Shares of Bloom Energy Corp (NYSE:BE) are trading sharply lower Wednesday morning after Jefferies downgraded the stock from Hold to Underperform. The downgrade interrupts a rally that has seen the clean energy company's stock surge more than 187% over the past six months.

What To Know: Recent investor enthusiasm was largely fueled by the booming artificial intelligence sector, which has created massive demand for Bloom Energy’s fuel cell technology to provide reliable, scalable power for data centers.

A series of positive developments have bolstered the stock’s impressive run, including a partnership announced in July to power Oracle’s AI data centers.

The rally over the past six months was also supported by a strong second-quarter earnings report, which boasted record revenue of over $401 million. Adding to the momentum, Bloom Energy announced plans to double its manufacturing capacity by the end of 2026.

Jefferies analyst Dushyant Ailani downgraded Bloom Energy from Hold to Underperform on Wednesday and raised the price target from $24 to $31. Despite the bullish long-term outlook tied to AI, Wednesday's analyst downgrade has prompted a pullback as investors take profits following a strong run in shares.

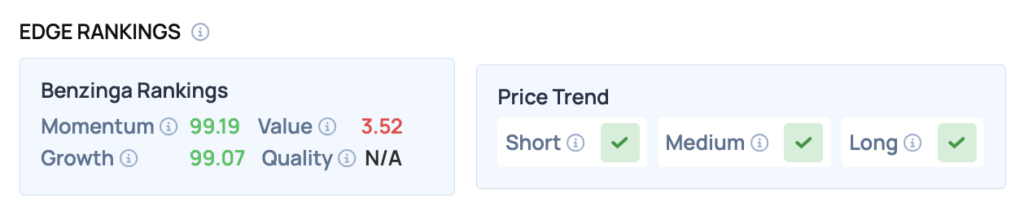

Benzinga Edge Rankings: Reflecting its powerful uptrend prior to the downgrade, Benzinga Edge rankings show Bloom Energy with near-perfect scores for Momentum (99.19) and Growth (99.07), contrasted by an extremely low Value score of 3.52.

Technical Momentum: The current price of Bloom Energy at $70.76 reflects a sharp daily decline of 8.55%, indicating bearish momentum. The stock is trading well above its 50-day moving average of $47.64, suggesting that it has experienced a strong upward trend recently. However, the sharp drop may indicate a potential reversal, with key support levels to watch around the 50-day moving average.

Bloom Energy shares were down 13.16% at $67.30 at the time of publication on Wednesday, according to Benzinga Pro.

How To Buy BE Stock

By now you're likely curious about how to participate in the market for Bloom Energy – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock