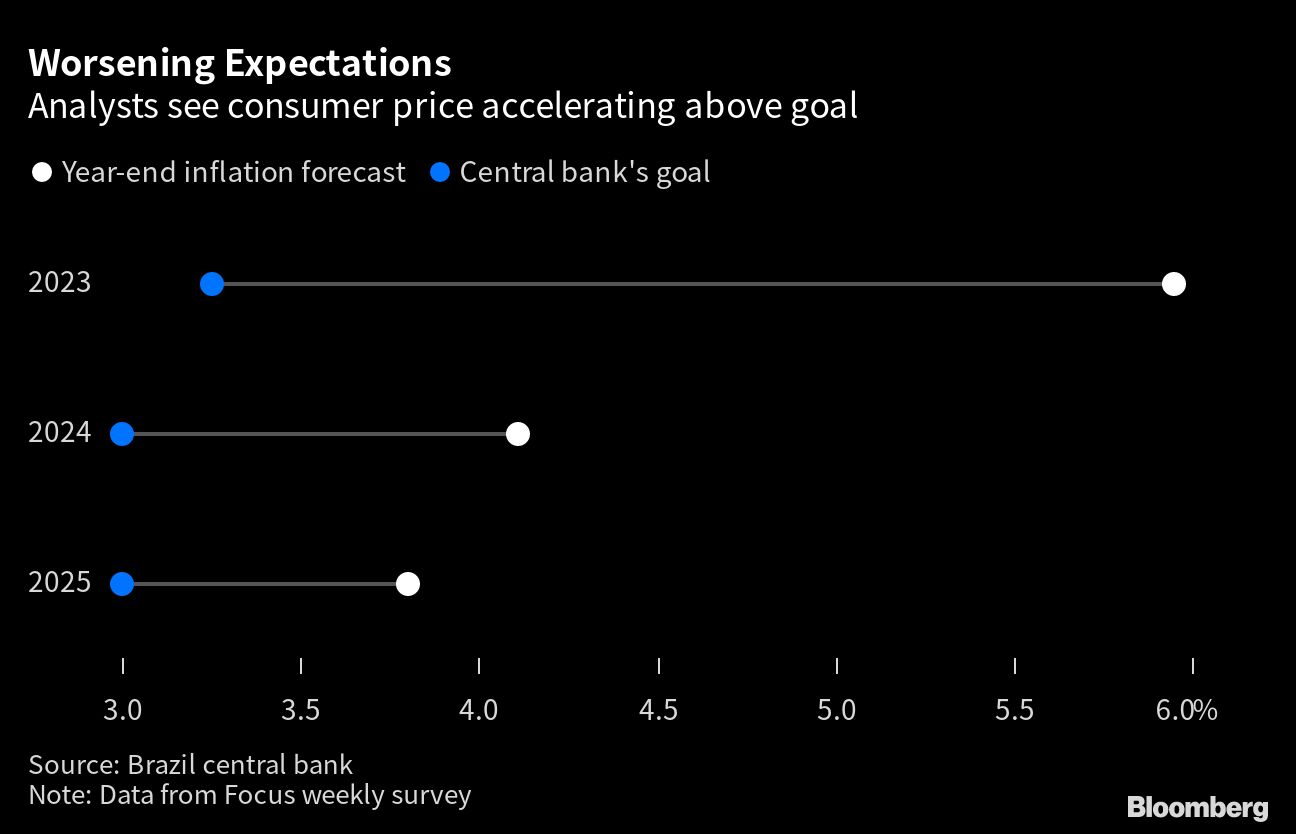

Board members led by Roberto Campos Neto are battling expectations that consumer prices will increase above target through 2025. Annual inflation has receded more slowly than forecast, and measures that strip out the most volatile items, like food and fuel, are on the rise.

The statement’s tone will likely boost swap rates and cause the real to outperform peer currencies on Thursday, leading traders to reassess bets on the possibility of a rate cut in May.

What Bloomberg Economics Says

“The tone of the Brazilian central bank’s post-meeting statement after leaving the policy rate unchanged on Wednesday was more hawkish than we expected. Markets may come away recognizing the BCB’s commitment to the inflation targets. Politicians, however, will likely note there was no reference to a forthcoming rate cut, while language leaving a hike on the table remained. That should increase criticism of the BCB’s board, its independence and the country’s inflation targets.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

Brazil’s decision came hours after the Federal Reserve’s move to increase rates by a quarter percentage point and signal that more hikes may be in the pipeline, despite the recent banking crisis.

‘Truly Absurd’

Lula has argued for lower rates since taking office in January. The leftist leader intensified his criticism on Tuesday, which was the start of the bank’s two-day policy meeting, calling the interest rate “truly absurd” and asserting that Campos Neto “doesn’t care” about job creation.

His chief of staff, Rui Costa, followed suit just a few hours before the rate decision, saying that the central bank chief is doing a “disservice to Brazilians” by keeping borrowing costs at current levels.

“It was a very hawkish statement that’s certainly going to create a lot of noise within the government, but Campos Neto held firm,” said Daniel Weeks, chief economist at Garde Asset Management. “The board surprised the market, in the sense that the market was already pricing in the chance of a rate cut at the next meeting.”

In recent weeks, Haddad has advanced a series of fiscal measures he says will create room for a rate cut. He reinstated higher taxes on fuel and sped up work on a new fiscal framework in an effort to ease concerns about government spending and Brazil’s debt outlook.

Internal debates over key elements of the fiscal proposal, however, prevented the government from finalizing and publicly releasing it before the rate decision meeting.

Bank Credibility

In their statement, policymakers wrote that activity indicators have been in line with the central bank’s expectations for a domestic slowdown. At the same time, the global environment has deteriorated, and “episodes” involving banks in the US and Europe have increased uncertainty.

Still, board members raised their 2023 inflation forecast to 5.8% and their 2024 estimate to 3.6%. By comparison, the central bank targets annual inflation at 3.25% this year and 3% next.

“The policy statement is hawkish and jives with the fact that the inflation forecasts for both 2023 and 2024 moved further up,” said Alberto Ramos, chief Latin America economist at Goldman Sachs & Co. There is “no indication of near-term rate cuts. The credibility of the central bank is reinforced by the clear-eyed message.”

--With assistance from Martha Beck, Josue Leonel and Giovanna Serafim.

©2023 Bloomberg L.P.