Investors shouldn’t read too much into Friday’s advance in Indian bonds, which follows a slower-than-estimated rise in inflation last month.

That’s because the softer headline number masks an increase in demand-side pressures, which is what the central bank looks to manage through interest rates. The so-called core inflation climbed to 4.6 percent in September from 4.5 percent in August, according to estimates from Deutsche Bank AG.

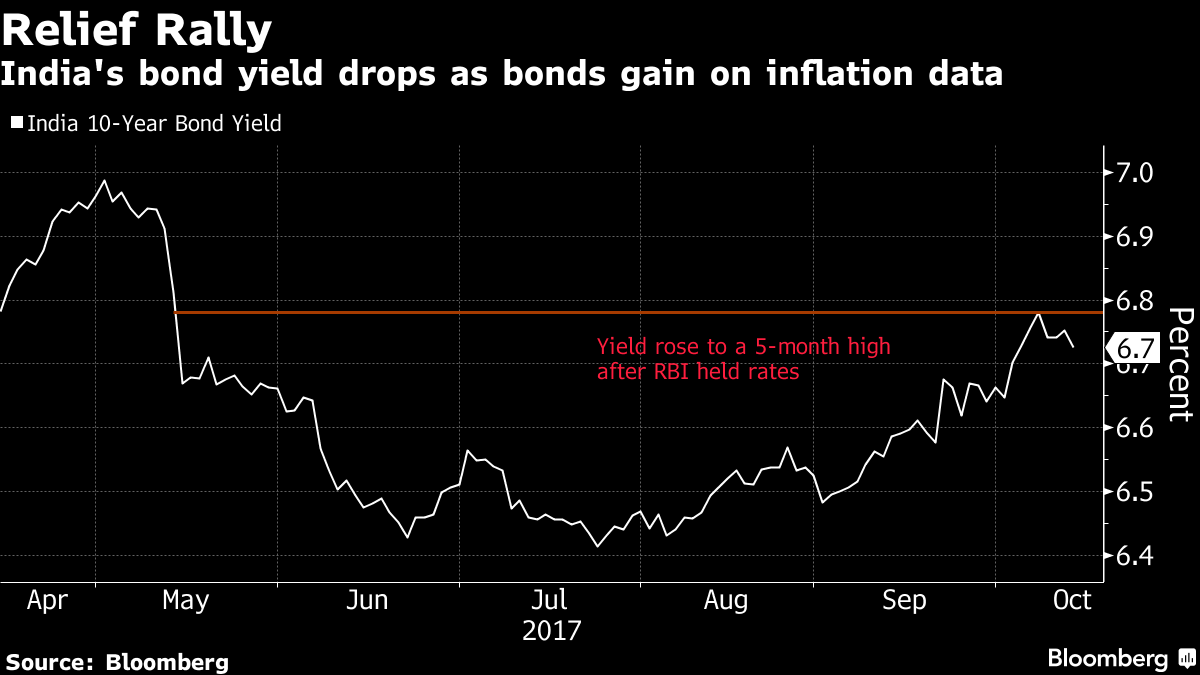

Consumer prices rose 3.28 percent in September from a year earlier, slower than the 3.53 percent median estimate in a Bloomberg survey. The benchmark 10-year bond yield fell 3 basis points to 6.73 percent in Mumbai on Friday. It reached the highest since mid-May on Monday after the Reserve Bank of India last week held rates steady, raised inflation forecasts and reiterated a neutral policy stance.

September’s CPI data is unlikely to sway the inflation-targeting RBI into cutting rates anytime soon, according to Deutsche Bank and Morgan Stanley.

Also, other negatives for the bond market remain: rising debt supply, central bank’s open-market operations to drain banking-system liquidity, a potential widening of India’s fiscal deficit and likely higher U.S. interest rates.

To contact the reporter on this story: Kartik Goyal in Mumbai at kgoyal@bloomberg.net.

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Shikhar Balwani, Ravil Shirodkar

©2017 Bloomberg L.P.