The Bank of Japan decided Tuesday to modify its massive monetary easing policy, effectively allowing long-term interest rates to rise higher. The BOJ's policy to guide 10-year Japanese government bond yields to around zero will be made more flexible.

The decision, which was made at the Monetary Policy Meeting, was aimed at reducing the side effects of the easing policy, as the prolongation of the policy has become inevitable in light of lower inflation forecasts.

The board also decided to maintain the easing policy itself, aiming to guide the short-term interest rate to minus 0.1 percent and long-term interest rate to around zero.

The board noted in its statement that "the yields may move upward and downward to some extent mainly depending on developments in economic activity and prices."

As for the amount of Japanese government bonds to be purchased, the BOJ said it would keep its target to increase purchases at an annual pace of about 80 trillion yen, but "will conduct purchases in a flexible manner."

The board decided by a 7-2 vote to modify the policy for long-term interest rates.

The central bank also clarified its stance to persistently continue the easing policy until it meets the 2 percent increase in the rate of the consumer price index (CPI).

As a future guideline for policy rates, the BOJ intends to "maintain the current extremely low levels of short- and long-term interest rates for an extended period of time," taking into account the effects of the consumption tax rate hike scheduled to take place in October 2019. The board passed on additional easing measures.

The BOJ had taken a stance of not allowing the long-term interest rate to hover above 0.1 percent. When the 10-year JGB yield had been about to go above 0.1 percent, the bank had stemmed the surge through fixed-rate operations, in which the bank purchases unlimited volumes of JGBs at a designated yield. From now on, however, the BOJ will likely take means to allow a temporal surge as long as the rise will not greatly deviate from the level of around zero.

The annual interest rate on a portion of money that private financial institutions deposit at the Bank of Japan is minus 0.1 percent, but the bank will reduce the size of this policy-rate balance to which a negative interest rate is applied, from the current size of about 10 trillion yen.

The central bank currently buys 6 trillion yen worth of exchange-traded funds (ETFs) per year, but will take a more flexible approach to the pace of purchasing ETFs. The Bank of Japan has decided to do so as it was pointed out that price formation in the stock market has been skewed.

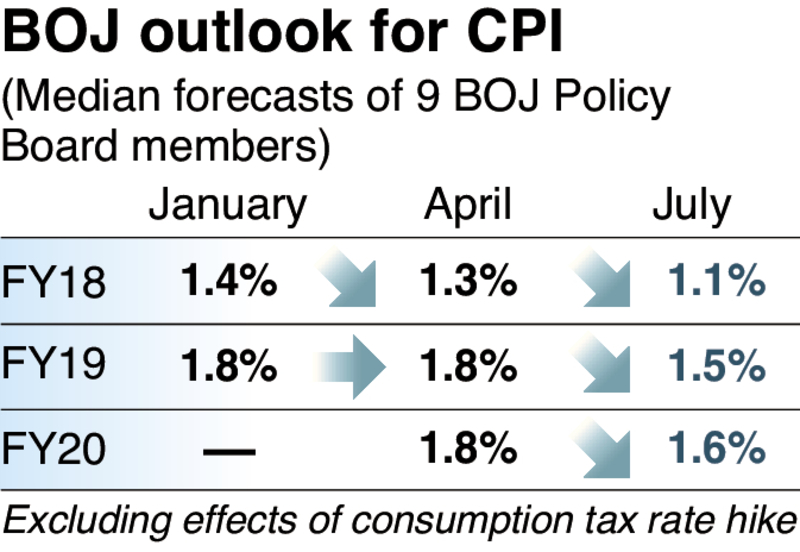

In the Outlook for Economic Activity and Prices report, which was released following the monetary meeting, the central bank revised downward its forecast for the annual inflation rate from that in April.

The bank lowered its forecast of the CPI (all items less fresh food) from 1.3 percent to 1.1 percent for fiscal 2018, from 1.8 percent to 1.5 percent for fiscal 2019, and from 1.8 percent to 1.6 percent for fiscal 2020.

While Bank of Japan Gov. Haruhiko Kuroda said at a press conference in April that the inflation rate "will highly likely hit the 2 percent target around 2019," it has become difficult to realize the target.

As the timing of achieving the inflation target was pushed back, the large-scale monetary easing policy -- which has been ongoing since 2013 -- will be extended for a longer period.

According to observers, the continued ultralow interest rates will bring adverse effects as banks will experience downward pressure on corporate earnings and the bond market will fall into a state of paralysis due to declining trading volumes. There also is the issue of difficulties in managing pension funds. The prolonged monetary easing policy is expected to further intensify these adverse effects.

BOJ settles into endurance game as inflation target remains elusive

By Kojiro Sekine / Yomiuri Shimbun Staff Writer

The Bank of Japan reviewed its monetary easing measures during Tuesday's policy-setting meeting, apparently forced to consider growing criticism regarding the side effects that have stemmed from the prolonged implementation of the measures.

With the early achievement of its 2 percent inflation target still out of sight, the BOJ will have to play a game of endurance. The central bank will likely encounter difficulty in steering its monetary policy.

Under Haruhiko Kuroda, who assumed the BOJ governorship in spring 2013, the central bank has continued to implement large-scale monetary easing measures. Kuroda initially pledged to achieve the 2 percent inflation target "with a time frame of about two years in mind." However, price increases have been sluggish since then.

In September 2016, the BOJ changed the main target for its monetary policy from the "quantity" of government bonds it purchases to "interest rates," switching its tactic to an endurance game.

Regarding the prospects of achieving the 2 percent inflation target, the BOJ removed the time frame -- "around fiscal 2019" -- in the April policy-setting meeting. As a result, bewilderment spread in the financial markets -- how long will the BOJ continue monetary easing measures? -- making it difficult to say how the central bank's policy will turn out.

It is a welcome development that the BOJ gave consideration to the side effects and revised its policy. It must make efforts to mitigate these side effects while paying close attention to the financial markets in the future.

Read more from The Japan News at https://japannews.yomiuri.co.jp/