Boeing stock climbed 2.36% after President Donald Trump revealed that Uzbekistan Airways has entered into an agreement with Boeing Co. (NYSE:BA) for the purchase of up to 22 Boeing 787 Dreamliners, while reports of Turkey ordering Boeing follow.

Boeing’s Uzbekistan And Reported Turkey Deal

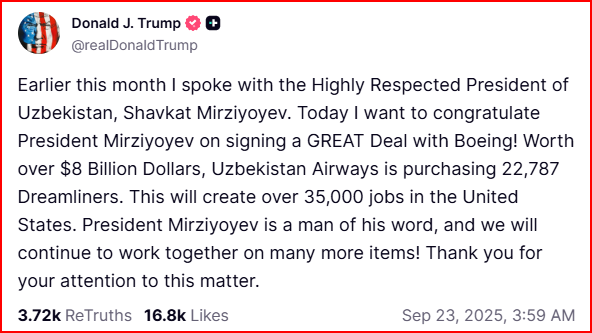

Trump disclosed the deal on Monday on his Truth Social, stating that the order will support approximately 35,000 jobs in the U.S.. The deal, worth $8.5 billion, is considered to be the largest commercial aircraft agreement of its kind in Central Asia, with the Commerce Department valuing it at $8.5 billion. Boeing also announced the same via press release. Uzbekistan Airways is set to purchase 14 Dreamliners with an option for an additional eight, as per the deal.

Check out the current price of BA stock here.

Meanwhile, Turkish President Tayyip Erdogan is said to be preparing a major purchase of hundreds of Boeing aircraft and Lockheed Martin (NYSE:LMT) jets, along with pursuing more than $10 billion in local production agreements, according to Bloomberg. The deals, pending Trump's approval, are expected to come up during Erdogan's meeting with him at the White House on September 25.

Trump expects to conclude trade and defense agreements at the meeting, including a major Boeing aircraft purchase, a substantial F-16 deal, and ongoing F-35 discussions with Turkey. On Monday, Erdogan said that Turkey would discuss acquiring F-35 fighter jets in the talks.

See Also: Hex Trust CEO Alessio Quaglini Says US Rules To Unlock Bitcoin's Next Wave – Benzinga

Lawmakers in Beijing Push Boeing-China Jet Deal

A bipartisan group of U.S. lawmakers visiting Beijing discussed a potential agreement for China to purchase additional Boeing jets, reported Reuters on Tuesday.

U.S. Ambassador to China David Purdue said the negotiations are nearing completion and are "very important to the president." Representative Adam Smith, leading the delegation, stressed the significance of Boeing rebuilding its presence in the Chinese market.

Boeing's Recovery Gains Pace Amid Legal Challenges

The deal between Uzbekistan Airways and Boeing comes at a time when Boeing’s operational recovery is gaining momentum. The increase in aircraft deliveries for its key 737 MAX and 787 programs is signaling a potential rebound in cash flow and overall financial performance for the aerospace giant.

Boeing’s stock has been performing well, with Bank of America Securities analyst Ronald J. Epstein reaffirming a Buy rating on Boeing Co. with a $270 price forecast, pointing to stable deliveries and cash flow recovery as catalysts for stronger results.

However, Boeing is also facing legal challenges, with families of victims from a deadly crash in India filing a lawsuit against the aerospace giant and Honeywell International Inc. (NASDAQ:HON). The families claim that a defective fuel cutoff switch caused the disaster, which resulted in the deaths of 242 people on board and 19 others on the ground.

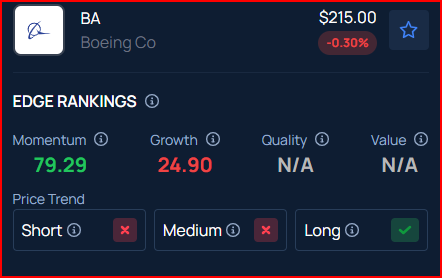

Benzinga’s Edge Rankings place Boeing in the 79th percentile for momentum and the 25th percentile for growth, reflecting its strong performance in both areas. Check the detailed report here.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.