/Booking%20Holdings%20Inc%20app%20and%20website%20by-AlexandraPopova%20via%20Shutterstock.jpg)

Headquartered in Norwalk, Connecticut, Booking Holdings Inc. (BKNG) has grown into one of the world’s largest online travel service providers. With a market cap of $166.3 billion, the company manages a portfolio of prominent brands, including Booking.com, Priceline, Agoda, and Kayak, that collectively serve travelers in over 220 countries and territories.

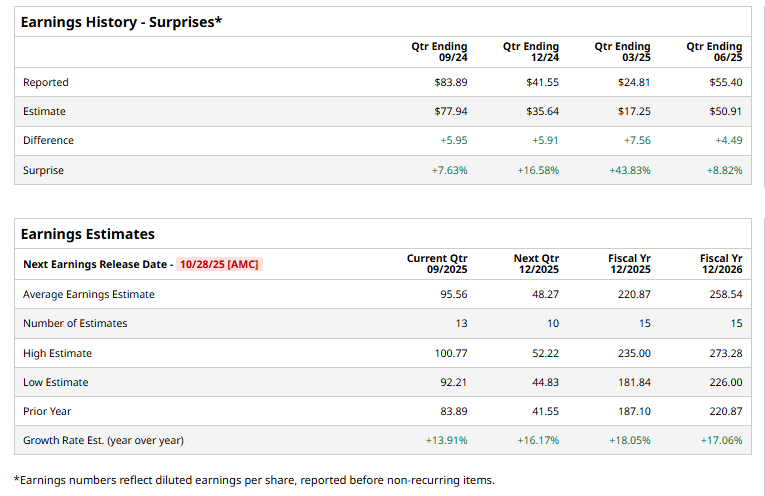

The booking company is set to report its third-quarter earnings after market close on Tuesday, Oct. 28. Ahead of the event, analysts expect BKNG to report a profit of $95.56 per share, up 13.9% from $83.89 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the current year, analysts expect Booking Holdings to report an EPS of $220.87, up 18.1% from $187.10 in fiscal 2024.

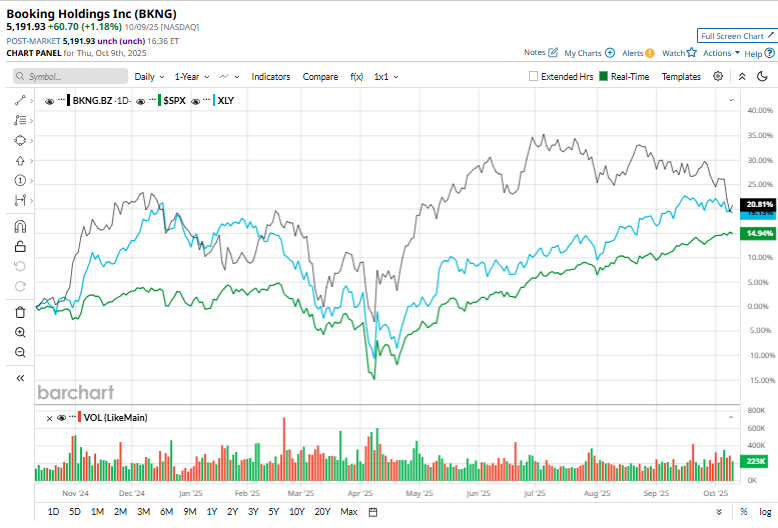

Booking Holdings' shares have gained 21% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 16.3% gains and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 18.6% returns over the same period.

Over the past year, Booking Holdings has outperformed the broader market, fueled a rebound in international travel, and experienced robust demand from high-income travellers. Ongoing technology investments and its diverse portfolio of leading travel brands have also contributed to sustained growth and reinforced its position as a market leader.

On Oct. 9, BKNG shares climbed 1.2% after BTIG analyst Jake Fuller reiterated a “Buy” rating on Booking Holdings, setting a $6,250 price target.

The consensus opinion on BKNG stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 38 analysts covering the stock, 22 advise a “Strong Buy” rating, two suggest a “Moderate Buy” rating, and 14 suggest a “Hold.”

The average target price for BKNG is $6,081.41, indicating a potential upside of 17.1% from the current price levels.