/Boston%20Scientific%20Corp_%20logo%20on%20iPad-%20by%20Kate%20Krav-Rude%20via%20Shutterstock.jpg)

Boston Scientific Corporation (BSX), headquartered in Marlborough, Massachusetts, develops, manufactures, and markets medical devices for use in various interventional medical specialties globally. With a market cap of $157.9 billion, the company’s products are used in interventional cardiology, cardiac rhythm management, peripheral interventions, electrophysiology, neurovascular intervention, endoscopy, and more.

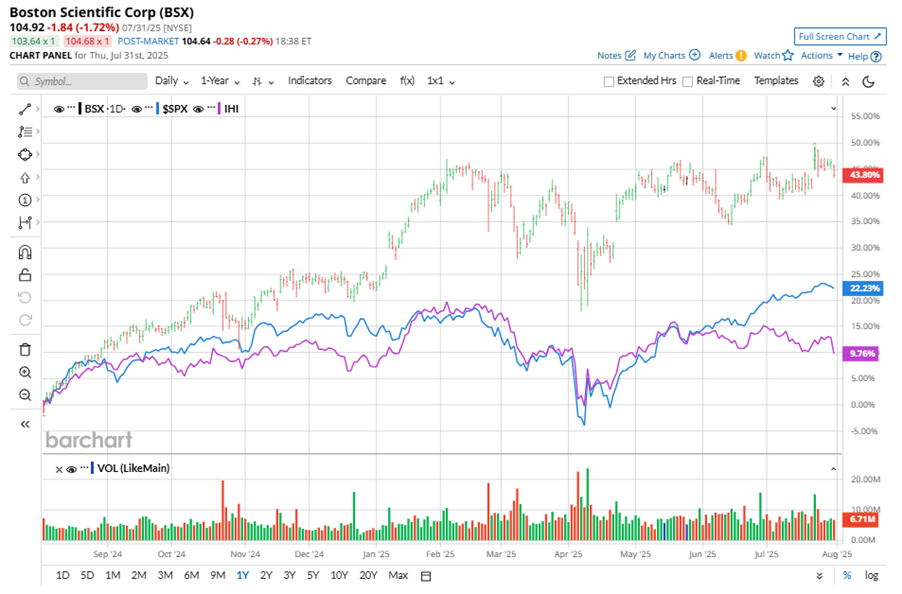

Shares of this medTech giant have outperformed the broader market over the past year. BSX has gained 41.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.6%. In 2025, BSX stock is up 17.5%, surpassing the SPX’s 7.8% rise on a YTD basis.

Zooming in further, BSX’s outperformance is also apparent compared to the iShares U.S. Medical Devices ETF (IHI). The exchange-traded fund has gained about 9% over the past year. Moreover, BSX’s double-digit gains on a YTD basis outshine the ETF’s 2.3% gains over the same time frame.

BSX's strong performance can be credited to its robust product portfolio and dedicated global team. Key achievements in the second quarter include FDA approval for expanding the FARAPULSE PFA System, initiation of the ReMATCH IDE trial, and securing CE Mark for the WATCHMAN FLX Pro device in Europe. The company also finalized the acquisitions of Intera Oncology and SoniVie, enhancing its offerings in liver cancer and hypertension treatment technologies.

On Jul. 23, BSX shares closed up more than 4% after reporting its Q2 results. Its adjusted EPS of $0.75 beat Wall Street's expectations of $0.72. The company’s revenue was $5.1 billion, exceeding Wall Street forecasts of $4.9 billion. The company expects full-year adjusted EPS in the range of $2.95 to $2.99.

For the current fiscal year, ending in December, analysts expect BSX’s EPS to grow 18.7% to $2.98 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

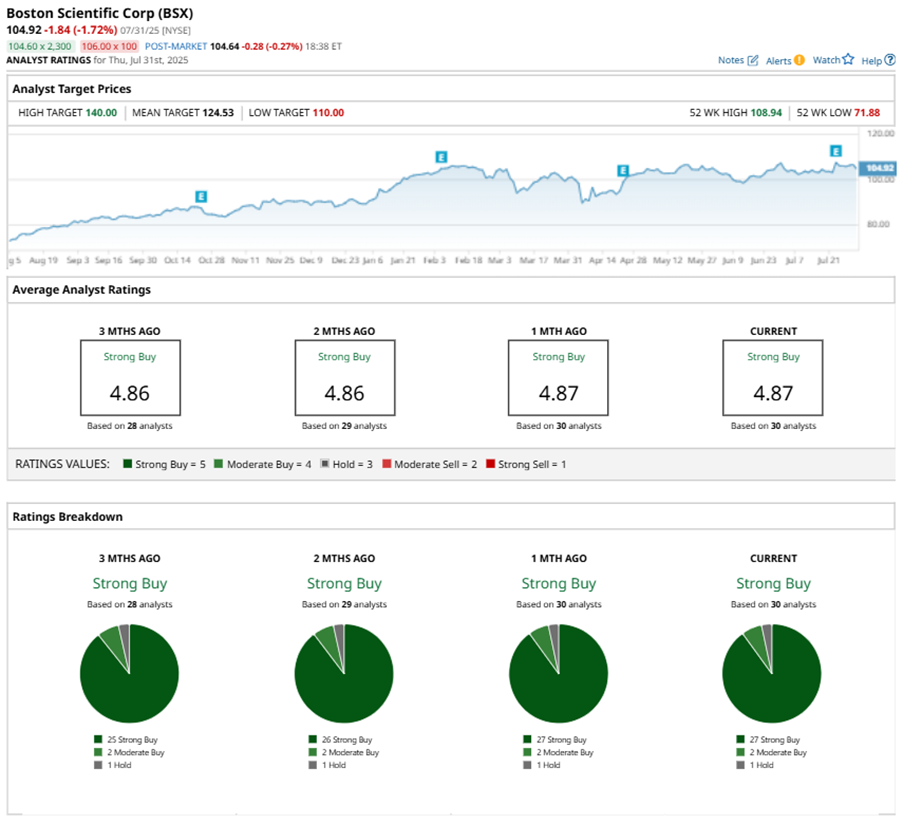

Among the 30 analysts covering BSX stock, the consensus is a “Strong Buy.” That’s based on 27 “Strong Buy” ratings, two “Moderate Buys,” and one “Hold.”

This configuration is more bullish than two months ago, with 26 analysts suggesting a “Strong Buy.”

On Jul. 24, Raymond James Financial, Inc. (RJF) analyst Jayson Bedford maintained a “Buy” rating on BSX with a price target of $124, implying a potential upside of 18.2% from current levels.

The mean price target of $124.53 represents an 18.7% premium to BSX’s current price levels. The Street-high price target of $140 suggests an ambitious upside potential of 33.4%.