Boeing posted a narrower-than-expected first-quarter loss Wednesday, but it cautioned that a recovery in production for its workhorse 737 Max jet will take time after a series of manufacturing and safety issues culminated in the Alaska Airlines door-plug incident earlier this year.

Shares in the group turned lower in mid-day trading, however, after U.S. Transportation Secretary Pete Buttigieg said the planemaker won't be able to increase its 737 Max production rates until the end of a 90-day Federal Aviation Administration quality-control probe, which started in late February.

Boeing (BA) , which has reported only one profitable quarter over the past four years, reported an adjusted core loss of $1.13 per share, down from the $1.27 a share loss it reported over the same period last year and besting the Wall Street consensus forecast of a loss of $1.76 per share.

Group revenues fell 7.5% from a year earlier to $16.57 billion, narrowly topping analysts' consensus forecast of a $16.23 billion tally.

Related: GE Aerospace leaps after boosting profit forecast following historic split

Boeing delivered 83 aircraft to customers over the three months ended in March, the company said, including 67 of its 737 Max jets and 13 of its 787 Dreamliner. The group booked orders for 111 new planes as well, taking its overall backlog to around $529 billion.

Adjusted free cash flow was pegged at negative $3.9 billion for the quarter, however, putting its longer-term goal of $10 billion in free cash flow by 2025 or 2026 at significant risk as production slows amid safety checks and regulatory probes.

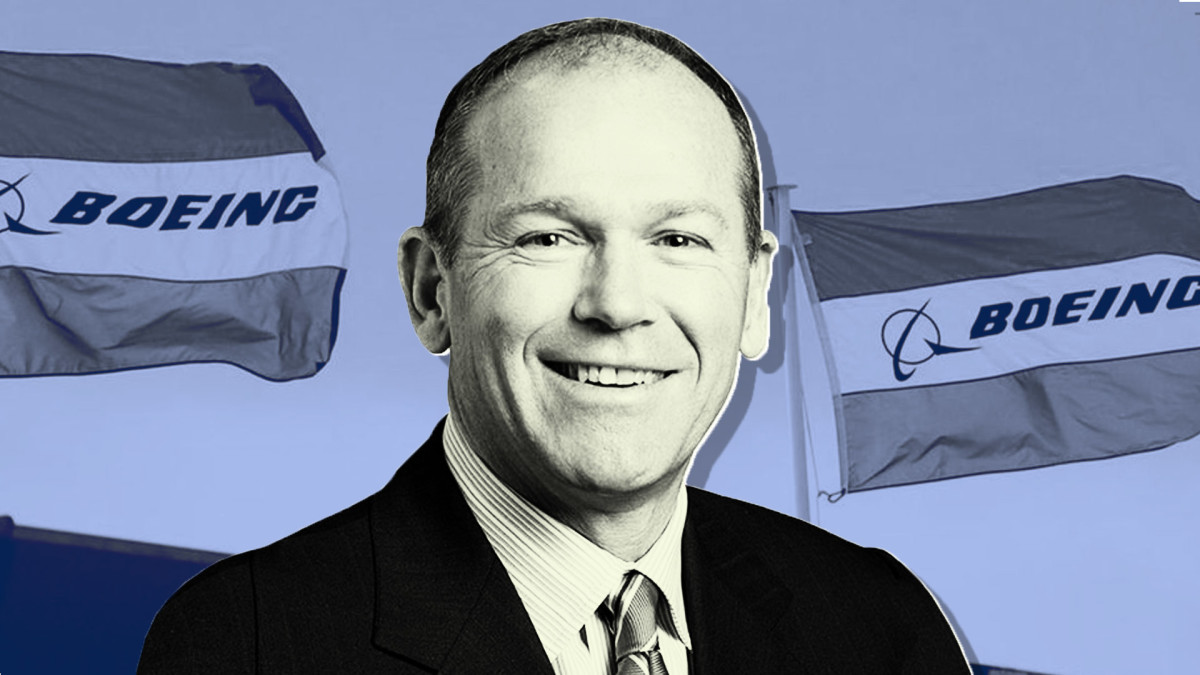

"Our first-quarter results reflect the immediate actions we've taken to slow down 737 production to drive improvements in quality," said CEO Dave Calhoun. "We will take the time necessary to strengthen our quality and safety management systems, and this work will position us for a stronger and more stable future."

Blackstone/TheStreet Illustration/ Getty

Boeing shares, which rose as much as 3.6% in early trading, were last marked 0.16% lower at 168.90 each, a move that extends the stock's year-to-date decline to around 33%.

Calhoun stepping down later this year

Late last month, Calhoun, who has led the group since 2020, said he would step down at the end of this year. Stan Deal, Boeing's highly respected head of its commercial aircraft division, is also opting to retire.

Boeing has suffered a series of major safety issues over the past five years, with the second of two major disasters in 2019, the fatal crash of a Boeing 737 Max in Ethiopia, leading to the resignation of then CEO Dennis Muilenburg.

Related: Got stocks? Don't panic

Boeing's years-long effort to win back trust in the safety of its workhorse jet, which was grounded by virtually every aviation administration in the world, found support when the planemaker won permission to resume deliveries of the 737 Max aircraft to China, the world's biggest aircraft market, earlier this year.

However, Calhoun's effort suffered a major setback shortly after when a door plug on a different version of the aircraft blew open during an Alaska Airlines flight.

More Wall Street Analysts:

- Analyst unveils new Nike price target ahead of big summer for sports

- Analysts weigh in on Google-parent Alphabet’s stock after cloud event

- Analysts revamp Disney stock price target after proxy fight

Calhoun said the incident, which triggered the grounding of hundreds of Max 9 flights, as well as investigations by both the Federal Aviation Administration and the National Transportation Safety Board, left him "shaken to the bone."

The FAA has said Boeing won't be able to expand its current 737 Max production rate until the probes are complete and the aerospace stalwart can ensure the fleet's ultimate safety.

Calhoun's position, however, became increasingly untenable after reports emerged last week that several major U.S. airline CEOs asked to meet with Chairman Larry Kellner to discuss safety concerns and the likely delay of scores of planes over the coming years tied to various probes into Max safety.

Related: Veteran fund manager picks favorite stocks for 2024