Apple Inc. (NASDAQ:AAPL) Original Films' high-octane racing drama "F1" gunned past expectations with an estimated $144 million worldwide launch, handing the tech giant its first bona-fide box-office victory while premium IMAX screens supplied nearly a fifth of the fuel.

What Happened: The Brad Pitt vehicle sped to $55.6 million in the U.S. and Canada, with IMAX patrons accounting for 23% of domestic sales, according to the company and studio estimates.

IMAX said its large-format auditoriums delivered $28 million globally, or 19% of total revenue — the fourth-highest opening-weekend share in the format's history behind "Dune," "Mission: Impossible — Ghost Protocol" and "Oppenheimer."

Moviegoers paid up for the "affordable luxury". Research firm EntTelligence, noted by The Hollywood Reporter, pegs the average IMAX ticket at $19.51, about 40% above the $13.82 standard stub, a premium IMAX chief Richard Gelfond has trumpeted for months.

The victory easily eclipsed pre-release projections of about $115 million and followed $10 million in Thursday previews.

Why It Matters: "F1" also out-accelerated Apple's earlier theatrical attempts which include spy caper "Argylle," space-race dramedy "Fly Me to the Moon" and Martin Scorsese's prestige epic "Killers of the Flower Moon," which topped out at $158.8 million worldwide on a reported $200 million budget.

However, the Cupertino company may struggle to replicate the feat without IMAX turbo-boosts, as implied by Business Insider’s James Faris. Faris points out that only 19% of global screens carry the format and rivals now jockey for the same premium real estate.

Apple has not disclosed production costs, but industry trackers cited by Variety place "F1" north of $250 million after extensive on-track filming with Formula 1 teams. Its next wide release, spy thriller "Ghost Satellite," is slated for December and lacks confirmed IMAX dates, which is likely to serve as a test of whether Apple's newfound momentum can survive on standard screens.

According to Benzinga Pro data, Apple’s stock is down 14.78% year-to-date and has declined 4.12% over the past 12 months.

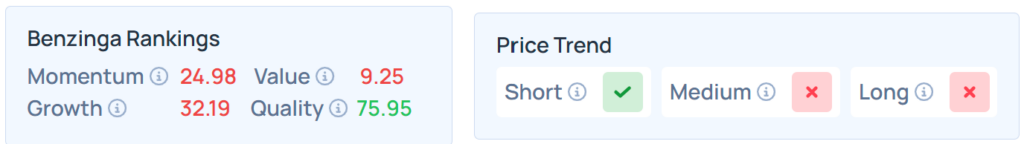

Benzinga’s Edge Stock Rankings indicate that Apple’s shares continue to trend lower across medium and long-term periods. Additional performance details can be found here.

Photo Courtesy: Michael Potts F1 on Shutterstock.com

Read Next: