The decision of the Bank of Japan on Friday to leave its large-scale monetary easing policy unchanged brought to the fore the fact that the central bank is still far from realizing its 2 percent inflation target as an exit strategy for its quantitative monetary relaxation measures.

Amid the U.S. Federal Reserve Board and the European Central Bank heading toward the normalization of their monetary policies, it has become clear that the Bank of Japan is being left behind them in coping with monetary easing.

Deflationary mind-set

In providing a reason for the slowing of inflation, BOJ Gov. Haruhiko Kuroda said at a press conference following the Monetary Policy Meeting on Friday: "Medium- and long-term inflation expectations aren't rising much. A sort of deflationary mind-set has persisted, which can be said to be a factor that does not exist in the United States and Europe."

Kuroda's reasoning is based on his analysis that the mind-set in which prices will not rise is deeply ingrained into companies and consumers after they experienced low economic growth and deflation for 15 years from 1998 to 2013.

The core consumer price index, excluding volatile fresh food prices, rose a slight 0.7 percent in April from a year earlier. The central bank plans to examine reasons for sluggish inflation at the next Monetary Policy Meeting in the end of July.

Fed takes initiative

The Fed has spearheaded the exit strategy to normalizing large-scale monetary easing measures.

In response to the robust economic recovery in the United States, achieving its 2 percent inflation target, the Fed raised its key interest rate to a range of 1.75 percent to 2 percent on Wednesday.

On Thursday, the ECB, which governs 19 eurozone countries including Germany and France, decided to end its quantitative easing program by the end of this year as it has become more confident of achieving a desirable price level, largely changing its direction toward financial normalization.

In contrast, the BOJ did not move to modify its monetary easing measures.

On Friday, the central bank decided to continue guiding 10-year Japanese government bond yields to around zero and maintaining the quantitative easing measure for purchasing JGBs at "an annual pace of increase in the amount outstanding of its JGB holdings of about 80 trillion yen."

Asked about the exit strategy at the press conference, Kuroda only repeated his conventional view: "It's too early to talk about a specific method or process of normalization and exit strategy at the moment."

Future risks

With the BOJ being left behind in crafting an exit strategy, there will likely be some future risks.

If the country's economy enters recession, the BOJ will not be able to prevent the economic contraction from worsening because monetary easing measures it can take to stimulate the economy are limited.

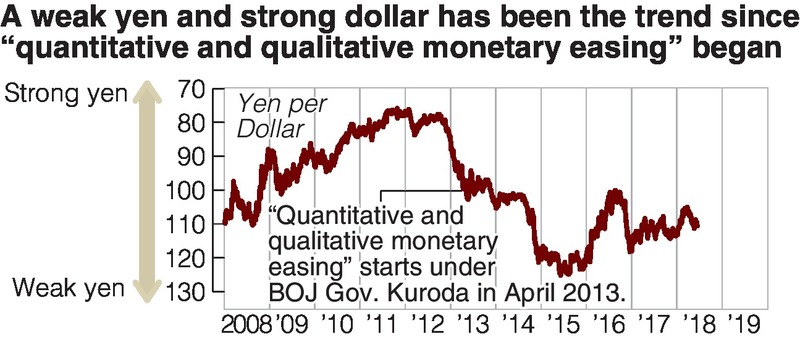

There is also concern that the BOJ's inability over an exit strategy may cause a sharp rise in the value of the yen. Observers view that the United States, which is leading the global economy, may enter recession as early as 2019, which may bring a slowdown to the global economy. If that is the case, it is widely seen that central banks in the United States and Europe will return to a policy of strengthening monetary easing measures.

Because pursuing monetary easing measures is a factor that triggers a sell-off of a country's currency, Japan, which does not have much room for implementing monetary easing measures compared with the United States and Europe, will likely face strong upside pressure on the yen.

The Japanese economy is steady, with corporate earnings having reached a record-high level and the unemployment rate having fallen to a 2 percent level. However, prices are not rising, which is a hard-to-solve problem.

Hideo Hayakawa, a senior executive fellow at Fujitsu Research Institute and a former executive director of the BOJ, stressed that the BOJ needs to move toward a revision of its policies, even at a stage under which the inflation target has yet to be achieved.

"It takes time to achieve the inflation target," Hayakawa said. "[The BOJ] should have discussions to revise its monetary policies to prepare for a possible next shock [such as a financial crisis] by taking into account side effects [of its current policies] and other factors."

Read more from The Japan News at https://japannews.yomiuri.co.jp/