/Boeing%20Co_%20plane-by%20Wirestock%20via%20iStock.jpg)

Aerospace and defense giant Boeing (BA) has faced scrutiny over the past few months due to some operational and financial challenges. Last month, this scrutiny was heightened after a Boeing 787 passenger jet crashed minutes after takeoff, resulting in the loss of more than 240 lives.

However, preliminary findings from the crash recently showed that the fuel control switches in the cockpit had been turned to effectively cut off fuel to the engines. This also made it clear that Boeing was likely not the cause of the crash. The Federal Aviation Administration (FAA) and Boeing both reported that the company’s fuel switch locks were safe to use.

This news led to BA stock surging to a fresh 52-week high. With its recovery gaining momentum, should you consider investing now, before the firm reports second-quarter earnings later this month?

About Boeing Stock

Founded in 1916 and headquartered in Arlington, Virginia, Boeing is one of the largest aerospace companies worldwide. With a market capitalization of $173 billion, Boeing manufactures commercial jetliners, defense systems, and space technology.

The company’s iconic aircraft models include the 737, the 777, and the 787 Dreamliner. In addition to its commercial operations, Boeing also supports military operations and space exploration initiatives.

This key player in the global aerospace industry is facing scrutiny and an uncertain climate following the recent crash. However, the company’s order numbers remain relatively robust, indicating that airlines continue to place their trust in Boeing.

Boeing delivered 150 commercial airplane programs in Q2 and has made 280 deliveries year-to-date (YTD). The company reported that it delivered 60 airplanes in June alone. In May, Qatar Airways announced that it would purchase up to 210 wide-body jets, setting a new record as the most significant wide-body order for Boeing. This includes the largest order for 787 Dreamliners and Qatar Airways' largest-ever order to date.

So far this year, BA stock has gained 30%, indicating that its recovery is well underway. On July 15, shares reached a 52-week high of $233.61.

Over the past 52 weeks, Boeing stock has gained 25%. This could be predicated upon the company’s recent leadership changes. Last year, Kelly Ortberg assumed the role of CEO. So far, Ortberg has been focused on steering Boeing toward more reliable production, improving focus and, most importantly, rebuilding confidence with regulators, airlines, and investors.

Boeing’s Last Quarterly Results Were Mixed

On April 23, Boeing reported its quarterly results for the first quarter of 2025. The company’s results were mixed compared to what analysts were expecting. Boeing reported an overall revenue of $19.5 billion, up 18% from the prior-year period. However, this figure fell short of Wall Street analysts’ $19.66 billion estimate.

Delivery of commercial airplanes during Q1 rose by 57% YOY to 130, leading to a 75% jump in commercial airplane revenue to $8.15 billion. On the other hand, defense, space, and security revenue dropped by 9% YOY to $6.3 billion. Still, this latter segment’s operating margin grew annually from 2.2% to 2.5%.

Boeing reported an overall core loss per share of $0.49, narrower than the loss per share of $1.13 reported in the prior-year period and Wall Street’s loss-per-share estimate of $1.30. The company's operating margin of 2.4% was also significantly better than its year-ago value.

While Boeing’s bottom line is expected to remain in the red for the short term, analysts believe losses will narrow. For Q2, loss per share is expected to narrow by 50% YOY. In fiscal 2026, the company is expected to turn a profit of $2.43 per share, indicating massive growth of 188%.

What Do Analysts Think About Boeing’s Stock?

Following the news of Boeing’s exoneration, multiple analysts raised their price targets on BA stock.

Bernstein raised its price target from $249 to $282, maintaining an “Outperform” rating. Analysts remain optimistic about Boeing’s defense, space, and security systems, as well as its global services.

Citing the company’s improving commercial operations and growing delivery figures, analysts at Susquehanna raised their BA price target from $252 to $265, keeping a “Positive” rating on the stock. After previewing Boeing’s aerospace and defense segment’s Q2 earnings, Citi also maintained its “Buy” rating while raising the price target from $220 to $270.

Last month, Redburn Atlantic analyst Olivier Brochet upgraded Boeing stock from “Neutral” to “Buy.” Brochet also raised the price target from $180 to $275, expressing confidence in the company’s operational stability.

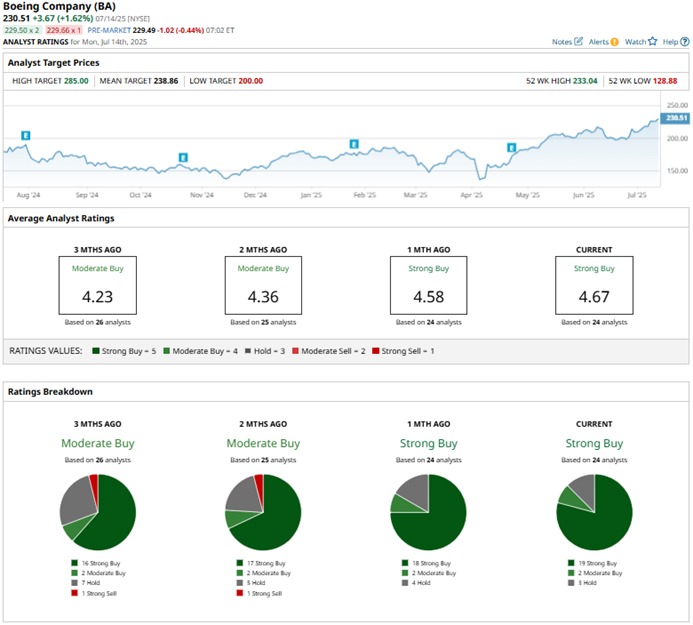

Boeing is receiving praise for its recovery on Wall Street, with analysts giving it a consensus “Strong Buy” rating overall. Of the 24 analysts rating BA stock, a majority of 19 analysts rate it a “Strong Buy,” two suggest a “Moderate Buy,” and three analysts play it safe with a “Hold” rating. The consensus price target of $239.32 represents 3.6% upside from current levels. However, the Street-high price target of $285 indicates 23% potential upside.

Bottom Line

Boeing’s recovery has impressed Wall Street, while news of the company likely having no fault related to the recent 787 plane crash has positioned shares for further gains. As a result, BA stock might be a buy now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.