Bolt Projects Holdings Inc. (NASDAQ:BSLK) is on a decline in pre-market trading on Thursday, a day after surging over 550%.

Check out the current price of BSLK stock here.

Market Volatility Strikes Biotech After Record Gains

Bolt Projects shares fell 26.54% in pre-market trading to $10.52 on Thursday, despite closing up 556.88% at $14.32 during the regular trading session on Wednesday, as per Benzinga Pro data.

The biomaterials company’s extreme volatility followed robust second-quarter earnings and announcement of potential $20 million financing.

Strong Revenue Growth Drives Initial Rally

The Berkeley, California-based company reported second-quarter revenue of $1.3 million from its Vegan Silk Technology Platform, a 23-fold increase from $56,000 in the prior year period. The company achieved positive gross margins ahead of internal estimates through operational efficiencies and pricing discipline.

“Demand for Vegan Silk continues to grow, resulting in positive gross margins a quarter ahead of estimate,” said Dan Widmaier, Chairman and CEO. Bolt maintained full-year revenue guidance of $4.5 million for 2025 and $9.0 million for 2026, introducing new gross profit targets of $500,000 and $1.0 million, respectively.

See Also: Apple Supplier Foxconn Profit Set For 11% Jump As AI Server Boom Powers Record Revenue: Report

A non-binding term sheet Bolt entered with Ascent Partners LLC for up to $20 million in preferred stock and equity line financing also contributed to this gain.

Profit-Taking Pressure Mounts

The after-hours decline in the stock of the biotech innovator follows classic momentum stock behavior, where retail and short-term traders who rode the 557% wave begin taking profits.

With average daily volume around 3.94 million shares and the stock’s 52-week range spanning $1.75 to $340.40, BSLK exhibits the extreme volatility typical of low-cap biotech stocks during major catalysts. It has a market capitalization of $29.52 million.

Underlying Concerns Resurface

Despite positive earnings, fundamental challenges remain visible. Bolt holds only $1.0 million in cash as of June 30, down from $3.5 million at year-end 2024. The company also received a NASDAQ delisting notice on August 12.

These factors may have contributed to investor caution following the initial surge, as the $20 million Ascent Partners financing deal still requires shareholder approval and depends on stock price thresholds.

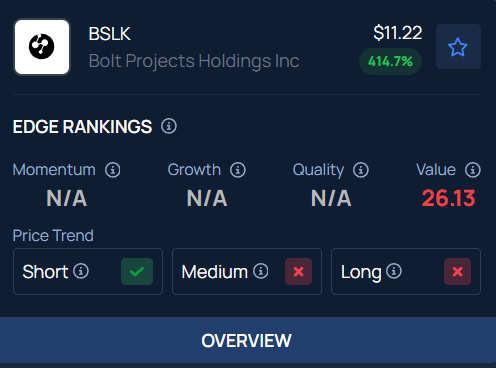

Benzinga's Edge Stock Rankings indicate that BSLK has a positive price trend over the short term. Know how its momentum lines up with other well-known names.

Read Next:

Photo courtesy: Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.